Please use a PC Browser to access Register-Tadawul

A Look At Banc Of California (BANC) Valuation After Strong Q4 Earnings And Share Price Gains

Banc of California, Inc. BANC | 20.07 | +1.31% |

Banc of California (BANC) is back in focus after reporting fourth quarter results that included net interest income of US$251.36 million and net income of US$77.39 million, both above the prior year period.

The earnings release appears to have kept positive momentum intact, with a 90-day share price return of 21.60% and a 1-year total shareholder return of 32.79% at a share price of US$20.38. This suggests investors are reacting to recent financial results and the completed buyback program with growing confidence rather than fading interest.

If this kind of bank earnings story has caught your attention, it could be a good moment to see how other lenders are positioned and compare them with solid balance sheet and fundamentals stocks screener (None results).

With Banc of California trading at US$20.38 and showing both an intrinsic discount and a gap to analyst targets, the key question is whether you are looking at genuine value or a price that already reflects future growth?

Most Popular Narrative: 9.8% Undervalued

With Banc of California trading at $20.38 against a most-followed fair value estimate of about $22.59, the current price sits below that narrative anchor and puts the recent move into a valuation context.

The successful merger integration with Pacific Western Bank is unlocking cost synergies, revenue cross-sell opportunities, and scale benefits, which are already contributing to tangible book value expansion and margin improvement and are likely to further boost future profitability.

Curious what kind of revenue profile, margin shift and future earnings multiple it takes to reach that fair value number? The most followed narrative lays out a specific path for higher profits, share count trends and required valuation reset. If you want to see exactly which financial assumptions sit behind that gap to fair value, the full narrative connects all those dots.

Result: Fair Value of $22.59 (UNDERVALUED)

However, the story can change quickly if Southern California commercial real estate weakens or if integration costs from recent deals eat into the margin assumptions behind that fair value.

Another Angle: P/E Ratios Point to a Richer Price Tag

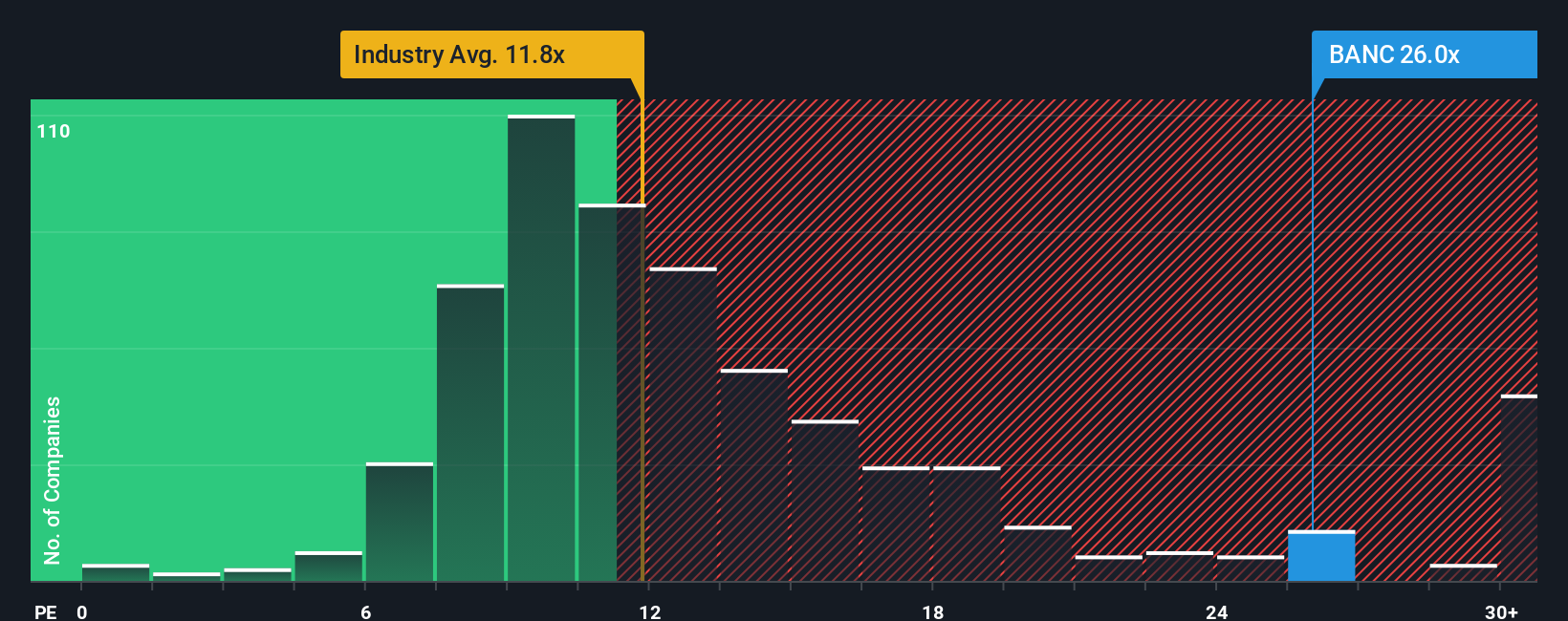

While our fair value estimate suggests Banc of California is trading at a discount, the P/E tells a different story. At 18.8x earnings, the stock sits above both the US Banks industry average of 11.7x and an estimated fair ratio of 17.2x. That richer multiple can mean investors are already paying up. How comfortable are you with that margin of safety?

Build Your Own Banc of California Narrative

If you see the numbers differently or prefer to weigh the data yourself, you can test your own thesis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Banc of California.

Looking for more investment ideas?

If Banc of California has sharpened your interest, do not stop here. Use the Screener to line up fresh ideas that match how you like to invest.

- Target potential value candidates by scanning these 872 undervalued stocks based on cash flows that currently trade at a discount to their underlying cash flows.

- Ride emerging tech themes by focusing on these 24 AI penny stocks that are tied to artificial intelligence growth stories.

- Put cash flow to work by reviewing these 13 dividend stocks with yields > 3% that offer yields above 3% for income focused portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.