Please use a PC Browser to access Register-Tadawul

A Look At Alkami Technology (ALKT) Valuation As Analyst Optimism And Revenue Growth Draw Investor Interest

Alkami Technology Inc ALKT | 17.03 | +2.16% |

Alkami Technology (ALKT) is back on investor radar as upbeat analyst sentiment and interest in its digital banking platform coincide with recent share price moves, despite ongoing losses and a mixed recent return profile.

Recent price action reflects this tension between optimism and risk, with a 1 day share price return of 1.94% to US$16.27, following a year to date share price return decline of 28.26% and a 1 year total shareholder return decline of 50.55%, even as the 3 year total shareholder return sits at 3.50%.

If Alkami’s digital banking story has caught your attention, it can be useful to see what else is gaining traction in similar areas. You could start with our screener of 57 profitable AI stocks that aren't just burning cash.

With the stock down sharply over the past year but analysts seeing scope for a much higher share price, the key question is whether Alkami is quietly undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 49.3% Undervalued

At US$16.27, the most followed narrative for Alkami Technology points to a fair value of about US$32.11, putting a big gap between price and expectations.

Continued rollout of new products and expansion into adjacent banking services (e.g., AI personalization, integrated data/marketing, payments), coupled with demonstrated high client retention rates, supports recurring revenue expansion and provides multiple avenues for margin improvement and long-term earnings upside.

Curious what earnings path and margin profile could justify nearly double today’s price, plus a premium future earnings multiple and stronger cash generation assumptions? The full narrative lays out those numbers clearly.

Result: Fair Value of $32.11 (UNDERVALUED)

However, there are real pressure points here, including softer recent revenue trends and heavier competition that could squeeze pricing and slow Alkami’s recurring revenue progress.

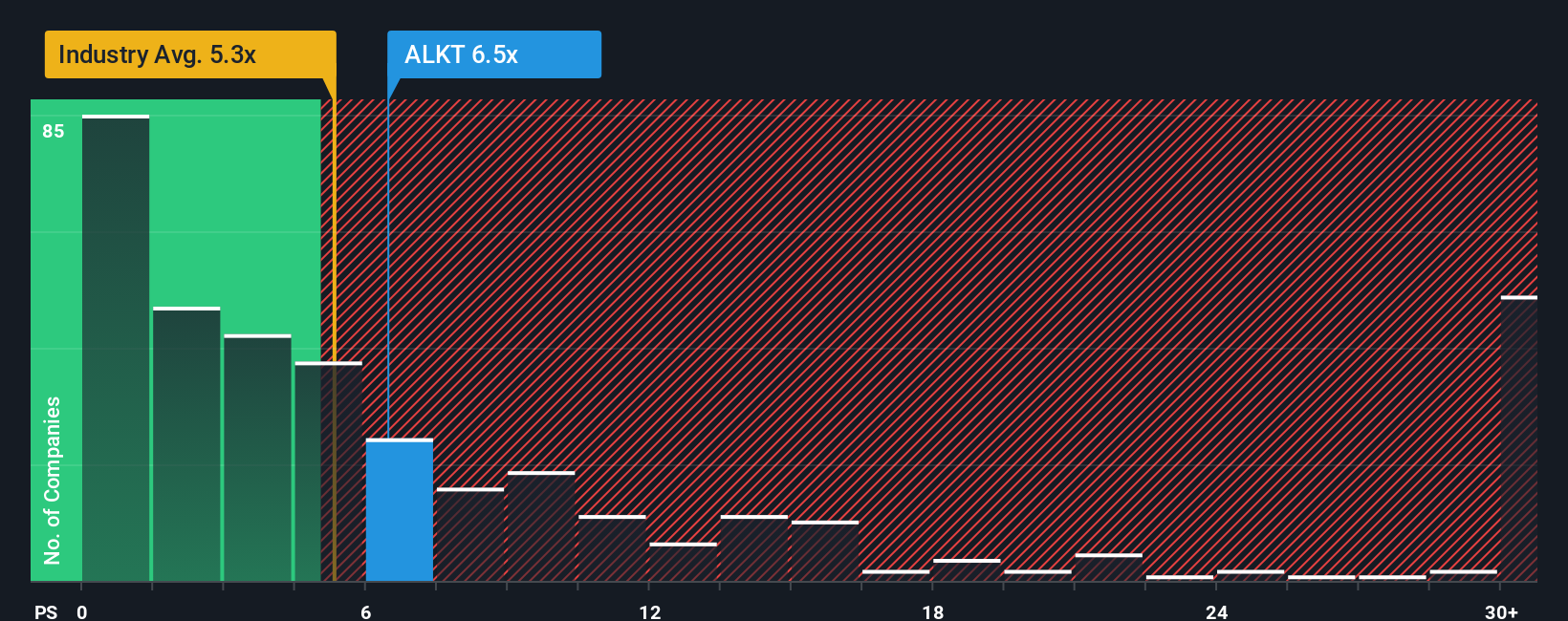

Another View: Price To Sales Sends A Different Signal

The DCF work suggests Alkami is undervalued, yet the simple P/S check points in the opposite direction. At about 4.1x P/S, the shares sit above the US Software industry at 3.6x, the peer average at 3.2x, and the 3.7x fair ratio indicated by our model. So is the discount really as clear as it first appears?

Build Your Own Alkami Technology Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a complete Alkami view yourself in just a few minutes, starting with Do it your way.

A great starting point for your Alkami Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Alkami has sharpened your thinking, do not stop here. Use the Simply Wall St screener to spot other opportunities before they move without you.

- Target potential value opportunities by scanning our list of 53 high quality undervalued stocks that currently stand out on quality and pricing strength.

- Prioritise financial resilience by focusing on companies in our solid balance sheet and fundamentals stocks screener (45 results) that may better handle tougher conditions.

- Build a watchlist of under the radar names using our screener containing 23 high quality undiscovered gems before more investors start paying attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.