Please use a PC Browser to access Register-Tadawul

A Look At Albany International (AIN) Valuation After New Cybersecurity Certification Win

Albany International Corp. Class A AIN | 59.44 | -0.03% |

Why Albany International’s new cybersecurity certification matters

Albany International (AIN) just cleared a key hurdle for its Albany Engineered Composites segment, securing U.S. Department of War Cybersecurity Maturity Model Certification Level 2 through an accredited third party assessor.

The CMMC Level 2 certification lands at a time when Albany International’s share price has been relatively choppy, with a recent 1 month share price return of 11.59% and a year to date share price return of 9.97%. This is set against a 1 year total shareholder return decline of 27.63% that points to longer term investors still sitting on losses even as shorter term momentum shows some signs of rebuilding.

If this defense focused update has your attention, it could be a good moment to broaden your watchlist with aerospace and defense stocks as potential peers in the space.

With the shares still down on a 1 year and 3 year view, yet trading at what one model suggests is roughly a 29% intrinsic discount, you have to ask: is this a genuine reset, or is the market already pricing in future growth?

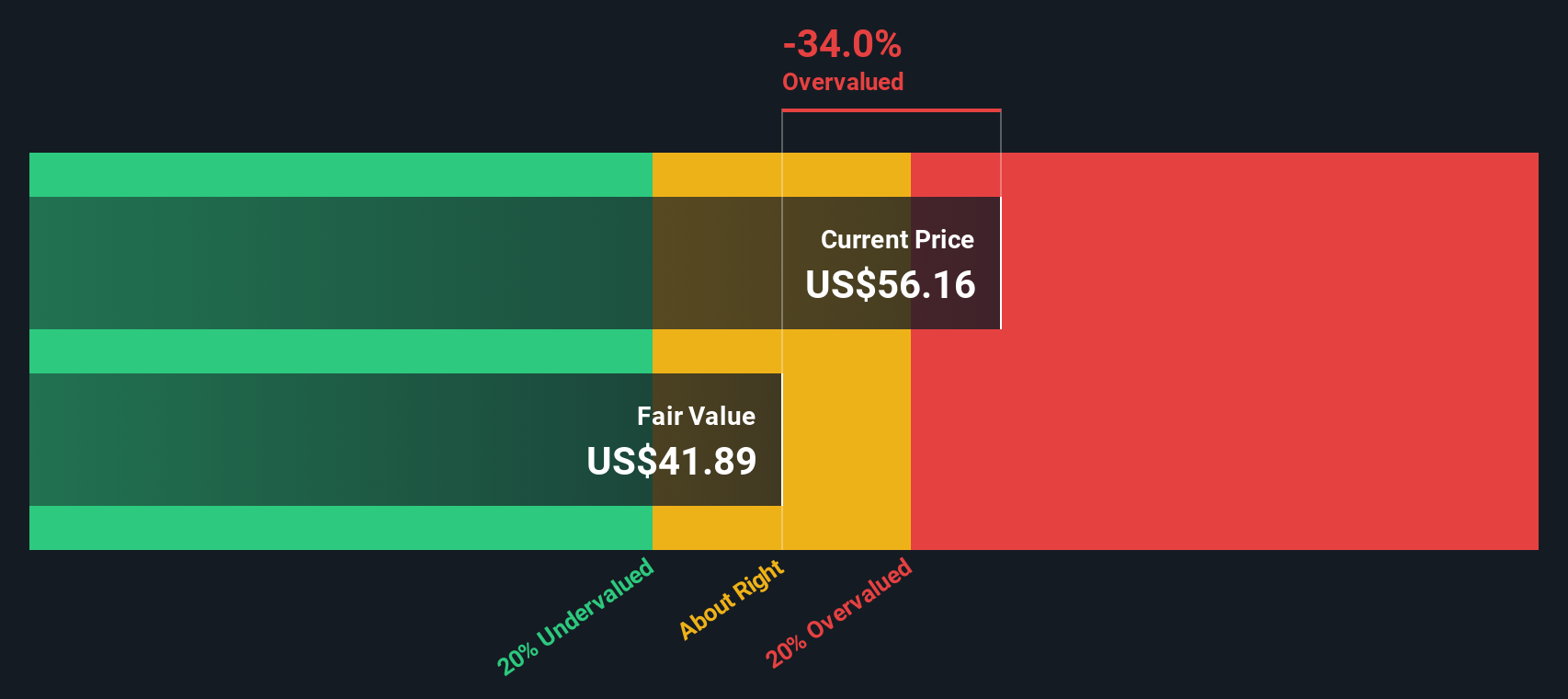

Most Popular Narrative: 7.6% Overvalued

At a last close of $57.56 versus a widely followed fair value estimate of $53.50, the current price sits above where this narrative lands.

The analysts have a consensus price target of $64.5 for Albany International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $79.0, and the most bearish reporting a price target of just $55.0.

Curious what justifies a fair value below today’s price while earnings are expected to improve sharply? The tension sits in revenue trends, margin rebuild, and the profit multiple baked into that $53.50 figure. The full narrative lays out those moving parts in plain numbers.

Result: Fair Value of $53.50 (OVERVALUED)

However, there are still clear pressure points, including weak traditional paper demand in key regions and heavy reliance on a handful of aerospace programs that could significantly affect earnings.

Another View: Cash Flows Tell a Different Story

The fair value narrative at $53.50 suggests Albany International is 7.6% overvalued, yet our DCF model points the other way, with a future cash flow value of $81.58 per share, implying the stock trades at a sizeable discount. When price and cash flows disagree this much, which signal would you lean on?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Albany International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Albany International Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to build your own view from scratch, you can put together a custom narrative in just a few minutes, starting with Do it your way.

A great starting point for your Albany International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one company, you risk missing other angles on growth, income, and themes that could fit your portfolio even better.

- Spot fresh opportunities in smaller names by checking out these 3524 penny stocks with strong financials that already show stronger financial footing than many expect from this corner of the market.

- Tap into long term technology themes by scanning these 24 AI penny stocks that sit at the intersection of artificial intelligence, automation, and data driven products.

- Strengthen your income focus by reviewing these 13 dividend stocks with yields > 3% that can help you build a watchlist around yield and consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.