Please use a PC Browser to access Register-Tadawul

A Look at Check Point Software (CHKP) Valuation After New Browser Launch and CMO Appointment

Check Point Software Technologies Ltd. CHKP | 192.12 | -3.20% |

If you’re weighing your next move with Check Point Software Technologies (CHKP), this week has been anything but business as usual. The company has just unveiled its new Enterprise Browser for Harmony SASE customers, aiming to address one of the toughest challenges for today’s hybrid businesses: securing unmanaged devices. In addition, Check Point welcomed Brett Theiss as its new Chief Marketing Officer, bringing fresh leadership with a proven track record in accelerating growth and reshaping tech brands. For investors, these developments signal more than operational tweaks; they hint at bold ambitions to close security gaps and strengthen Check Point’s presence in an evolving cybersecurity market.

The market has started to respond to these shifts, with the stock edging up over the past month and reversing some weakness from earlier in the year. This modest climb follows a year where momentum in CHKP has held steady. Total returns are up around 4% over the past 12 months, and the longer-term picture shows solid gains over the past three and five years. Strategic product launches like Enterprise Browser, along with leadership changes, suggest the company is positioning itself for continued relevance as new cybersecurity challenges emerge.

After a solid, though not sensational, year for the stock and these recent changes, is Check Point now flying under the radar, or has the market already priced in all the growth on the horizon?

Most Popular Narrative: 11.7% Undervalued

According to the most widely followed narrative, Check Point Software Technologies is seen as undervalued relative to its fair value estimate. The current consensus places the fair value well above today’s share price, primarily because of growth projections and solid fundamentals.

The Infinity platform continues to gain traction, with strong double-digit revenue growth and increased customer adoption. It now accounts for over 15% of total revenue. This supports expectations for revenue growth through enhanced customer retention and cross-selling opportunities.

Curious how a steady, cloud-driven revenue stream turns into such a bullish outlook? There is one key metric hiding in plain sight that might surprise you, and it is not customer growth. Think you know what really drives this valuation? You will want to see the full narrative to find out.

Result: Fair Value of $223.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, growing macroeconomic uncertainty and intensifying competition in AI and SASE could put pressure on margins and slow Check Point’s projected growth trajectory.

Find out about the key risks to this Check Point Software Technologies narrative.Another Perspective: Our DCF Model Tells a Different Story

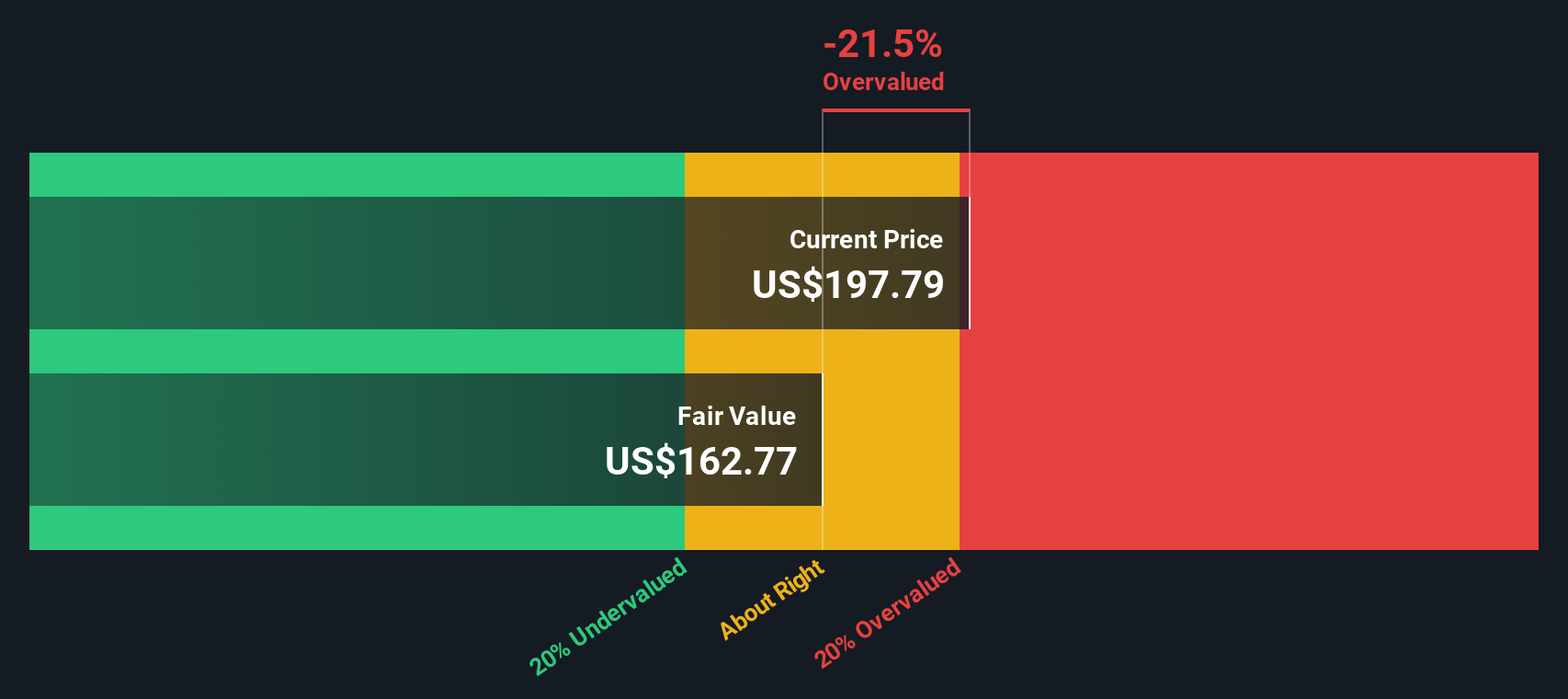

While analysts view Check Point as undervalued, our SWS DCF model reaches the opposite conclusion. It suggests the shares may be overvalued based on projected future cash flows. Which viewpoint will prove more accurate as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Check Point Software Technologies Narrative

If the above perspectives do not quite fit your views or you would rather take a hands-on approach, you can analyze the numbers and craft your own narrative from scratch in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Check Point Software Technologies.

Looking for More Investment Ideas?

Do not let great opportunities slip through your fingers. Focus your search on stocks that align with your goals by using the Simply Wall Street Screener's smartest tools today.

- Elevate your watchlist by checking out companies paying out reliable income and steady yields in the market with dividend stocks with yields > 3%.

- Spot tomorrow’s standouts early by investigating breakthrough innovators positioned in artificial intelligence with AI penny stocks.

- Zero in on value gems ready for potential growth by searching for shares currently trading below their real worth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.