Please use a PC Browser to access Register-Tadawul

A Look At Collegium Pharmaceutical (COLL) Valuation After Recent Share Price Pullback

Collegium Pharmaceutical, Inc. COLL | 45.00 | -0.40% |

Event context and recent share performance

Collegium Pharmaceutical (COLL) has drawn attention after recent trading, with the share price at US$45.60 and returns showing a 2.8% decline over the past day and 5.3% decline over the past week.

While the recent 1 day and 7 day share price returns are negative, the 90 day share price return of 28.96% and 1 year total shareholder return of 36.73% suggest momentum has been building over a longer period, with multi year total shareholder returns also positive.

If Collegium’s moves in pain management have caught your attention, it can be useful to scan other healthcare names. You can use our screener for healthcare stocks as a next step.

With Collegium generating US$757.07m in revenue, US$58.44m in net income and trading at US$45.60, the question for you is simple: is this still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 14.2% Undervalued

With Collegium Pharmaceutical closing at US$45.60 against a narrative fair value of about US$53.17, the latest consensus frames the shares as trading at a meaningful discount, built on detailed assumptions about 2026 earnings power and profitability.

Collegium's disciplined capital allocation and ongoing business development (M&A) strategy, including pursuing synergistic pain/CNS assets, is expected to drive portfolio diversification and inorganic growth, further reducing revenue concentration risk and providing additional sources of EBITDA and earnings stability.

Want to see what is behind that higher earnings profile, wider margins, and the lower future P/E baked into this story? The full narrative lays out a detailed path from today’s profits to a leaner share count, richer cash flows and a valuation multiple that sits below the wider pharmaceuticals group. The numbers are all there, you just need to see how they fit together.

Result: Fair Value of $53.17 (UNDERVALUED)

However, this depends on pain products holding up against patent expirations and possible generic competitors, and on higher fixed costs not squeezing earnings if growth falls short.

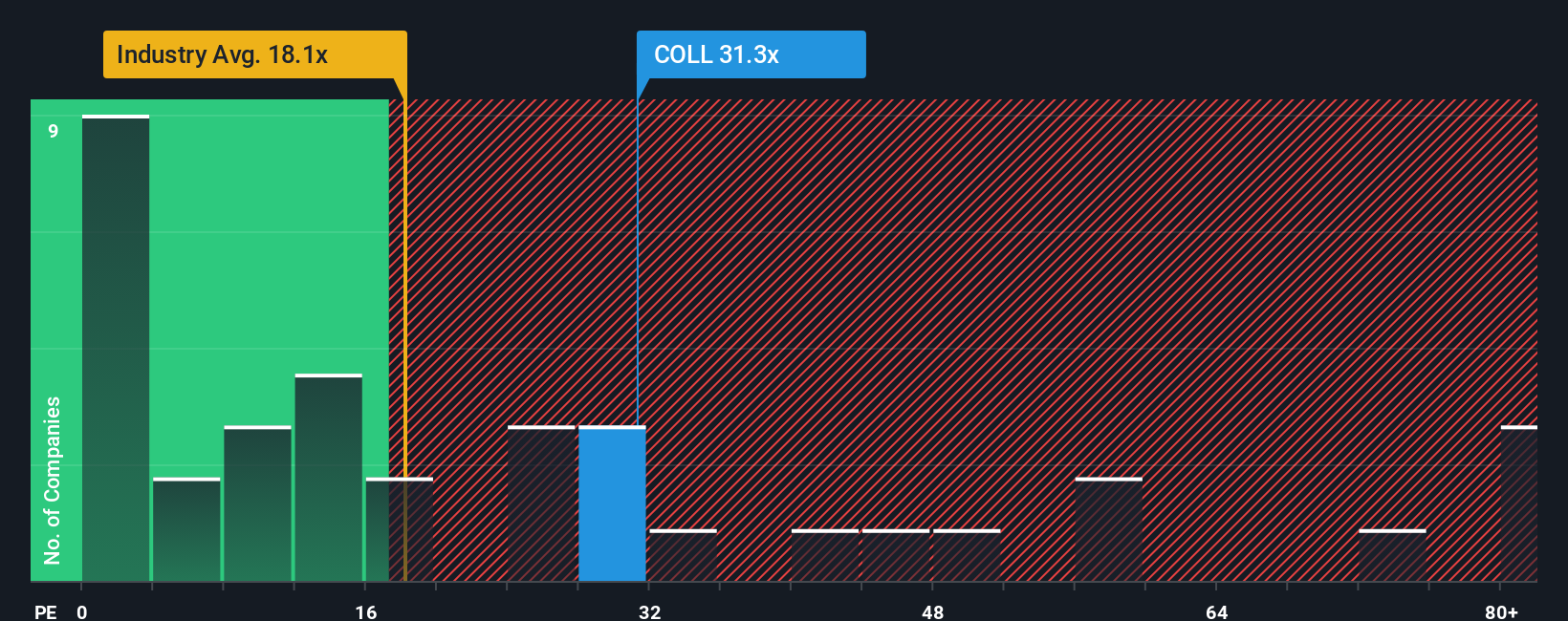

Another View: Earnings Multiple Sends A Different Signal

The narrative fair value of about US$53.17 points to upside, but the earnings multiple tells a tighter story. At a P/E of 24.7x versus a peer average of 20.3x and a fair ratio of 23.3x, the shares look somewhat expensive. Is that premium a comfort or a warning for you?

Build Your Own Collegium Pharmaceutical Narrative

If parts of this story do not quite line up with your own view, or you simply prefer working from the raw numbers yourself, you can build a custom Collegium thesis in just a few minutes with Do it your way.

A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Collegium is just one name on your radar, now is a good time to broaden your watchlist and line up a few more potential opportunities.

- Spot potential value by scanning these 864 undervalued stocks based on cash flows that the market may not be fully paying attention to yet.

- Tap into growth themes by checking out these 24 AI penny stocks that are tied to artificial intelligence trends.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% that might suit a yield oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.