Please use a PC Browser to access Register-Tadawul

A Look At Agios Pharmaceuticals (AGIO) Valuation After AQVESME FDA Approval And Commercial Launch

Agios Pharmaceuticals, Inc. AGIO | 29.25 | +2.34% |

Agios Pharmaceuticals (AGIO) stock is in focus after the recent FDA approval and U.S. commercial launch of AQVESME for thalassemia, alongside upcoming mitapivat regulatory steps in sickle cell disease and a stated path to profitability.

Despite the AQVESME launch and upcoming mitapivat milestones, Agios Pharmaceuticals' recent 1-month share price return of 9.23% comes after a 90-day share price decline of 34.33% and a 1-year total shareholder return decline of 14.25%. This suggests recent momentum has picked up from a weaker base.

If AQVESME and the broader rare disease pipeline have caught your attention, this could be a good moment to look across the sector and see how other healthcare stocks compare.

With Agios trading at $27.80 after a 90-day decline of 34.33% but a recent 30-day rebound of 9.23%, is this weakness signaling an undervalued rare disease story, or is the market already pricing in future growth?

Most Popular Narrative: 22.8% Undervalued

Against the last close of $27.80, the most followed narrative points to a fair value of $36.00, built on aggressive growth and margin assumptions.

Upcoming potential FDA approval and commercial launch of PYRUKYND for thalassemia in the U.S. is set to significantly expand Agios' addressable market, driven by the high rate of disease diagnosis through newborn screening and well-defined patient populations, which should lift revenue growth in coming years.

Curious what kind of revenue ramp and profit margin shift justify that higher fair value, especially with a premium future P/E baked in? The full narrative spells out the growth curve, the timing assumptions and the earnings power the model is banking on. See our AI narrative and valuation for Agios Pharmaceuticals.

Result: Fair Value of $36 (UNDERVALUED)

However, that upside view still leans heavily on PYRUKYND broadening into new indications, while high R&D and SG&A spending could keep net income in loss territory for longer.

Another View: Multiples Signal Caution

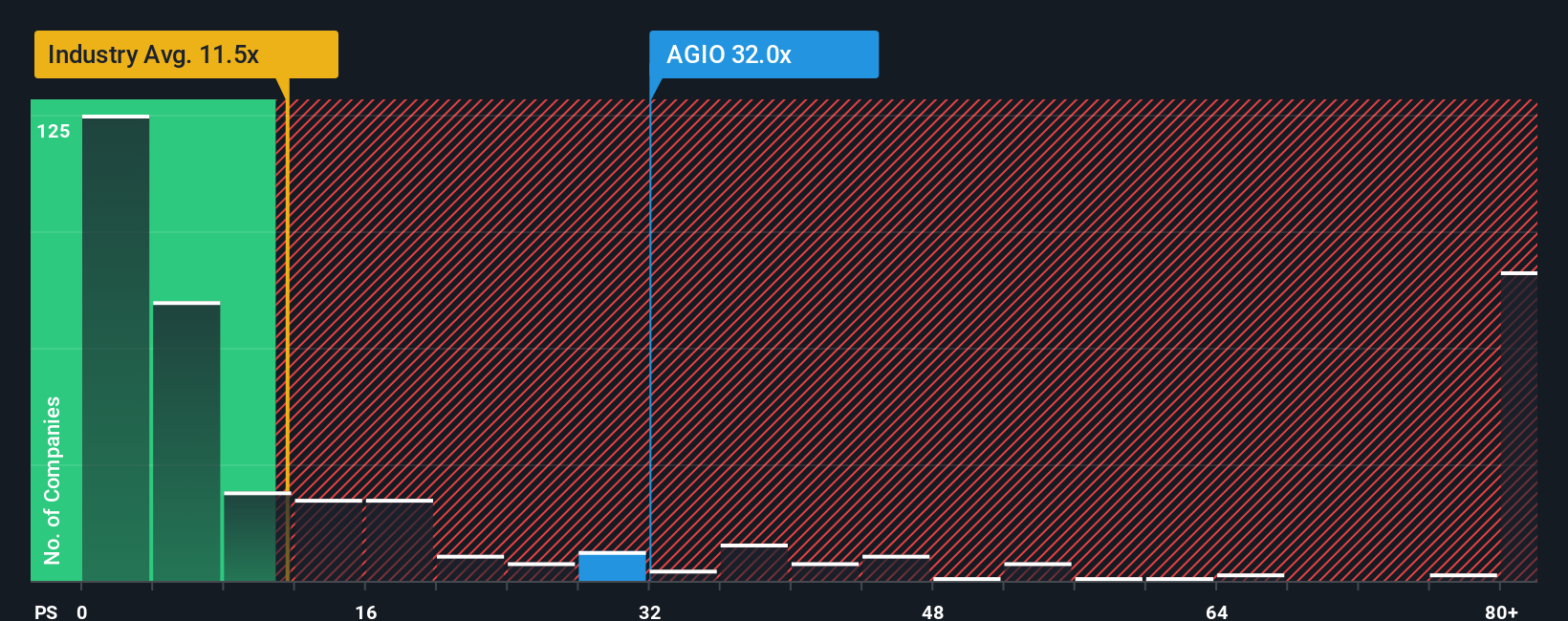

That 22.8% undervalued call sits awkwardly next to how the market is actually pricing Agios. On a P/S of 36.2x, the shares trade far above the US Biotechs average of 12.3x and peer average of 7.1x, while the fair ratio points to 0x. That is a wide gap for an unprofitable company. Is this a misunderstood opportunity, or simply a lot of optimism already in the price?

Build Your Own Agios Pharmaceuticals Narrative

If you see the numbers differently or prefer to stress test your own assumptions against the market data, you can build a custom thesis in a few minutes: Do it your way

A great starting point for your Agios Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Agios has sparked your interest, do not stop here. Use the Simply Wall Street Screener to spot other opportunities that could fit your portfolio before others do.

- Spot potential value candidates early by checking out these 869 undervalued stocks based on cash flows that may offer more attractive price tags than the broader market.

- Tap into fast-changing tech trends by scanning these 24 AI penny stocks that are shaping how artificial intelligence reaches real-world products and services.

- Expand your watchlist beyond traditional sectors by reviewing these 80 cryptocurrency and blockchain stocks that are building around blockchain, digital assets, and new payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.