Please use a PC Browser to access Register-Tadawul

A Look At Carpenter Technology (CRS) Valuation After Raised Guidance And Strong Quarterly Earnings

Carpenter Technology Corporation CRS | 389.73 | +1.50% |

Carpenter Technology (CRS) is back in focus after its latest quarterly report, which paired higher sales and net income with raised operating income guidance for both the third quarter and full fiscal year 2026.

The raised guidance and recent buyback sit alongside strong price action, with a 17.3% 7 day share price return, 13.2% 90 day share price return and a very large 5 year total shareholder return. Taken together, these factors suggest momentum has been building rather than fading.

If Carpenter Technology's move has caught your attention, it could be a good moment to see what else is shaping industrial demand and materials, starting with our 30 best rare earth metal stocks.

With CRS up sharply and trading about 11% below the average analyst price target, the key question now is whether the raised guidance and buybacks still leave upside on the table or whether the market is already pricing in future growth.

Most Popular Narrative: 4.5% Undervalued

The most followed narrative sets Carpenter Technology's fair value at $382.37, slightly above the last close of $365.11. It relies on consistent long term assumptions rather than significant model changes.

Record demand for power generation materials (with power gen revenues up over 100% YoY) and increased electrification (industrial gas turbines and electric motors using advanced alloys/magnetic materials) are driving significant new order flow, enhancing operating margins due to aerospace-level profitability.

Want to see what is baked into that fair value? The narrative leans on firm revenue growth, richer margins, and a premium earnings multiple. The full story connects those building blocks step by step.

Result: Fair Value of $382.37 (UNDERVALUED)

However, you still have to weigh the risk that heavy aerospace and defense exposure, plus large brownfield expansion spending, could pressure margins and free cash flow if demand softens.

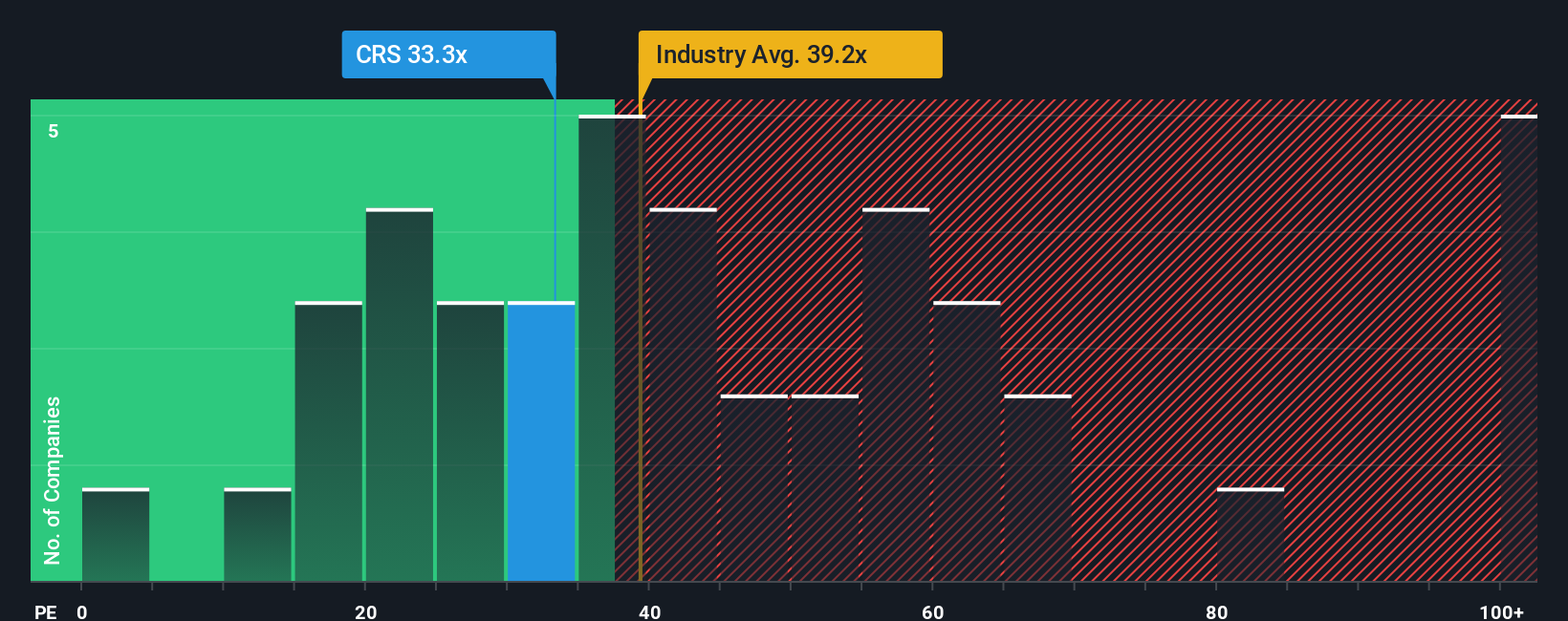

Another View: Earnings Multiple Flags Rich Pricing

That $382.37 fair value suggests modest upside, but the earnings multiple tells a tighter story. At a P/E of 41.8x, Carpenter Technology trades above peers at 36.9x and even above its own fair ratio of 36.4x, which points to valuation risk if expectations cool.

Build Your Own Carpenter Technology Narrative

If parts of this narrative do not quite fit your view, or you prefer to work from the raw numbers yourself, you can quickly build a version that matches your own thesis. Start from your key assumptions and risk views, then refine it in a few minutes with Do it your way.

A great starting point for your Carpenter Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Carpenter Technology is on your radar, do not stop here. The real edge comes from comparing opportunities side by side using focused stock lists tailored to your goals.

- Target value potential by scanning 52 high quality undervalued stocks that combine quality fundamentals with prices that may sit below what many investors might expect.

- Prioritize resilience by checking 84 resilient stocks with low risk scores where balance sheets, earnings quality and risk flags are already filtered for you.

- Spot under followed opportunities through our screener containing 24 high quality undiscovered gems that highlight companies with solid metrics but limited market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.