Please use a PC Browser to access Register-Tadawul

A Look At Affiliated Managers Group’s Valuation After Hitting An All Time High On Strong Results And Analyst Optimism

Affiliated Managers Group, Inc. AMG | 287.69 | -10.72% |

Affiliated Managers Group (AMG) recently reached an all-time high, with the share price climbing 5% in a single session as favorable analyst commentary combined with reported financial results and lifted investor sentiment.

That all time high sits on top of a strong run, with a 30 day share price return of 12.57% and a 90 day share price return of 30.59%. The 1 year total shareholder return of 75.04% suggests momentum has been building rather than fading.

If AMG’s move has your attention, this can be a useful moment to broaden your watchlist with fast growing stocks with high insider ownership.

With AMG now near its all-time high and trading at a discount of about 14% to the average analyst price target, is the market leaving room for upside, or already pricing in the company’s future growth?

Most Popular Narrative: 9.6% Undervalued

The most followed narrative sees Affiliated Managers Group’s fair value at about US$345.57 per share, compared with the latest close of US$312.29, and connects that gap to detailed views on growth, margins and risk.

Affiliated Managers Group's disciplined capital allocation deploying nearly $1.2 billion across growth investments and share repurchases in the first half of 2025 points to ongoing per-share earnings growth and return on equity expansion, with substantial buybacks expected to continue compounding shareholder value through enhanced EPS.

The narrative places significant weight on measured revenue growth, firmer profit margins and a future earnings multiple that is lower than today’s. The exact mix of those assumptions matters a lot. If you want to see how they fit together, the full narrative lays out every piece.

Result: Fair Value of $345.57 (UNDERVALUED)

However, this depends on alternative and tax efficient strategies continuing to attract assets, as well as on key affiliates like Pantheon and AQR avoiding performance or fundraising setbacks.

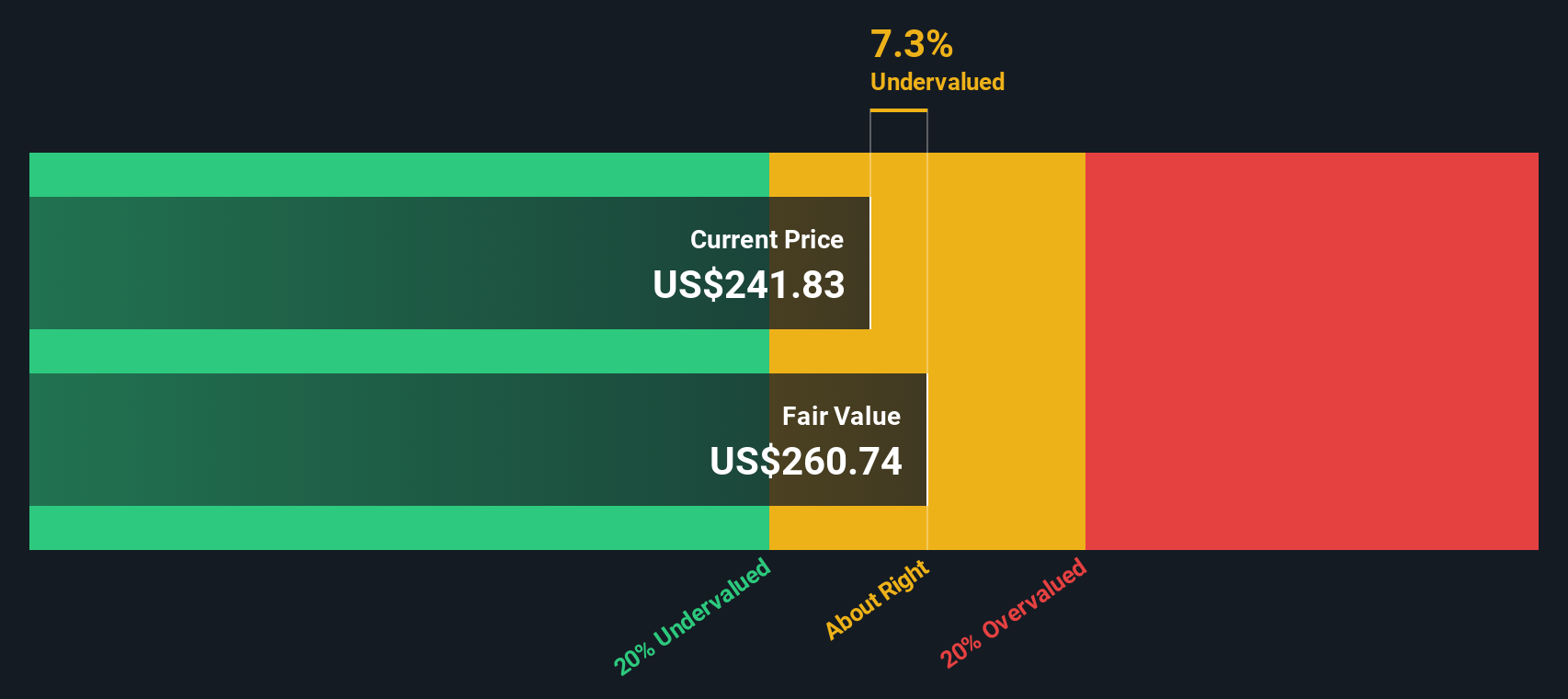

Another View: Our DCF Flags a Tighter Margin of Safety

While the narrative-based fair value of US$345.57 points to upside, our DCF model comes out more conservative, with a fair value of US$298.14. At the current price of US$312.29, AMG screens as slightly overvalued on this view. This raises a simple question: how much valuation risk are you comfortable holding?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Affiliated Managers Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Affiliated Managers Group Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can build a fresh Affiliated Managers Group view in just a few minutes, starting with Do it your way.

A great starting point for your Affiliated Managers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If AMG has sharpened your focus, do not stop there. Broaden your opportunity set with a few targeted screens that surface very different types of ideas.

- Chase potential mispricing by scanning these 879 undervalued stocks based on cash flows that line up strong cash flows with prices that may not fully reflect them.

- Tap into market megatrends by sorting through these 26 AI penny stocks that connect artificial intelligence themes with listed companies.

- Strengthen your search for income by filtering for these 12 dividend stocks with yields > 3% that might suit a yield focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.