Please use a PC Browser to access Register-Tadawul

A Look At Alamo Group (ALG) Valuation After Recent Share Price Momentum

Alamo Group Inc. ALG | 213.46 | +1.51% |

What recent performance says about Alamo Group

Alamo Group (ALG) has quietly delivered a positive run recently, with the stock up about 6.8% over the past week, roughly 11% over the past month, and about 26.7% in the past 3 months.

Zooming out, the recent momentum in Alamo Group’s share price, including the 11.4% 30 day share price return and 22.2% year to date share price return, sits against a 12.8% 1 year total shareholder return. This suggests that interest has been building rather than fading.

If this move has you thinking about where else equipment and infrastructure trends could lead, it might be worth checking out our screener of 24 power grid technology and infrastructure stocks as another way to source ideas.

So with Alamo Group’s recent gains, the analyst price target sitting close by, and an intrinsic value estimate slightly above today’s price, should you see upside still on the table, or has the market already priced in future growth?

Most Popular Narrative: 5.2% Undervalued

Alamo Group’s most followed narrative pegs fair value at about $219.75, a touch above the last close of $208.30, which anchors the current upside debate.

Robust organic growth in the Industrial Equipment division, evidenced by record sales (+17.6% YoY), soaring backlog (~$510 million), and strong order bookings (+21% YoY in Q2), is directly tied to rising infrastructure investments and government spending. These conditions are expected to persist globally and support continued revenue expansion and earnings growth.

Curious how this backlog story ties into the valuation? The narrative leans heavily on steady revenue growth, rising margins and a future earnings multiple that has to hold up. The full write up spells out the profit and revenue path that needs to happen, as well as the discount rate that brings it all back to today’s $219.75 fair value call.

Result: Fair Value of $219.75 (UNDERVALUED)

However, the story could look different if Vegetation Management recovery stalls, or if government and municipal spending on infrastructure and maintenance softens more than expected.

Another View: Cash Flows Tell A Tighter Story

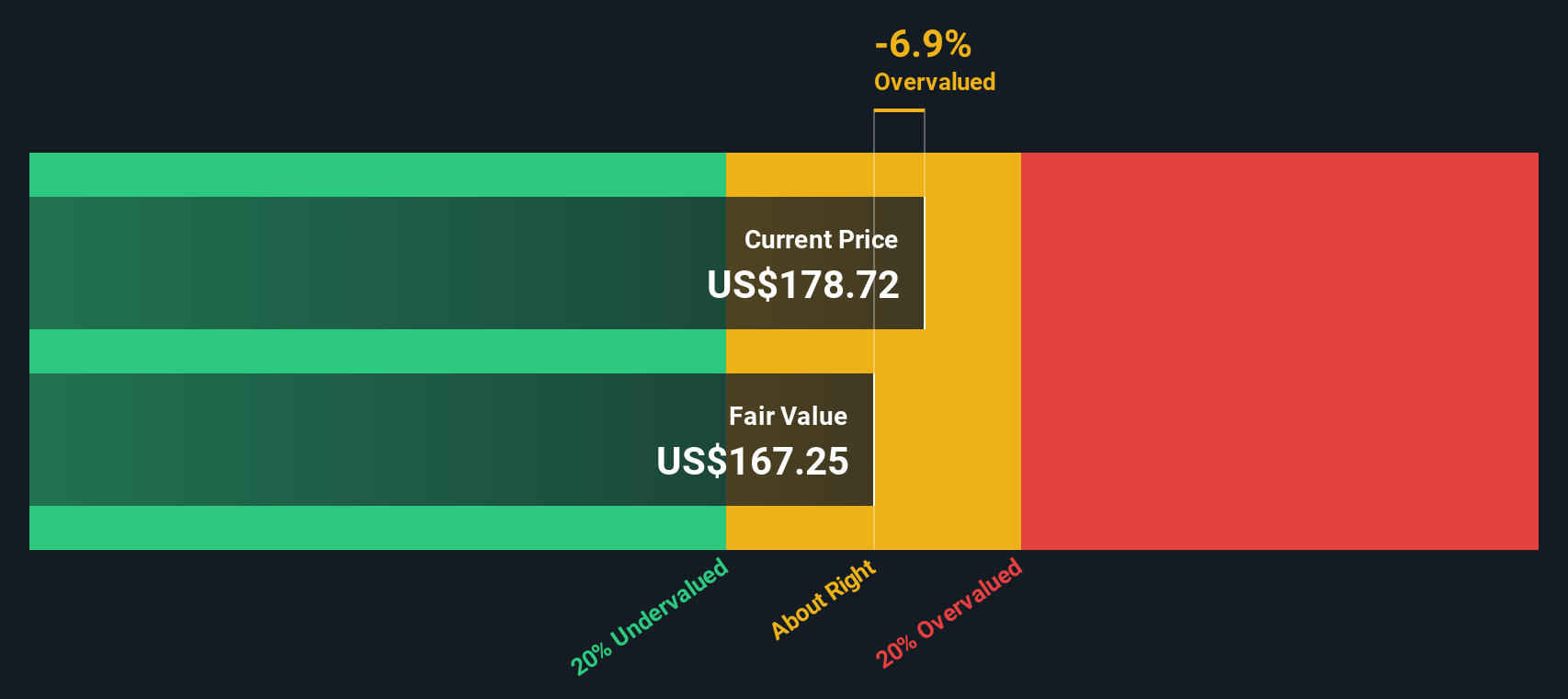

While the narrative and analyst target point to Alamo Group being about 5.2% undervalued at a fair value of $219.75, our DCF model tells a closer story, with a future cash flow value of $202.20 against the current $208.30 share price, which screens as slightly overvalued. So which anchor do you trust more: earnings potential or cash flows?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alamo Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alamo Group Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to piece together your own view from the data, you can build a full Alamo Group story in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alamo Group.

Looking for more investment ideas?

If Alamo Group has you thinking bigger about your portfolio, do not stop here. These next ideas could be where your next move comes from.

- Target quality at a discount by scanning our list of 52 high quality undervalued stocks that pair fundamentals with more modest price tags.

- Stack potential returns with consistency by checking out 14 dividend fortresses, focused on companies offering yields from stronger payout profiles.

- Sleep a bit easier by reviewing 82 resilient stocks with low risk scores, built around businesses our model scores with more resilient risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.