Please use a PC Browser to access Register-Tadawul

A Look At Arrow Electronics (ARW) Valuation After Strong Q4, AI Infrastructure Growth And Expanded Citrix Partnership

Arrow Electronics, Inc. ARW | 157.03 | +2.05% |

Arrow Electronics (ARW) is back in focus after a strong fourth quarter, upbeat guidance for early 2026, and an expanded Citrix partnership that hands Arrow responsibility for all Citrix Service Providers in key regions.

Those fourth quarter numbers, upbeat first quarter 2026 guidance, and the expanded Citrix role have arrived alongside strong momentum. A 30 day share price return of 34.65% and a 1 year total shareholder return of 43.14% suggest interest has been building.

If Arrow’s recent run has you thinking about where else demand for computing and infrastructure could matter, take a look at our screener of 34 AI infrastructure stocks as a starting list of ideas.

With the shares up 44% over 90 days and trading around $156 against an average analyst target of $137.50, investors now have to ask: Is Arrow still on sale, or is the market already pricing in future growth?

Most Popular Narrative: 44.3% Overvalued

The most followed narrative puts Arrow Electronics’ fair value at $108.25, well below the recent $156.19 close, which sets up a clear valuation gap for investors to assess.

The analysts are assuming Arrow Electronics's revenue will grow by 7.3% annually over the next 3 years.

Analysts assume that profit margins will increase from 1.6% today to 2.1% in 3 years time.

Curious how steady revenue growth, a step up in margins, and a different future earnings multiple all tie together into that $108.25 figure? The full narrative lays out a detailed earnings path, the implied profitability shift, and the valuation checkpoints it uses to argue that the current price is running well ahead of those assumptions.

Result: Fair Value of $108.25 (OVERVALUED)

However, there are still real pressure points, from potential disintermediation as customers adopt direct sourcing platforms to geopolitical and tariff risks that could unsettle Arrow’s revenue and margins.

Another View: Earnings Multiple Sends a Different Signal

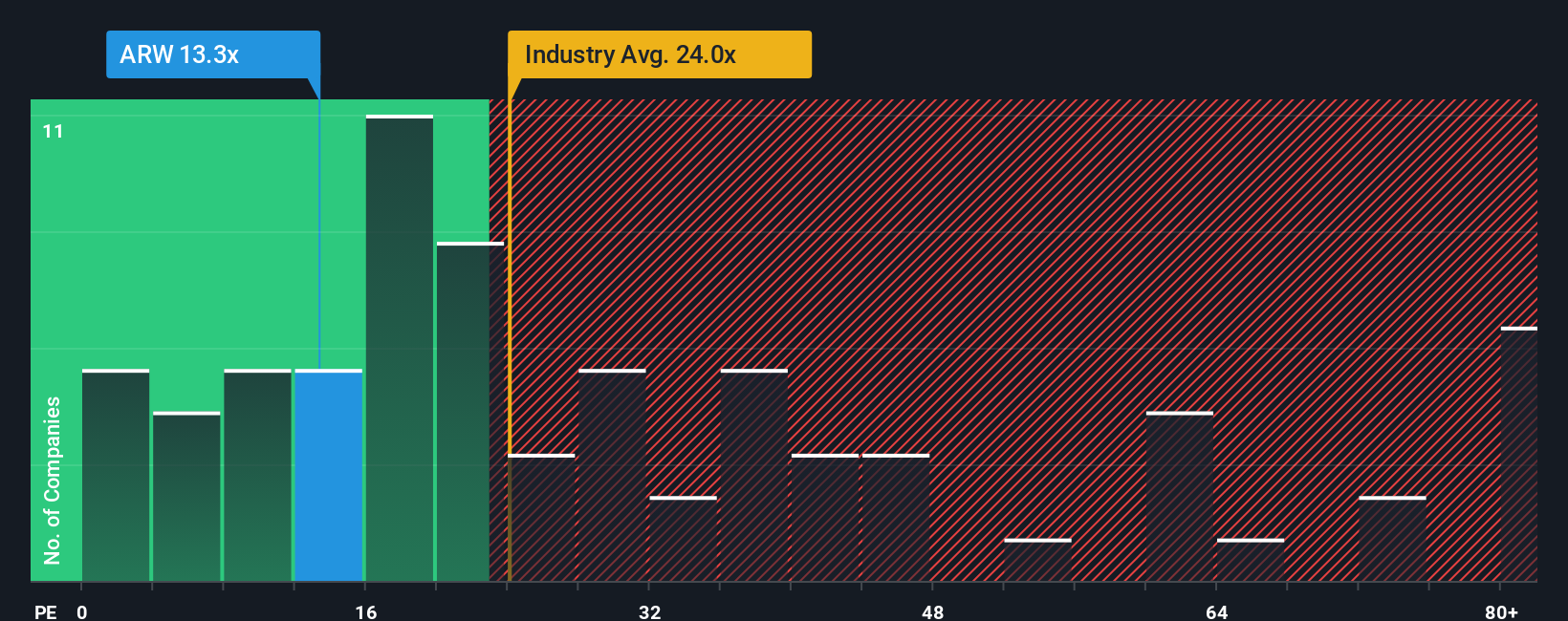

The narrative fair value of $108.25 paints Arrow as 44.3% overvalued, but the current P/E of 14x sits well below the US Electronic industry at 27.1x, the peer average at 19x, and even a fair ratio of 21.8x. That gap suggests the market may be pricing in more risk than these peers. Which story do you think is closer to reality?

Build Your Own Arrow Electronics Narrative

If you see the data differently, or prefer to test your own assumptions, you can build a custom Arrow story in minutes, starting with Do it your way.

A great starting point for your Arrow Electronics research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Arrow has sparked your interest, do not stop here. Broaden your watchlist with focused stock ideas that could sharpen how you think about risk and reward.

- Spot potential mispricings early by scanning our list of screener containing 23 high quality undiscovered gems before they appear on everyone else’s radar.

- Prioritize resilience by reviewing companies in the 85 resilient stocks with low risk scores that score well on our risk metrics and qualitative checks.

- Anchor your portfolio with quality names from the solid balance sheet and fundamentals stocks screener (44 results) that pair financial strength with consistent fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.