Please use a PC Browser to access Register-Tadawul

A Look At CareTrust REIT’s (CTRE) Valuation After Recent Analyst Upgrades And Rising Earnings Estimates

CareTrust REIT, Inc. CTRE | 36.71 | -1.69% |

Why recent analyst upgrades put CareTrust REIT (CTRE) on more investors’ radar

Recent analyst upgrades and new coverage with positive ratings have drawn fresh attention to CareTrust REIT (CTRE), as rising earnings estimates prompt investors to reassess the healthcare focused landlord’s stock.

The recent analyst upgrades come after a steady period for the share price, with a 90 day share price return of 4.36% and a year to date share price return of 1.49%. Long term total shareholder returns of 38.33% over one year and more than doubling over three and five years suggest momentum has been building rather than fading. Alongside the positive ratings, CareTrust REIT also recently outlined the tax status of its 2025 dividends, which may keep income focused investors attentive to the balance between ongoing distributions and the current US$36.85 share price.

If this healthcare REIT has caught your attention, it could be a good moment to widen your watchlist with other income and growth ideas across healthcare stocks.

With CTRE trading around US$36.85, an implied intrinsic discount of about 37% and a price target gap of roughly 12%, the key question is whether this reflects genuine mispricing or whether the market is already factoring in expectations for future growth.

Most Popular Narrative: 10.9% Undervalued

CareTrust REIT's most followed narrative pegs fair value at about $41.36 per share, a touch above the recent $36.85 close. This puts the current analyst upgrades in a clearer context.

The expanded investment pipeline of approximately $600 million, mainly in skilled nursing, seniors housing, and U.K. care homes, gives strong visibility into continued external growth, supporting FFO and dividend capacity. Rapid portfolio expansion and robust operator relationships across both the U.S. and U.K. are framed as a way to keep occupancy and rent collections resilient, which underpins the higher fair value estimate.

Curious what kind of revenue trajectory and margin profile are baked into that higher value? The narrative leans on ambitious growth, richer profitability, and a different earnings multiple than today. Want to see exactly which assumptions need to hold up to support a fair value above the current price?

Result: Fair Value of $41.36 (UNDERVALUED)

However, this hinges on smooth integration of new acquisitions and steady tenant health, with reimbursement or regulatory changes in skilled nursing quickly challenging those assumptions.

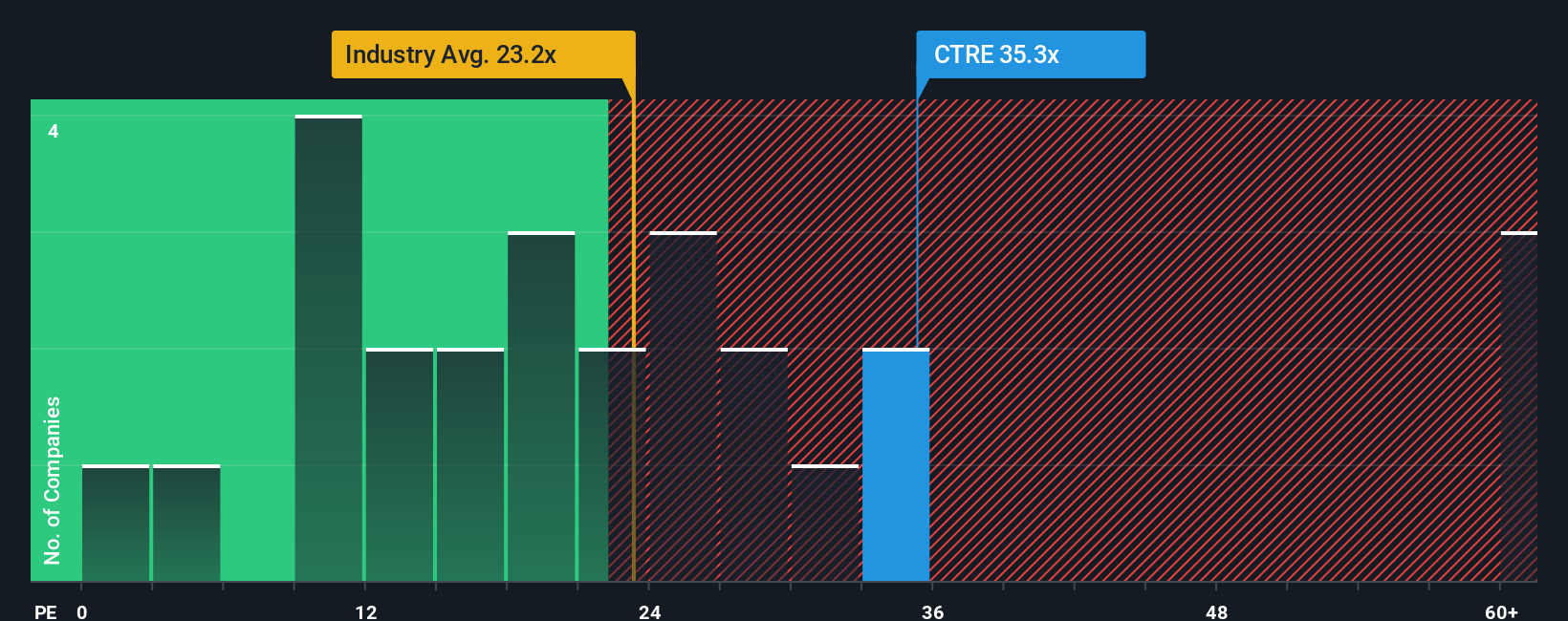

Another View: What The P/E Ratio Is Saying

Our fair value work points to CTRE trading at a discount, but the P/E ratio tells a more cautious story. At 31.6x earnings, the stock is richer than the global Health Care REITs average of 27x, yet cheaper than peer levels at 57.3x and below a fair ratio of 38.9x.

That mix of cheaper than peers but pricier than the wider industry hints at real valuation risk if growth or margins fall short, and potential upside if the market edges closer to the higher fair ratio. Which side of that trade off do you think current earnings can justify?

Build Your Own CareTrust REIT Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised CareTrust REIT thesis in just a few minutes, starting with Do it your way.

A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If CTRE is on your radar, do not stop there. Use the Simply Wall St Screener to spot other opportunities that could round out your portfolio.

- Hunt for high potential value plays using these 876 undervalued stocks based on cash flows that line up with your own expectations on cash flows and pricing.

- Tap into the momentum across digital assets with these 18 cryptocurrency and blockchain stocks and see which listed companies are most exposed to blockchain and cryptocurrency themes.

- Target reliable income by scanning these 14 dividend stocks with yields > 3% for yield focused ideas that might complement a healthcare REIT holding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.