Please use a PC Browser to access Register-Tadawul

A Look At Collegium Pharmaceutical (COLL) Valuation After 2026 Guidance And Nucynta Authorized Generic Agreements

Collegium Pharmaceutical, Inc. COLL | 45.00 | -0.40% |

Collegium Pharmaceutical (COLL) shares are reacting to fresh 2026 guidance, with management projecting US$805 million to US$825 million in net product revenue and outlining plans tied to Jornay PM and growth in its pain portfolio.

The fresh 2026 guidance and new Nucynta authorized generic agreements arrive after a sharp 42.13% 90 day share price return and a 38.38% one year total shareholder return, even with the recent 6.79% one month share price pullback and 6.64% one day decline. This suggests some momentum is being reassessed as investors digest the updated revenue outlook and new credit facility.

If this kind of specialty pharma story has your attention, it could be a good moment to scan other healthcare stocks that might fit your watchlist next.

With shares up strongly over the past year and the stock trading at a discount to the current analyst price target, the key question is whether Collegium still offers value or if the market has already priced in future growth.

Most Popular Narrative: 6.4% Undervalued

Compared with the last close of US$45.54, the most followed narrative points to a fair value of US$48.67, framing Collegium as modestly undervalued and tying that view to detailed earnings and margin assumptions.

Analysts expect earnings to reach $131.4 million (and earnings per share of $2.78) by about September 2028, up from $36.3 million today. The analysts are largely in agreement about this estimate.

Curious what bridges today’s earnings to that higher profit line? The narrative leans on changing margins, steady top line assumptions, and a future earnings multiple that may surprise you.

Result: Fair Value of $48.67 (UNDERVALUED)

However, the story can change quickly if generic competition bites into the core pain portfolio or if higher operating costs outpace the earnings ramp analysts are counting on.

Another Angle On Valuation

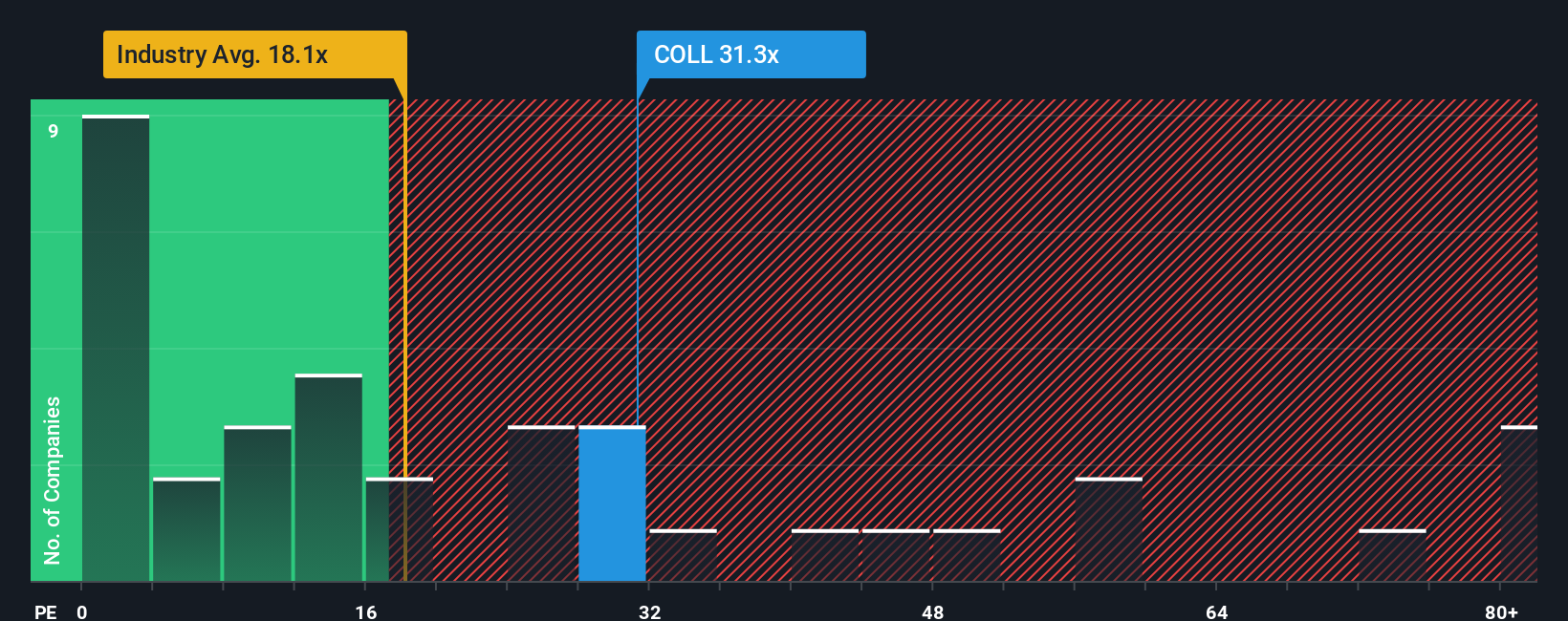

The narrative points to Collegium as modestly undervalued, yet the current P/E ratio of 24.6x is higher than the US Pharmaceuticals industry at 19.7x, the peer average at 23.3x, and even the 23.5x fair ratio estimate. That premium suggests less margin for error if earnings or margins fall short. Which signal do you trust more: the narrative or the market multiples?

Build Your Own Collegium Pharmaceutical Narrative

If you see the numbers differently or prefer to trust your own work, you can rebuild this story yourself in just a few minutes: Do it your way.

A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Collegium has sharpened your interest, do not stop here. The screener can surface other focused ideas that might deserve a spot on your radar next.

- Spot potential value opportunities early by checking out these 879 undervalued stocks based on cash flows that might line up with your return and risk expectations.

- Review these 28 AI penny stocks that connect artificial intelligence with business models and financials.

- Scan these 12 dividend stocks with yields > 3% that offer yields above 3% and may complement growth names in a diversified portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.