Please use a PC Browser to access Register-Tadawul

A Look At Community Financial System’s Valuation After New Share Repurchase Program Announcement

Community Financial System, Inc. CBU | 64.39 | +0.48% |

Share repurchase announcement and why it matters

Community Financial System (CBU) attracted fresh attention after Community Bank System, Inc. announced a share repurchase program covering up to 2,633,000 shares, subject to regulatory approval, running for 12 months from January 1, 2026.

The buyback announcement lands after a steady run, with the latest share price at $61.29 and a 90 day share price return of 11.42% suggesting momentum has been building. In contrast, the 1 year total shareholder return of 1.38% points to a more muted longer term outcome.

If this kind of capital return story has your attention, it can be useful to compare it with banks that look positioned for growth and insider alignment. A starting point could be fast growing stocks with high insider ownership.

With a buyback on the table, a share price at $61.29 and an implied discount of around 9% to the latest analyst target, the key question is whether CBU still offers value or if the market is already pricing in future growth.

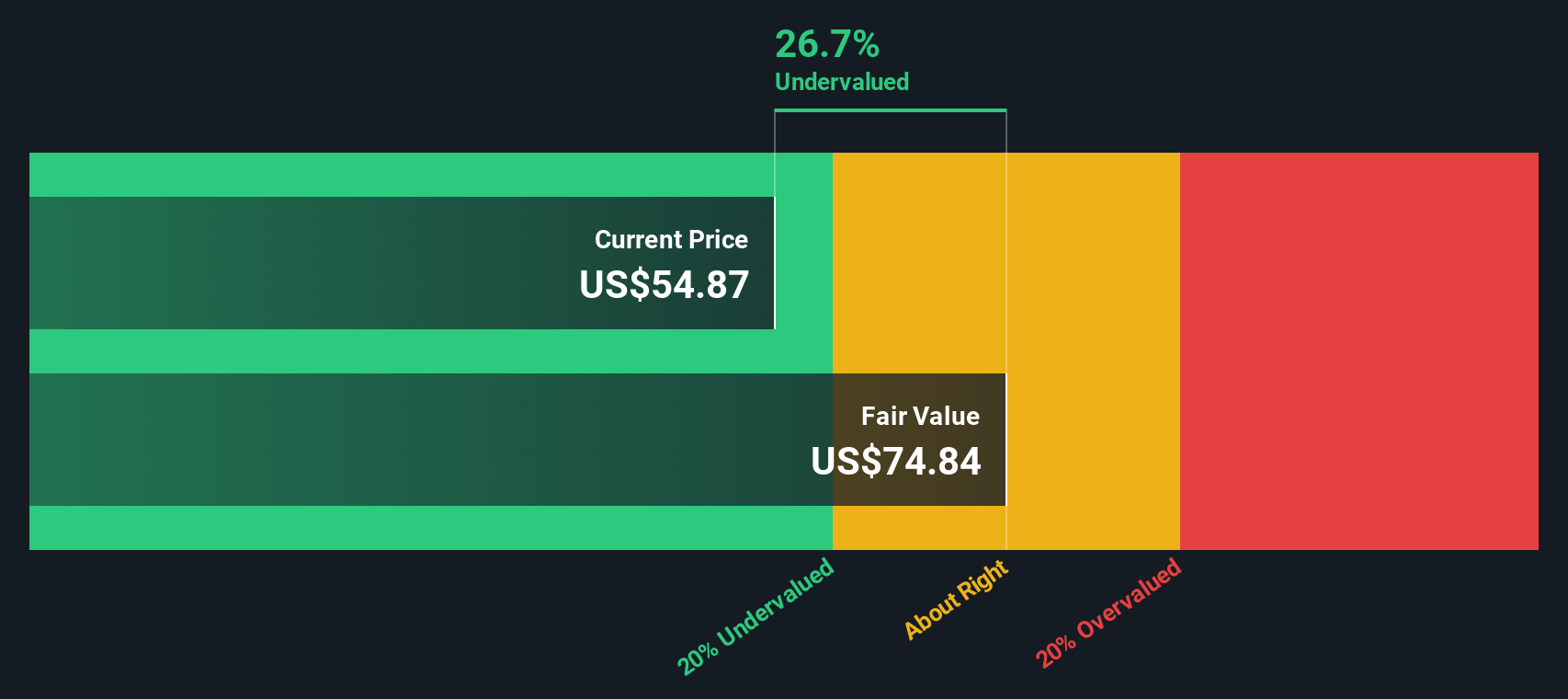

Most Popular Narrative: 9.1% Undervalued

Compared with the last close at $61.29, the most followed narrative anchors on a higher fair value, setting up a clear valuation gap for you to test.

The recently announced branch acquisition in Pennsylvania, combined with ongoing de novo branch expansion in high-growth regional markets, is expected to substantially increase Community Financial System's core deposit base and lending footprint, supporting sustainable top-line revenue growth and enhanced market share.

Curious what kind of revenue build, margin lift, and future earnings multiple need to line up for this valuation gap to make sense? The narrative leans on a tight set of growth, profitability, and discount rate assumptions that could change how you frame the current share price.

Result: Fair Value of $67.40 (UNDERVALUED)

However, you still need to weigh up higher credit risk in the loan book, as well as the cost and execution risk of the ongoing branch expansion program.

Another angle on value

Our SWS DCF model presents a very different view from the 9.1% undervalued narrative. On this basis, Community Financial System, at $61.29, is trading around 51.1% below an estimated fair value of $125.40, which suggests a much wider potential valuation gap. Which perspective do you think better reflects the risks and growth assumptions?

Build Your Own Community Financial System Narrative

If you are not fully on board with these views or simply want to test your own assumptions against the numbers, you can build a custom thesis in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Community Financial System.

Looking for more investment ideas?

If Community Financial System has sharpened your thinking, do not stop here; broaden your watchlist with focused stock ideas built from clear, data driven filters.

- Spot potential mispricings by checking out these 886 undervalued stocks based on cash flows that may offer more compelling entry points based on cash flows and fundamentals.

- Ride the AI wave with purpose by scanning these 25 AI penny stocks that tie artificial intelligence themes to real businesses and financials.

- Target income focused opportunities by reviewing these 12 dividend stocks with yields > 3% that combine higher yields with stock market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.