Please use a PC Browser to access Register-Tadawul

A Look At Aquestive Therapeutics (AQST) Valuation After Anaphylm Regulatory Update And FDA Feedback

AQUESTIVE THERAPEUTICS, INC. AQST | 3.95 | -0.25% |

Regulatory update on Anaphylm and why it matters for Aquestive Therapeutics (AQST)

Aquestive Therapeutics (AQST) recently reported fresh detail on the U.S. regulatory review of its Anaphylm sublingual epinephrine film, highlighting current FDA feedback on application deficiencies and timing risks around the January 31, 2026 PDUFA decision date.

The Anaphylm update arrived after a sharp reset in sentiment, with a 1-day share price return of -37.04% and a 7-day share price return of -39.38%, even though the 3-year total shareholder return sits at a very large gain of about 3x. Overall, short term share price momentum has clearly faded, while longer term total shareholder returns still reflect how differently the stock has traded over recent years.

If this kind of regulatory swing has you rethinking your watchlist, it could be a good moment to compare AQST with other healthcare stocks that are moving on their own clinical and approval cycles.

With AQST now trading around US$3.91 after a sharp pullback, alongside recent revenue growth and continued losses, you have to ask: is the regulatory uncertainty already baked in, or is the market still discounting future growth?

Most Popular Narrative: 62% Undervalued

With Aquestive Therapeutics last closing at US$3.91 against a narrative fair value of US$10.30, the gap in expectations is wide and tightly linked to Anaphylm and future earnings power.

The FDA review and potential success of Anaphylm could drive strong revenue growth and shift market preference toward needle-free drug delivery. Broad physician and patient preference for non-injectable formats, coupled with survey data indicating significant anticipated market share shift toward these alternatives, suggests Anaphylm could accelerate prescription volumes and, if adopted, drive substantial topline revenue expansion.

Curious what kind of revenue ramp and margin shift would have to materialise to back a fair value more than double today’s price? The most followed narrative leans on rapid top line expansion, a sharp swing in profitability and a premium earnings multiple that usually belongs to much larger drug makers. Want to see exactly how those pieces fit together, and what assumptions sit underneath that US$10.30 figure?

Result: Fair Value of $10.30 (UNDERVALUED)

However, that story can quickly change if Anaphylm faces approval setbacks or slower payer and physician uptake than analysts currently include in their models.

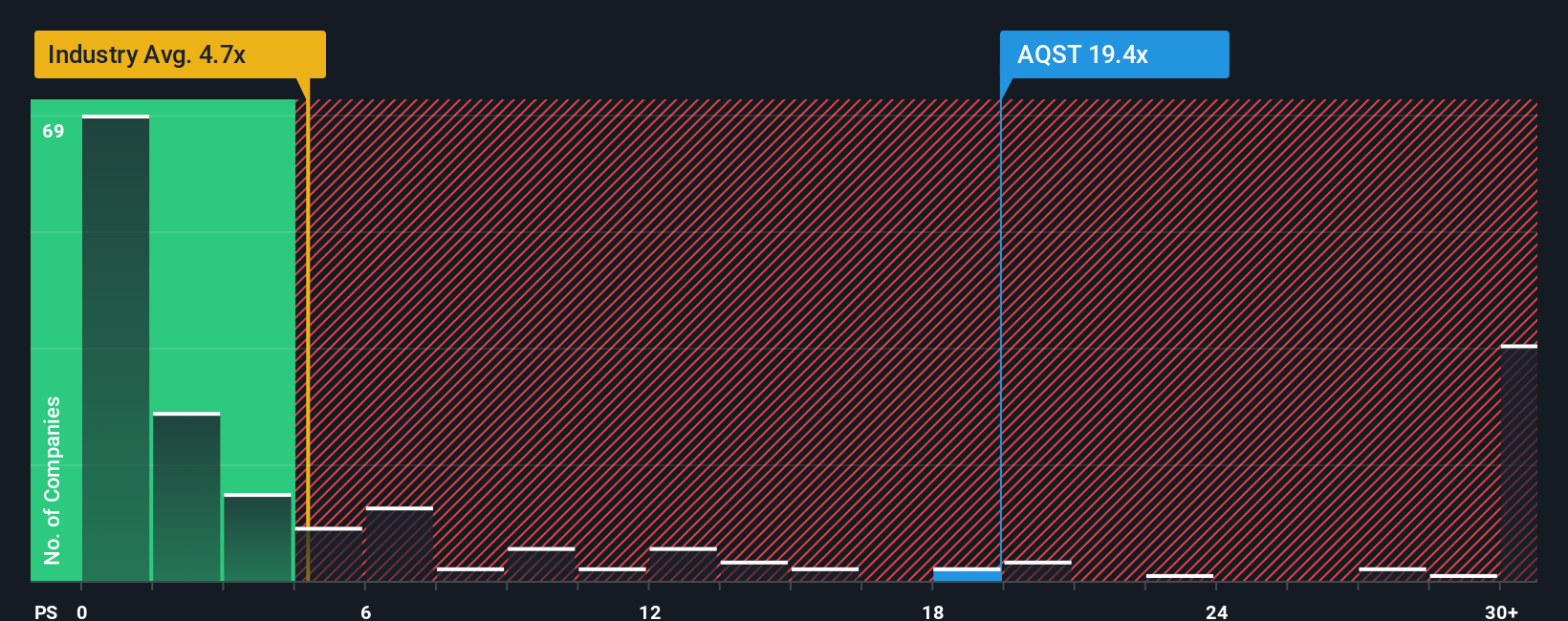

Another View: Price To Sales Paints A Tougher Picture

If you zoom out from narratives and fair value models, the simple P/S ratio tells a different story. AQST trades on roughly 11x sales, compared with about 4.3x for the wider US Pharmaceuticals group and 6.9x for peers, while the fair ratio sits closer to 7.8x.

That gap suggests the market is already paying a premium for future growth that has not yet translated into profits. This raises the question: how much execution risk around Anaphylm and the rest of the pipeline are you comfortable paying up for today?

Build Your Own Aquestive Therapeutics Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own assumptions directly, you can build a completely custom view from scratch in just a few minutes, Do it your way.

A great starting point for your Aquestive Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready to look beyond AQST?

If you are serious about finding your next idea, do not stop at one stock. Put the Simply Wall St screener to work and see what you might be missing.

- Spot potential mispriced opportunities by running your own filter across these 879 undervalued stocks based on cash flows that could merit a closer look.

- Target companies tied to long term technology themes by scanning these 29 quantum computing stocks that are pushing computing boundaries.

- Zero in on income ideas by checking these 12 dividend stocks with yields > 3% that may align with your yield goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.