Please use a PC Browser to access Register-Tadawul

A Look At Alphatec Holdings (ATEC) Valuation After 2026 Guidance Update And Theradaptive OsteoAdapt Deal

Alphatec Holdings, Inc. ATEC | 13.01 | -3.49% |

Alphatec Holdings (ATEC) grabbed attention after its 2026 revenue outlook implied slower growth at the same time the company secured exclusive U.S. rights to Theradaptive’s OsteoAdapt bone graft, sending the stock sharply lower.

The guidance update and Theradaptive partnership arrived after a volatile stretch for the shares, with a 24.5% 7 day share price return decline and 17.6% 30 day share price return decline, even as the 1 year total shareholder return sits at 47.9%. This suggests longer term holders have still been rewarded while recent momentum has faded.

If this kind of healthcare deal has your attention, it could be a good moment to compare Alphatec with other healthcare stocks that might fit your watchlist next.

With Alphatec now guiding to 17% 2026 revenue growth and the stock down sharply from recent levels, you have to ask: is the pullback offering a mispriced entry, or is the market simply resetting expectations for future growth?

Most Popular Narrative: 33.2% Undervalued

Alphatec’s most followed narrative places fair value at about US$24.62 per share, well above the last close of US$16.45, which anchors a more optimistic stance on the stock.

Ongoing innovation in integrated procedural solutions and the forthcoming launch of Valence (robotics/navigation) positions the company to participate in the adoption of advanced healthcare technologies, with the potential to affect both future revenue and long-term margins. Investments in foundational informatics, data-driven solutions (EOS, SafeOp), and a fully integrated surgical ecosystem are expected to support efforts to enhance clinical outcomes and procedural efficiency, which may in turn influence pricing power and earnings as value-based healthcare becomes more prevalent.

Curious what kind of revenue patterns, margin profile, and future earnings multiple are incorporated into that higher fair value estimate, and how tightly those assumptions are calibrated? The full narrative lays out a detailed financial framework.

Result: Fair Value of $24.62 (UNDERVALUED)

However, you still need to weigh the risk that spine procedure volumes or surgeon preferences shift toward alternatives, and that larger rivals pressure Alphatec’s pricing and margins.

Another Angle on Valuation

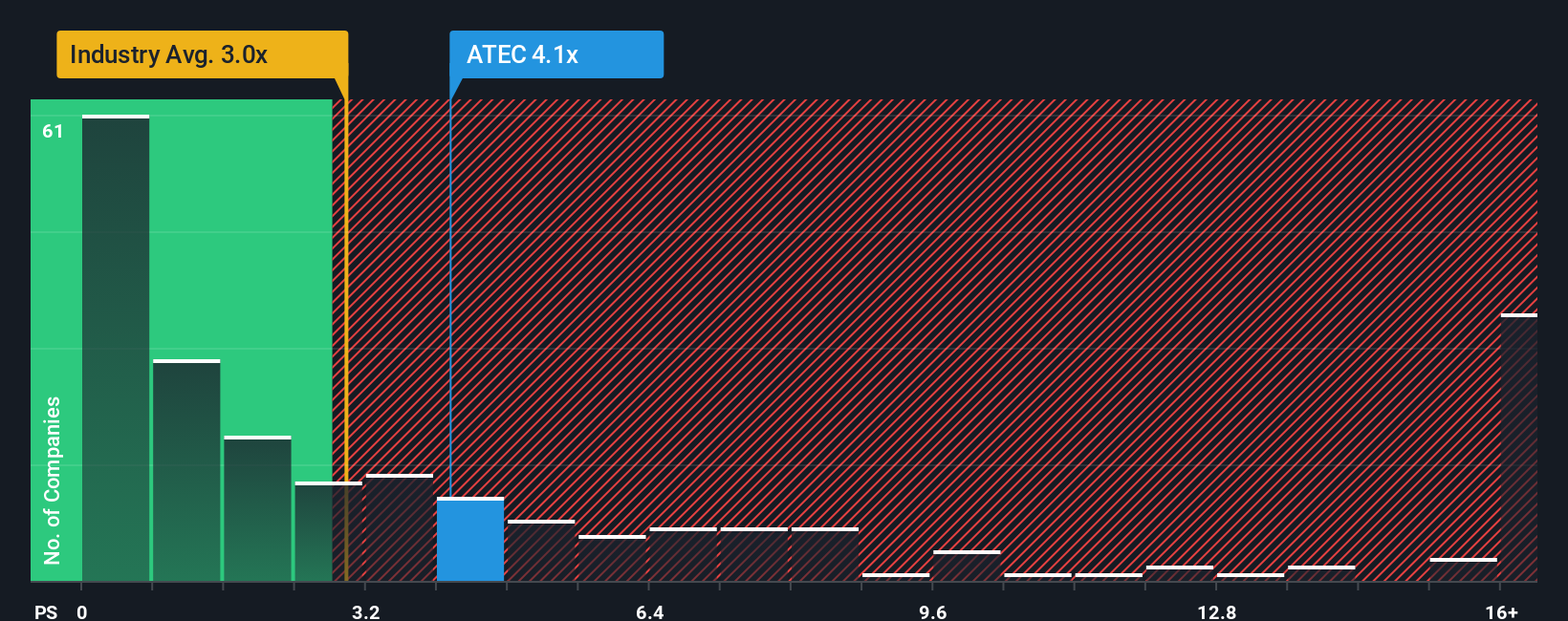

On revenue-based metrics, Alphatec looks less clear cut. The current P/S of 3.4x is slightly higher than the US Medical Equipment industry at 3.3x and well above the peer average of 2.7x, even though our fair ratio estimate sits at 3.7x. That mix of a small premium, a larger gap to peers, and a higher fair ratio raises a simple question: is this pricing closer to a quality premium or extra risk if expectations slip?

Build Your Own Alphatec Holdings Narrative

If you prefer to dig into the numbers yourself or you see the story differently, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your Alphatec Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Alphatec is just one piece of your watchlist, this is a good time to widen the field and line up a few more high conviction candidates.

- Target potential mispricings by checking out these 884 undervalued stocks based on cash flows that may offer more attractive entry points based on current cash flow metrics.

- Ride powerful technology trends by scanning these 25 AI penny stocks that are tied to artificial intelligence themes across different parts of the market.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that combine meaningful yields with equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.