Please use a PC Browser to access Register-Tadawul

A Look At Constellium (CSTM) Valuation After Deutsche Bank Shift To Hold Rating

Constellium SE Class A CSTM | 25.44 | -1.43% |

Why a Hold Rating on Constellium (CSTM) Is Getting Attention

Deutsche Bank’s decision to shift Constellium (CSTM) to a hold rating, while also revising its view on the stock’s potential, has put the aluminum producer back on many investors’ watchlists.

The stock’s recent moves have caught traders’ attention, with a 13.57% 1 month share price return, a 38.10% 3 month share price return, and a 101.35% 1 year total shareholder return. This suggests momentum has been building around Constellium, even as Deutsche Bank’s updated rating refocuses attention on risk.

If this kind of momentum story has you looking wider, it could be a good moment to see what else is moving among fast growing stocks with high insider ownership.

With Constellium trading at $20.84 against an analyst price target of about $21.55, and an estimated intrinsic value that is much higher, the key question is whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative: 3.6% Overvalued

Constellium’s most followed narrative points to a fair value of about $20.12, slightly below the last close at $20.84, which puts the current enthusiasm in context.

Analysts have reaffirmed their price target for Constellium at $20.12, citing unchanged expectations for revenue growth and profit margins. They also note a slight reduction in the discount rate along with a modest rise in projected future price-to-earnings ratios.

Curious how steady revenue assumptions, modest margin expansion, a higher future P/E, and a lower discount rate still add up to only a small premium over today’s price? The narrative joins those moving parts into one valuation story, but the exact mix of earnings power and required return might surprise you.

Result: Fair Value of $20.12 (OVERVALUED)

However, prolonged demand weakness in key end markets, along with rising capital and operating costs, could pressure margins and cash flow and challenge the current valuation narrative.

Another View: Multiples Send a Mixed Signal

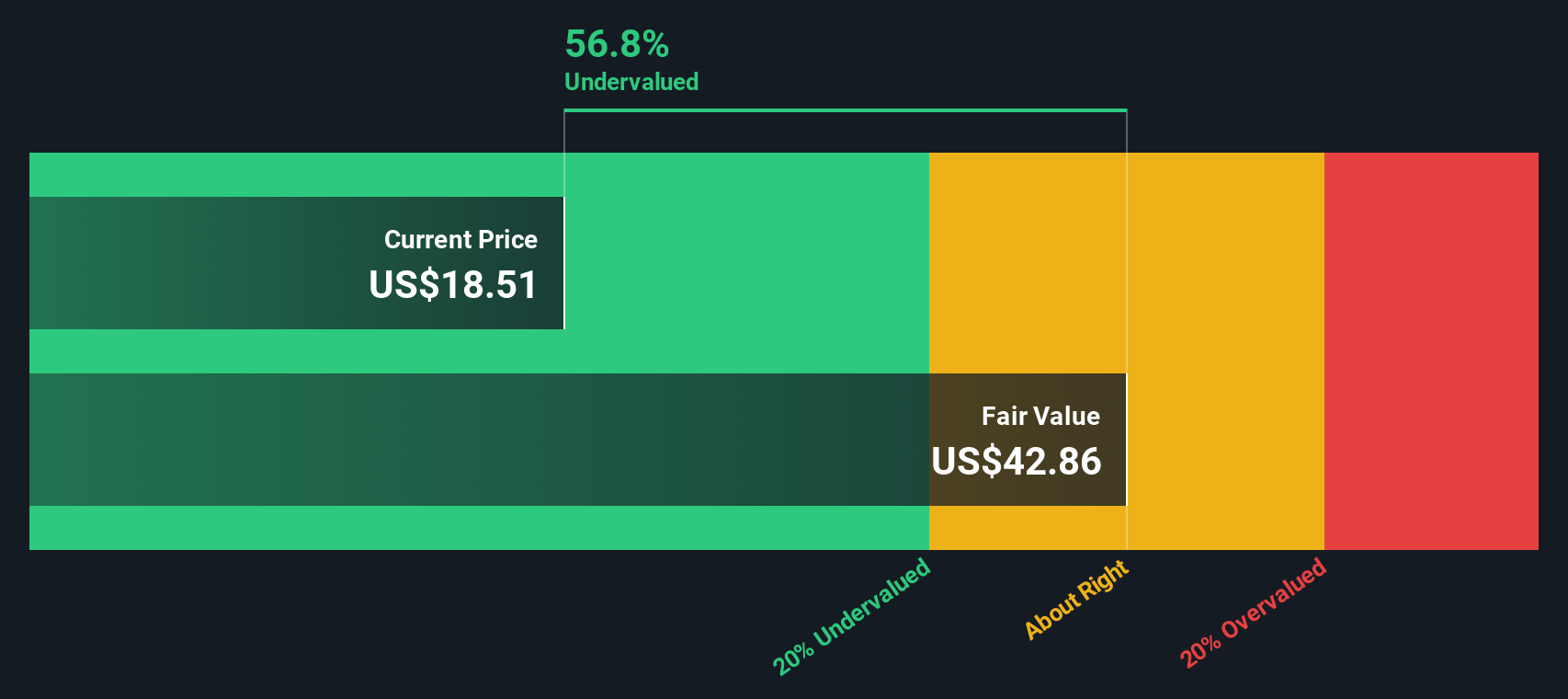

Our DCF model points to a fair value of about $44.57 for Constellium, which is much higher than the current share price of $20.84 and implies the stock screens as undervalued. That sits awkwardly next to the $20.12 narrative fair value that suggests a small premium instead.

For you, the gap between a DCF that sees room above $40 and a narrative fair value just above $20 raises a simple question: which set of assumptions do you trust more, the long term cash flow picture or the tighter near term story around margins and growth?

Build Your Own Constellium Narrative

If you look at the assumptions and feel they do not quite fit your view, run the numbers yourself and craft a version that does, Do it your way.

A great starting point for your Constellium research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Constellium has sharpened your thinking, do not stop here. Broaden your opportunity set and pressure test your thesis against other types of stocks on the radar.

- Zero in on potential higher risk or higher reward opportunities by scanning these 3539 penny stocks with strong financials that already clear basic financial strength checks.

- Spot companies tied to fast moving machine learning trends by checking out these 28 AI penny stocks that already meet defined filters.

- Hunt for potential value by reviewing these 883 undervalued stocks based on cash flows that appear attractively priced relative to their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.