Please use a PC Browser to access Register-Tadawul

A Look At Burlington Stores (BURL) Valuation After Wells Fargo Buy Rating Upgrade

Burlington Stores, Inc. BURL | 315.28 | +0.79% |

Wells Fargo’s Ike Boruchow recently upgraded Burlington Stores (BURL) to a buy rating, a move that has sharpened investor focus on how the off price retailer’s fundamentals compare with this renewed optimism.

The recent upgrade lands after a strong short term run, with a 30 day share price return of 14.22% and a 90 day share price return of 11.57%, while the latest close sits at US$306.31. At the same time, the 1 year total shareholder return of 5.42% and 3 year total shareholder return of 38.08% suggest that momentum has been building over a longer horizon, even as investors reassess the risk and growth profile of off price retail.

If this shift in sentiment around Burlington Stores has your attention, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership as potential ideas to research next.

With the stock up strongly in recent months and analysts setting a price target above the current US$306.31 level, the real question now is whether Burlington Stores still offers a buying opportunity or if the market is already pricing in future growth.

Most Popular Narrative: 10% Undervalued

With Burlington Stores’ fair value estimate of about US$339 sitting above the US$306.31 last close, the most followed narrative sees more upside already built into its cash flow and margin outlook.

Ongoing investments in automation (such as the new West Coast distribution center) and enhanced inventory management through reserve buying and supply chain initiatives allow Burlington to improve merchandise margins and achieve operating leverage, supporting long term earnings growth.

The ongoing upgrades to merchandising and store operations ("Burlington 2.0" initiatives), including modernized layouts and improved associate engagement, have produced measurable improvements in sales productivity and margin control. This indicates potential for further net margin expansion as these initiatives scale across the chain.

Curious how mid to high single digit revenue growth, fatter margins and a lower future P/E still back a higher fair value than today’s price? The full narrative walks through those moving parts in detail, including the profit bridge and what needs to happen by the late 2020s for that valuation to hold up.

Result: Fair Value of $339.29 (UNDERVALUED)

However, this hinges on store expansion and margin gains holding up, while continued underinvestment in digital and any hit to value-focused shoppers could quickly challenge that setup.

Another View: Market Pricing Looks Rich

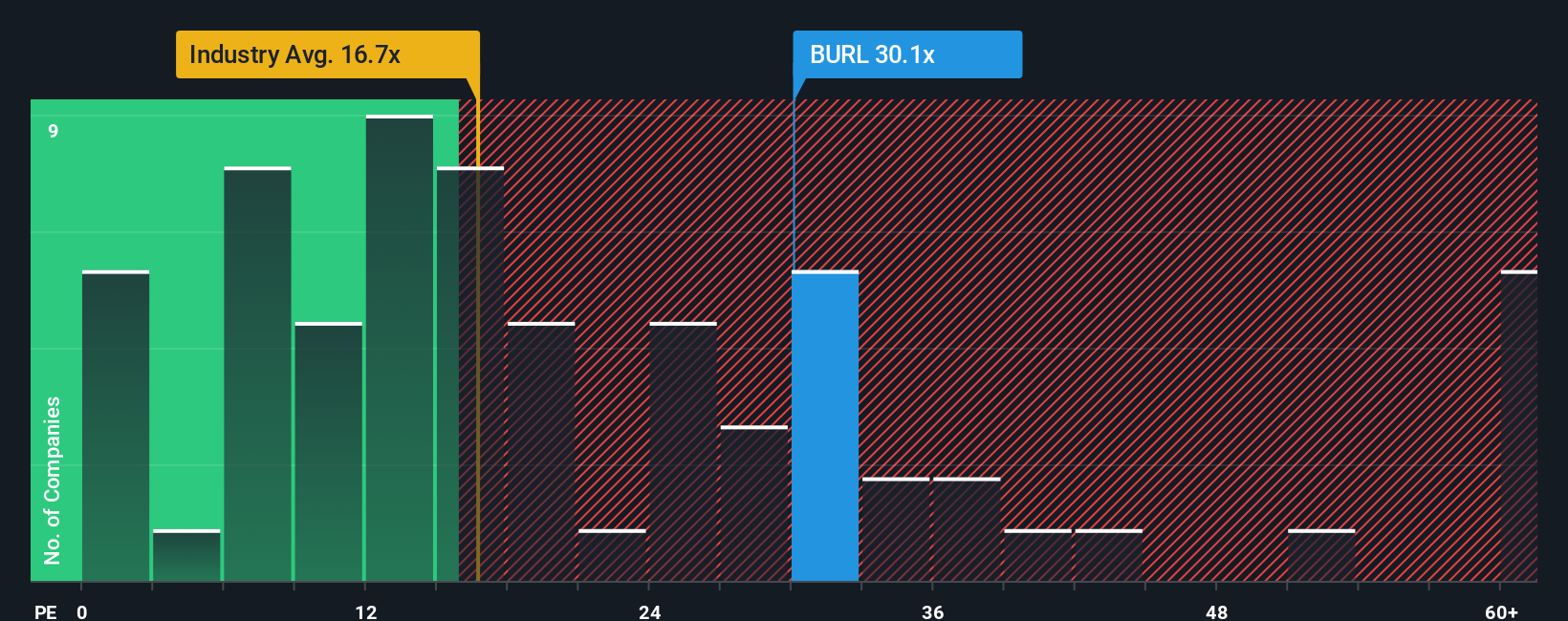

While the fair value narrative points to about US$339 per share and an undervalued setup, the current P/E of 34x tells a very different story. That multiple sits well above both the US Specialty Retail industry at 21x and the peer average at 20.6x, and even above Burlington’s own fair ratio of 23.8x. In plain terms, the market is already paying a premium, which could limit upside if growth or margins come in below expectations.

Build Your Own Burlington Stores Narrative

If you see the numbers differently, or simply prefer to walk through the data yourself, you can build a custom Burlington view in minutes with Do it your way.

A great starting point for your Burlington Stores research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, take a moment to line up your next potential opportunity using a few focused stock lists that keep quality and potential front of mind.

- Target steady income by reviewing these 12 dividend stocks with yields > 3% that could help anchor a long term, yield focused portfolio.

- Get ahead of the next technology wave by scanning these 24 AI penny stocks that are tied to artificial intelligence themes.

- Hunt for potential mispricing by checking these 865 undervalued stocks based on cash flows that the market may not be fully appreciating yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.