Please use a PC Browser to access Register-Tadawul

A Look at Alvotech’s (NasdaqGM:ALVO) Valuation Following Landmark Biosimilar Approvals in Japan

Alvotech Ordinary Shares ALVO | 5.10 | -5.58% |

Alvotech (NasdaqGM:ALVO) is on investors’ radar after its commercialization partner in Japan, Fuji Pharma, secured marketing approval for three biosimilars from the Japanese Ministry of Health, Labor and Welfare. AVT03, AVT05, and AVT06 all received the green light, with AVT05 making headlines as the first golimumab biosimilar approved for sale in any major global market. This regulatory win holds real significance and hints at new pathways for Alvotech's growth, adding momentum to the company’s international expansion story.

This development comes at a time when Alvotech’s stock has struggled; it is down 28% over the past year and just under 15% over the past three months. Annual revenue and net income growth, however, have impressed at 26% and 50%, respectively. The recent announcements about global partnerships and product approvals suggest building momentum, even if the market remains cautious, judging by the share price trims year-to-date.

Does this new approval open the door for a revaluation of Alvotech, or is the market already factoring in the company’s future growth prospects?

Most Popular Narrative: 55% Undervalued

The most widely followed narrative values Alvotech as significantly undervalued, pointing to strong future growth potential that is not yet reflected in the current share price.

Ongoing launch and approval pipeline activity, including upcoming regulatory decisions in major global markets (for AVT03, AVT05, AVT23, and others), positions the company to tap into blockbuster biologic markets coming off-patent. This could potentially drive a step-change in topline revenue once approvals are secured.

Want to know what’s powering this optimistic forecast? The secret is in aggressive growth projections and a sharp drop in the valuation multiple applied. Could this company really outpace market expectations? Find out what dramatic forecasts make up the foundation of this bullish price target.

Result: Fair Value of $17.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, delayed product approvals or intensifying price competition in biosimilars could quickly slow Alvotech’s growth and challenge the bullish outlook.

Find out about the key risks to this Alvotech narrative.Another View: Is the Market Missing Something?

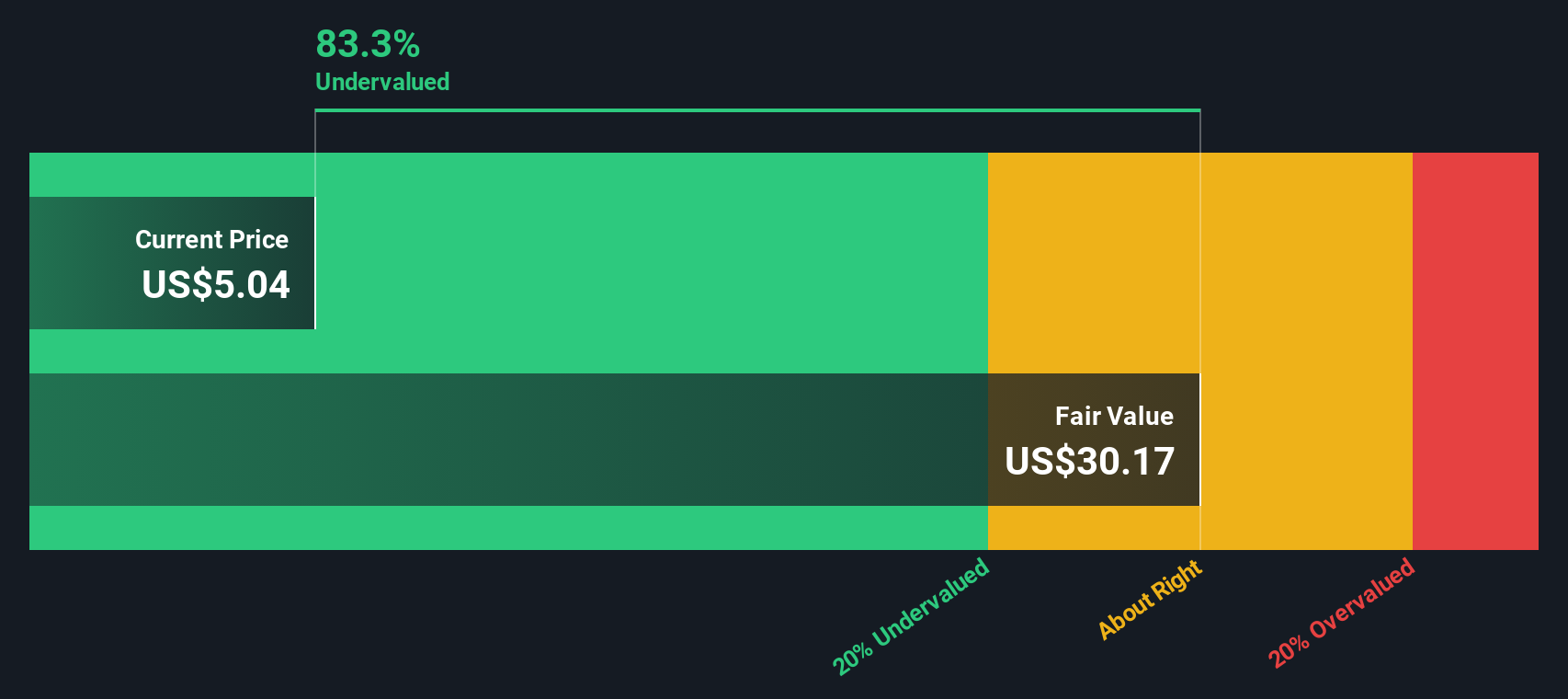

Looking through the lens of our DCF model, Alvotech still appears significantly undervalued, reinforcing the previous bullish take. But why does the market price it so far below its calculated fair value? Is skepticism justified, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alvotech Narrative

If you see the numbers differently, or want to analyze the company on your own terms, you can build a narrative in minutes. Do it your way.

A great starting point for your Alvotech research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let the next big opportunity slip past you. Spot smart moves with these dynamic investing angles tailored for your strategy, all powered by the Simply Wall Street Screener.

- Tap into emerging tech by tracking quantum computing stocks. Uncover companies breaking ground in quantum computing and reshaping how the world solves its toughest problems.

- Boost your income potential by reviewing dividend stocks with yields > 3%. Find companies offering market-beating dividend yields and reward yourself with reliable cash flow.

- Stay one step ahead as you scan undervalued stocks based on cash flows. Spot overlooked stocks selling for less than their true value before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.