Please use a PC Browser to access Register-Tadawul

A Look At Cardinal Health (CAH) Valuation As Earnings And Analyst Upgrades Refocus Investor Attention

Cardinal Health, Inc. CAH | 210.39 | -1.71% |

Cardinal Health (CAH) heads into its February 5, 2026 earnings report with investor attention focused on revised forecasts for earnings per share and revenue, as well as expectations around its Pharmaceutical and Medical segment performance.

At a share price of $210.93, Cardinal Health has seen a 29.57% 90 day share price return and a 63.37% 1 year total shareholder return, suggesting momentum has been building ahead of earnings and recent analyst upgrades.

If Cardinal Health’s recent run has you rethinking your healthcare exposure, this could be a handy moment to scan healthcare stocks for other names catching investors’ attention.

With the shares up strongly over the past year and trading near recent analyst targets, the key question now is whether Cardinal Health still offers upside or if the market is already pricing in future growth.

Most Popular Narrative: 8.4% Undervalued

With Cardinal Health last closing at $210.93 against a narrative fair value of $230.27, the valuation debate is centering on how durable its earnings engine really is.

The strong performance and continued investment in Other growth businesses such as at-Home Solutions, Nuclear and Precision Health, and OptiFreight Logistics aligns with the growing trend of outpatient and home healthcare, underpinning diversified revenue growth and supporting margin expansion.

Want to see what is behind that earnings story? The narrative leans on steady revenue gains, a slimmer cost base and a richer profit multiple than many expect. Curious which specific growth and margin assumptions are doing the heavy lifting in that $230.27 fair value?

Result: Fair Value of $230.27 (UNDERVALUED)

However, there are still pressure points to watch, including tariff headwinds in Global Medical Products and Distribution, as well as any slowdown in core pharmaceutical contract wins.

Another Angle On Valuation

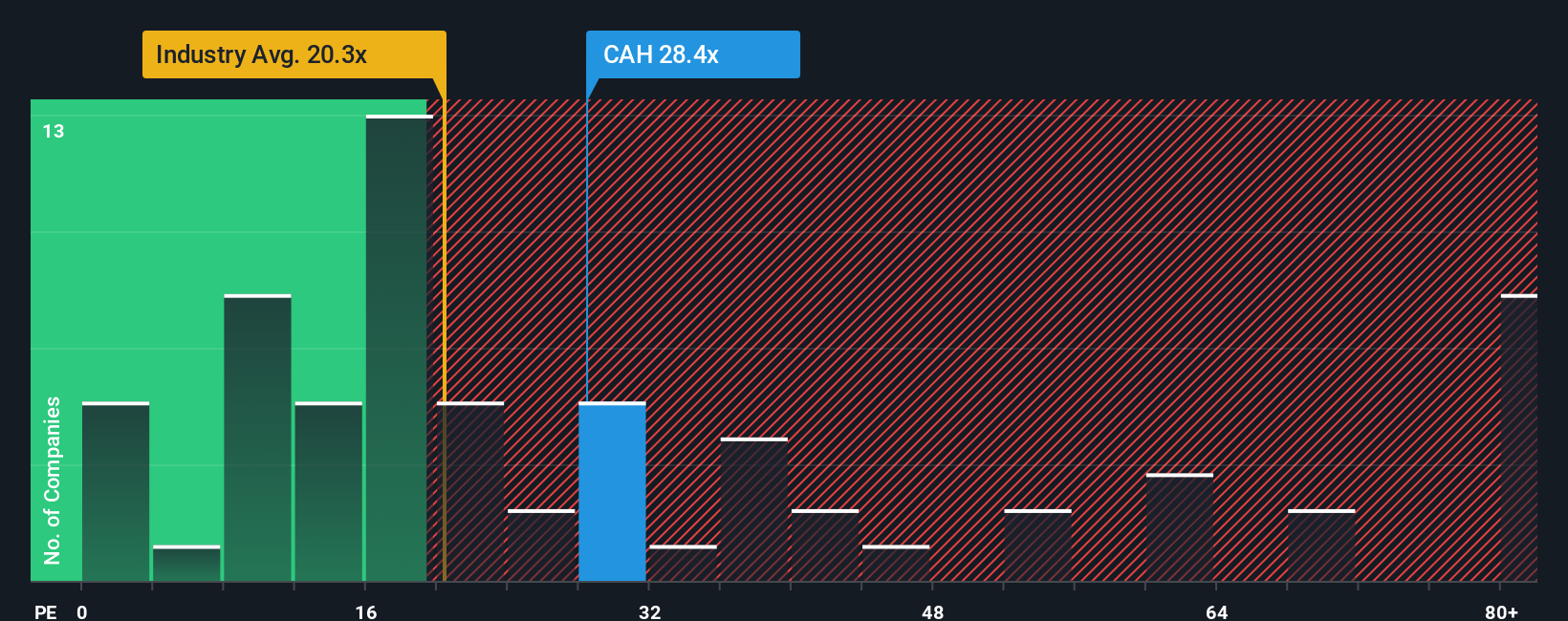

While the narrative fair value suggests Cardinal Health is 8.4% undervalued at $210.93, the P/E story is less forgiving. The shares trade on 31.4x earnings, richer than peers at 27.8x and above a fair ratio of 30.7x. That premium raises a simple question: how much good news is already in the price?

Build Your Own Cardinal Health Narrative

If you see the numbers differently or simply want to stress test your own assumptions, you can build a custom view in minutes with Do it your way.

A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Cardinal Health has sharpened your focus, do not stop here. The next step is lining up a few fresh ideas so you are not caught flat footed.

- Scan for income potential by checking out these 13 dividend stocks with yields > 3% that might suit a portfolio built around regular cash returns.

- Hunt for mispriced opportunities using these 887 undervalued stocks based on cash flows that currently screen as trading below their estimated cash flow value.

- Get ahead of emerging tech themes through these 24 AI penny stocks that tie artificial intelligence to real business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.