Please use a PC Browser to access Register-Tadawul

A Look At Broadstone Net Lease (BNL) Valuation After Investor Day And US$352 Million Healthcare Asset Sale

Broadstone Net Lease, Inc. BNL | 18.79 | +0.54% |

Investor day puts Broadstone Net Lease (BNL) in focus

Broadstone Net Lease (BNL) has moved into the spotlight after its investor day, where management highlighted a healthcare asset simplification plan, an industrial development pipeline, and the completed US$352 million sale of 57 healthcare properties.

Recent momentum has been firm, with a 1 month share price return of 4.97% feeding into a 12.49% year to date share price gain and a 37.00% 1 year total shareholder return. This suggests sentiment around the investor day updates and healthcare asset sale has been improving rather than fading.

If this REIT’s progress has you thinking about where else capital could work, it may be a good moment to broaden your search and check out 23 top founder-led companies.

With BNL trading close to analysts’ price target and recent returns already strong, the key question is simple: is there still value left on the table here, or are markets already pricing in future growth?

Most Popular Narrative: 2.7% Undervalued

Broadstone Net Lease last closed at $19.64, a touch below a widely followed fair value estimate of $20.18, which hinges on a detailed future cash flow story.

The company's proven ability to source relationship-based acquisitions and execute value-creating build-to-suit developments, while prudently managing leverage and self-funding growth through dispositions at attractive cap rates, allows BNL to maintain portfolio growth and expansion of cash flows independent of volatile equity markets, reducing financing risk and supporting NAV growth.

Curious what underpins that fair value? The narrative leans on measured revenue expansion, firmer margins and a future earnings multiple that assumes consistent execution. Want the full picture of those assumptions?

Result: Fair Value of $20.18 (UNDERVALUED)

However, you still need to factor in tenant credit issues and the reliance on ongoing acquisitions. Either of these could quickly challenge this underpriced story.

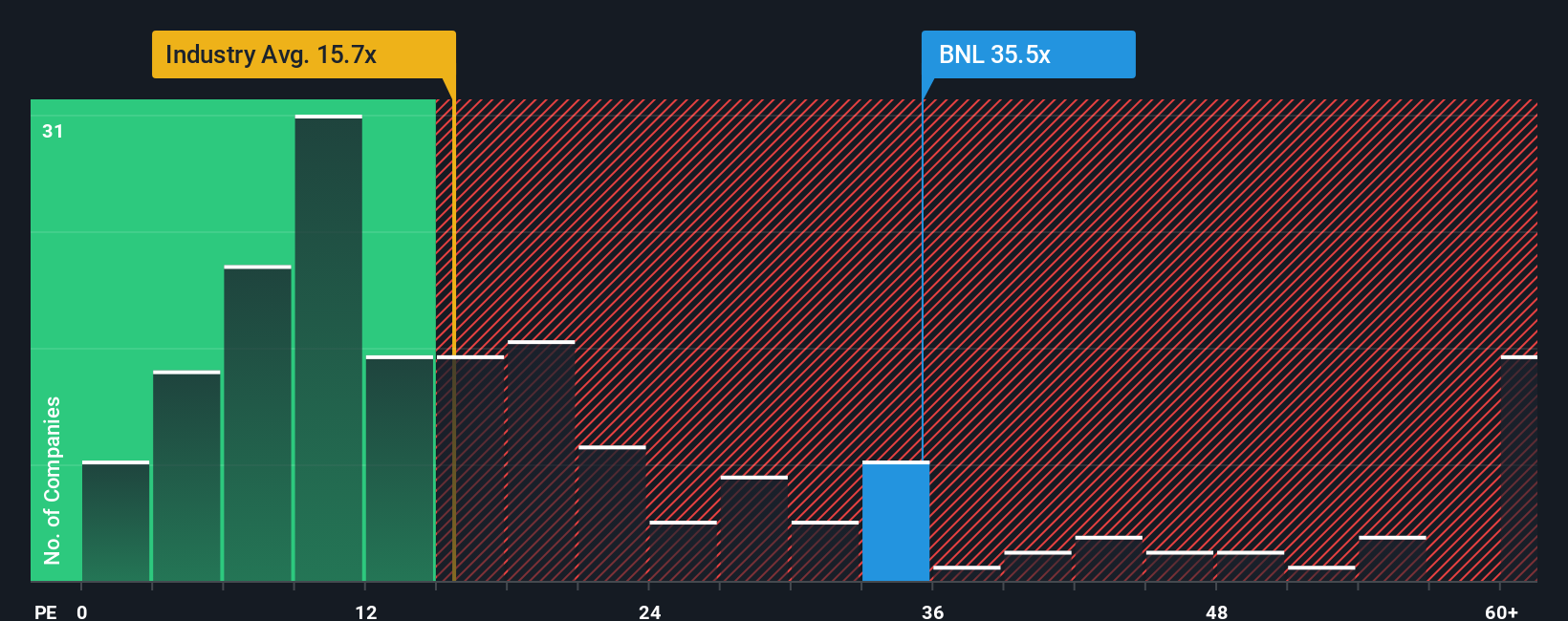

Another View: Earnings Multiple Sends A Different Signal

That 2.7% “undervalued” fair value hinges on future cash flows, but the current P/E ratio of 42x tells a tougher story. It sits well above the fair ratio of 36.1x, the US REITs industry at 16.1x, and peers at 25.1x. This points to meaningful valuation risk if expectations cool.

Build Your Own Broadstone Net Lease Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a custom Broadstone story in just a few minutes: Do it your way.

A great starting point for your Broadstone Net Lease research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Broadstone has sharpened your thinking, do not stop here; use this momentum to compare fresh opportunities and test your conviction across different types of stocks.

- Target potential mispricings by scanning for companies that look attractively valued on both quality and price using 53 high quality undervalued stocks.

- Lock in income-focused ideas by reviewing companies with resilient payouts that show up in 12 dividend fortresses.

- Protect your downside by filtering for companies with steadier risk profiles through 84 resilient stocks with low risk scores.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.