Please use a PC Browser to access Register-Tadawul

A Look At Axcelis Technologies (ACLS) Valuation After Recent Mixed Share Price Performance

Axcelis Technologies, Inc. ACLS | 80.16 | -0.57% |

Why Axcelis Technologies is on investors’ radar today

Axcelis Technologies (ACLS) has drawn fresh attention after a period of mixed share performance, with a 1 day decline, a weaker past week and month, but a slightly positive past 3 months.

For investors, that kind of uneven return profile often raises questions about how the current share price lines up with Axcelis’s actual business results and long term prospects in semiconductor equipment.

The recent 7 day share price return of 9.28% decline and 30 day share price return of 7.05% decline suggest momentum has cooled, even though the 1 year total shareholder return of 23.34% still reflects a stronger long term outcome.

If Axcelis has you thinking about where else growth and volatility might show up in semiconductors, it could be a good time to scan high growth tech and AI stocks as a next step.

With Axcelis trading at US$82.76 against an average analyst price target of US$98.50, and revenue and earnings moving in different directions, is the stock quietly undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 16% Undervalued

Axcelis’s most followed narrative pegs fair value at about $98.50, comfortably above the last close at $82.76, and ties that gap to long term demand drivers.

Adoption of silicon carbide (SiC) power devices in electric vehicles and industrial applications remains early stage, with penetration rates and SiC content per vehicle expected to rise globally and across hybrids. Axcelis's leadership in high-energy ion implantation positions it to benefit from this ramp, supporting future revenue and gross margin expansion as SiC demand multiplies.

To see what sits behind that SiC story and a higher fair value, even as earnings and margins are modeled lower for several years, the full narrative lays out the earnings path, margin assumptions and valuation multiple that need to line up for $98.50 to make sense.

Result: Fair Value of $98.50 (UNDERVALUED)

However, the story could change quickly if Axcelis’s heavy China exposure meets tighter export controls, or if customers remain cautious on advanced ion implanter spending.

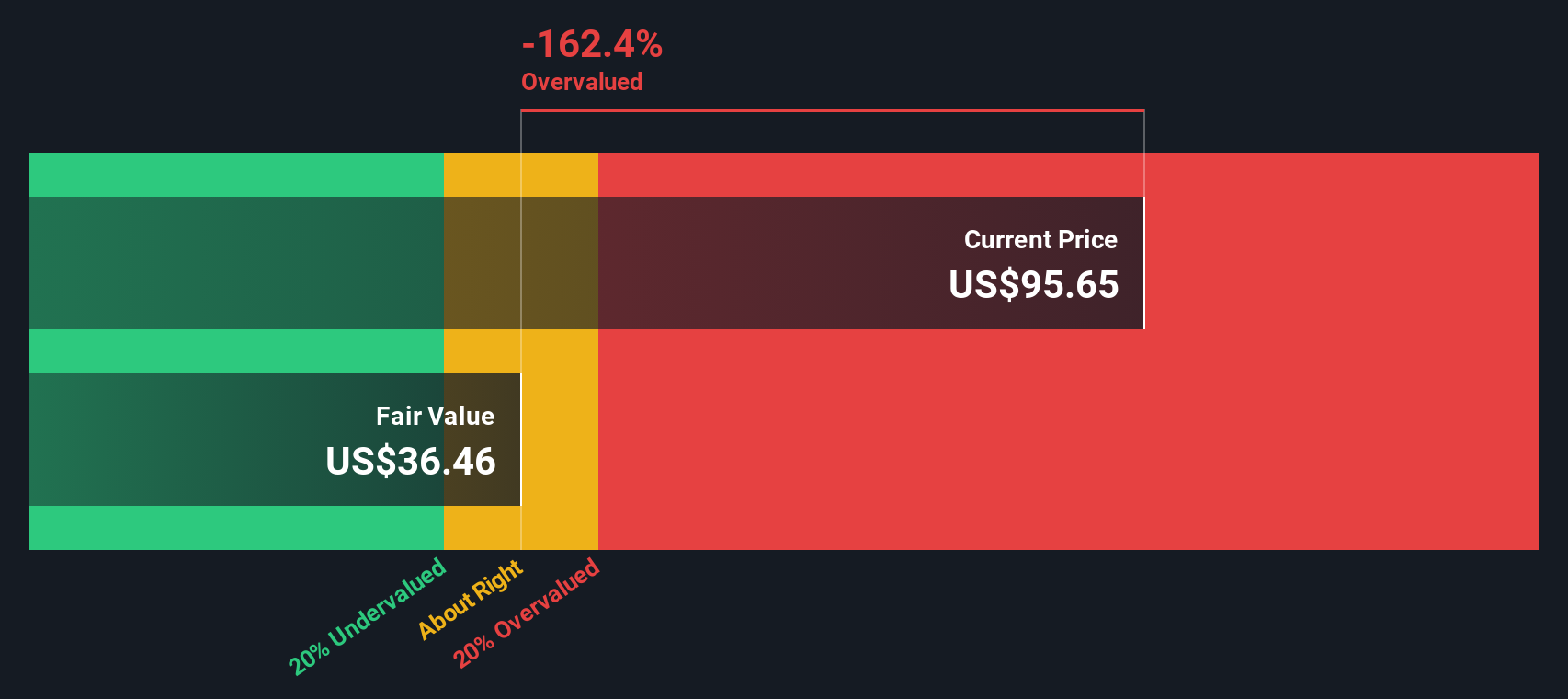

Another View: Our DCF Model Says Overvalued

While the analyst and narrative fair value of $98.50 points to Axcelis as 16% undervalued, the Simply Wall St DCF model suggests something very different. On that approach, the future cash flow value comes out at $34.47, which is well below the current $82.76 share price.

That gap means one method sees upside, while another flags valuation risk if cash flows stay closer to the DCF assumptions. It leaves you with a simple question: which story do you think better reflects how Axcelis will actually convert its business into cash over time?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Axcelis Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Axcelis Technologies Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test the assumptions yourself, you can build a personalized Axcelis view in just a few minutes with Do it your way.

A great starting point for your Axcelis Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Axcelis has sharpened your focus, do not stop here; use the Simply Wall St Screener to spot other opportunities that might suit your style before they move.

- Target potential turnaround stories by scanning these 863 undervalued stocks based on cash flows that the market may be overlooking right now.

- Ride major tech shifts by hunting through these 29 AI penny stocks that are tied to artificial intelligence trends across many industries.

- Lock in potential portfolio income by checking out these 11 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.