Please use a PC Browser to access Register-Tadawul

A Look At Ardagh Metal Packaging (AMBP) Valuation After Earnings Beat And Balance Sheet Moves

Ardagh Metal Packaging S.A AMBP | 4.45 4.45 | +1.37% 0.00% Post |

Ardagh Metal Packaging (AMBP) moved after reporting higher revenue and profit, alongside plans to extend debt maturities and increase investor transparency. This put its balance sheet and capital structure in sharper focus for shareholders.

At a share price of $4.35, Ardagh Metal Packaging has seen a 19.83% 3 month share price return and a 79.51% 1 year total shareholder return, suggesting recent momentum is building despite a more modest 4.82% year to date share price gain.

If this kind of rebound catches your eye, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership and see what else is gaining traction.

With shares rebounding and Ardagh Metal Packaging trading at a sizeable intrinsic discount alongside only a small gap to analyst targets, you have to ask yourself: is there still an opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 1% Overvalued

With Ardagh Metal Packaging last closing at $4.35 versus a narrative fair value of $4.30, the valuation gap is tight and hinges on specific growth and margin assumptions.

The combination of resilient double-digit shipment growth in the Americas and disciplined capital investments has led to deleveraging, greater financial flexibility, and a strong liquidity position, positioning the company to grow free cash flow and support ongoing dividends and reinvestment, all of which should drive higher future earnings per share.

Curious what earnings path is built into that fair value? Revenue grows steadily, margins lift off a low base, and a premium P/E is assumed. Want the full playbook?

Result: Fair Value of $4.30 (ABOUT RIGHT)

However, this depends on high leverage remaining manageable and on aluminum price swings not squeezing margins or earnings more than analysts currently expect.

Another View: Multiples Paint a Different Picture

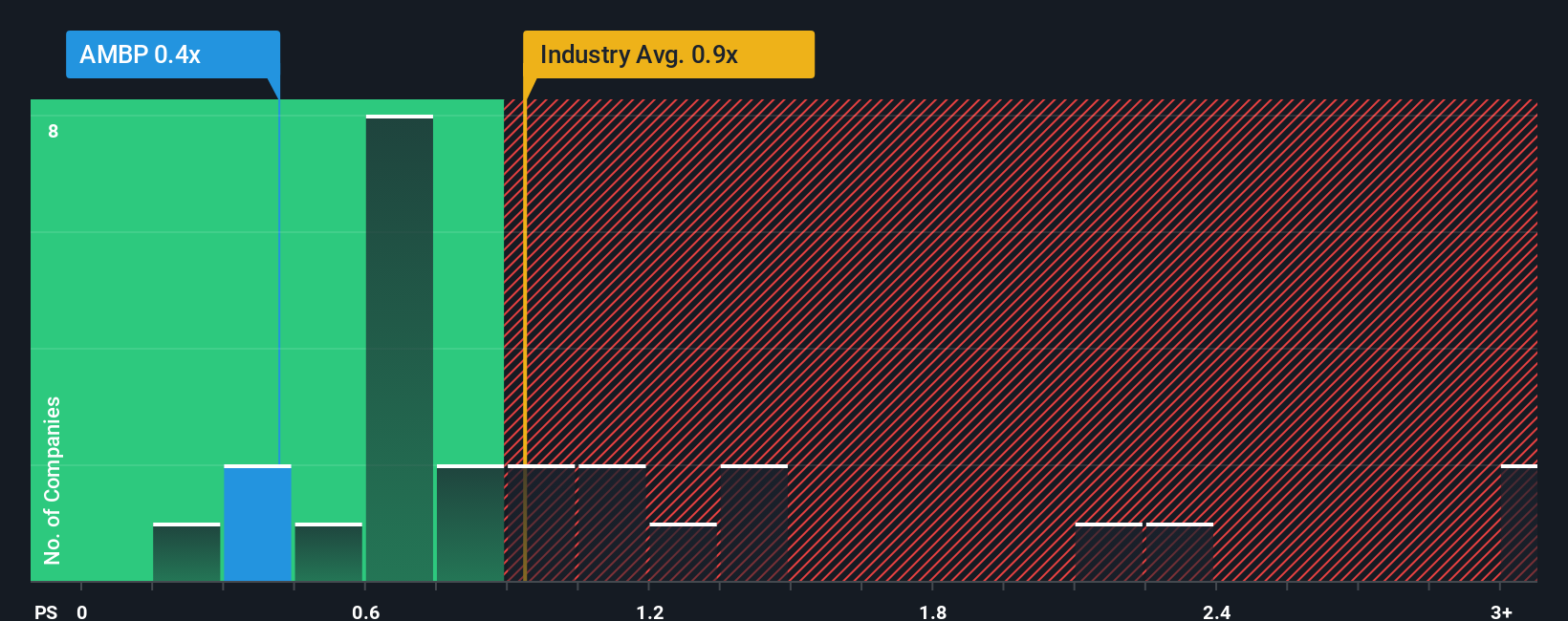

That 1% narrative premium might look tight, but the market is saying something else when you look at P/S. Ardagh Metal Packaging trades at 0.5x sales versus peers at 0.8x, the US Packaging industry at 0.9x, and a fair ratio of 0.7x. This points to valuation risk or opportunity depending on which story you trust more.

Build Your Own Ardagh Metal Packaging Narrative

If you see the data differently, or prefer to build your own view from the ground up, you can plug in your assumptions and Do it your way in under three minutes.

A great starting point for your Ardagh Metal Packaging research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about growing your portfolio, do not stop with a single stock. Use targeted screeners to find more ideas that fit your style.

- Spot early stage opportunities by scanning these 3545 penny stocks with strong financials that pair smaller market sizes with solid fundamentals and clear business models.

- Tap into long term trends in automation and data by focusing on these 28 AI penny stocks that are building real products, not just hype.

- Zero in on pricing gaps with these 872 undervalued stocks based on cash flows that appear inexpensive based on cash flows and may warrant a closer look before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.