Please use a PC Browser to access Register-Tadawul

A Look At Arlo Technologies (ARLO) Valuation After New Samsung SmartThings Security Agreement

ARLO TECHNOLOGIES, INC. ARLO | 13.58 | -1.88% |

Arlo Technologies (ARLO) is back in focus after the company announced a new agreement with Samsung SmartThings, expanding access to its AI powered smart security services within the SmartThings home automation app.

Despite the SmartThings agreement putting Arlo firmly in the smart home conversation, the stock has recently cooled, with a 30 day share price return of an 8.82% decline and a 90 day share price return of a 21.67% decline, while the 1 year total shareholder return of 15.65% and very large 3 year total shareholder return suggest momentum has been built over a longer horizon.

If this kind of AI driven security story interests you, it could be a good time to see what else is out there among high growth tech and AI stocks that the market is watching.

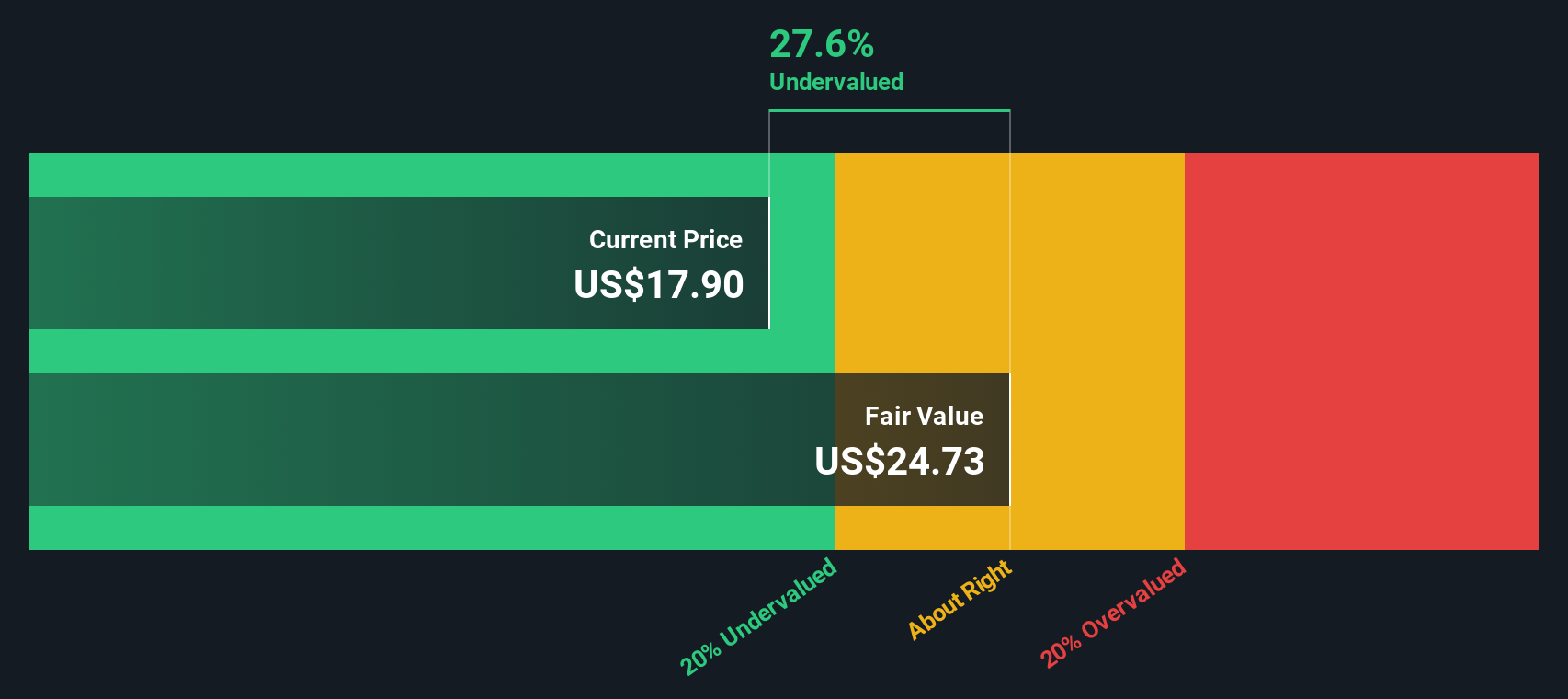

With Arlo reporting US$509.6m in revenue, positive net income and a value score of 4, yet trading well below the US$23.20 analyst price target and an estimated intrinsic value discount, is this a fresh entry point or is future growth already priced in?

Most Popular Narrative: 43% Undervalued

With Arlo Technologies closing at US$13.23 against a most-followed fair value of US$23.20, the narrative centers on whether future earnings can bridge that valuation gap.

The analysts have a consensus price target of $23.2 for Arlo Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $22.0.

Curious what kind of revenue mix, margin shift, and earnings profile would need to line up to support that fair value gap? The narrative leans heavily on a specific path for profitability, recurring revenue and valuation multiples. The full breakdown spells out how those moving parts are expected to interact.

Result: Fair Value of $23.20 (UNDERVALUED)

However, this depends on hardware pricing pressure and rising competition not eroding margins or subscriber growth, which could quickly challenge that underpriced story.

Another View: Market Ratios Flash A Different Signal

Our DCF model sees Arlo as trading about 20.3% below an estimated fair value of US$16.60, which supports the idea that the shares might be undervalued. That contrasts with a simple P/S check that looks less generous. Which of these signals do you put more weight on?

Build Your Own Arlo Technologies Narrative

If you do not buy into this view, or simply like to work through the numbers on your own terms, you can spin up a full narrative in just a few minutes with Do it your way.

A great starting point for your Arlo Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger watchlist, do not stop at one stock. Use the Simply Wall St Screener to surface new ideas quickly.

- Scan for high potential smaller names by checking out these 3564 penny stocks with strong financials that already show solid financial underpinnings.

- Zero in on AI focused opportunities by reviewing these 25 AI penny stocks that are catching attention for their exposure to artificial intelligence themes.

- Hunt for potential mispricing by filtering for these 870 undervalued stocks based on cash flows where current market prices may not fully reflect the underlying characteristics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.