Please use a PC Browser to access Register-Tadawul

A Look at Corcept Therapeutics’s Valuation After FDA Accepts Relacorilant Application for Ovarian Cancer Decision

Corcept Therapeutics CORT | 81.12 | -7.08% |

Most Popular Narrative: 45.8% Undervalued

The dominant market narrative sees Corcept Therapeutics as significantly undervalued, based on future revenue and profit projections supported by anticipated regulatory wins and commercial expansion.

The publication of the CATALYST study and the resulting increased awareness and screening for hypercortisolism among physicians are expanding the potential addressable patient pool. This is expected to drive significant acceleration in revenue growth over the next several years.

Curious why so many analysts believe Corcept’s price has room to soar? Their formula is not limited to clinical trials; it also relies on bold growth expectations and an earnings forecast that rivals the sector’s top players. Want to see how high those targets reach and what surprising assumptions factor into this bullish scenario? The full breakdown of the narrative's quantitative engine explains it all.

Result: Fair Value of $134.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing patent litigation and pricing pressures could sharply disrupt Corcept’s earnings outlook. These factors may also test the strength of the current bullish thesis.

Find out about the key risks to this Corcept Therapeutics narrative.Another View: Market Signals from Earnings Multiple

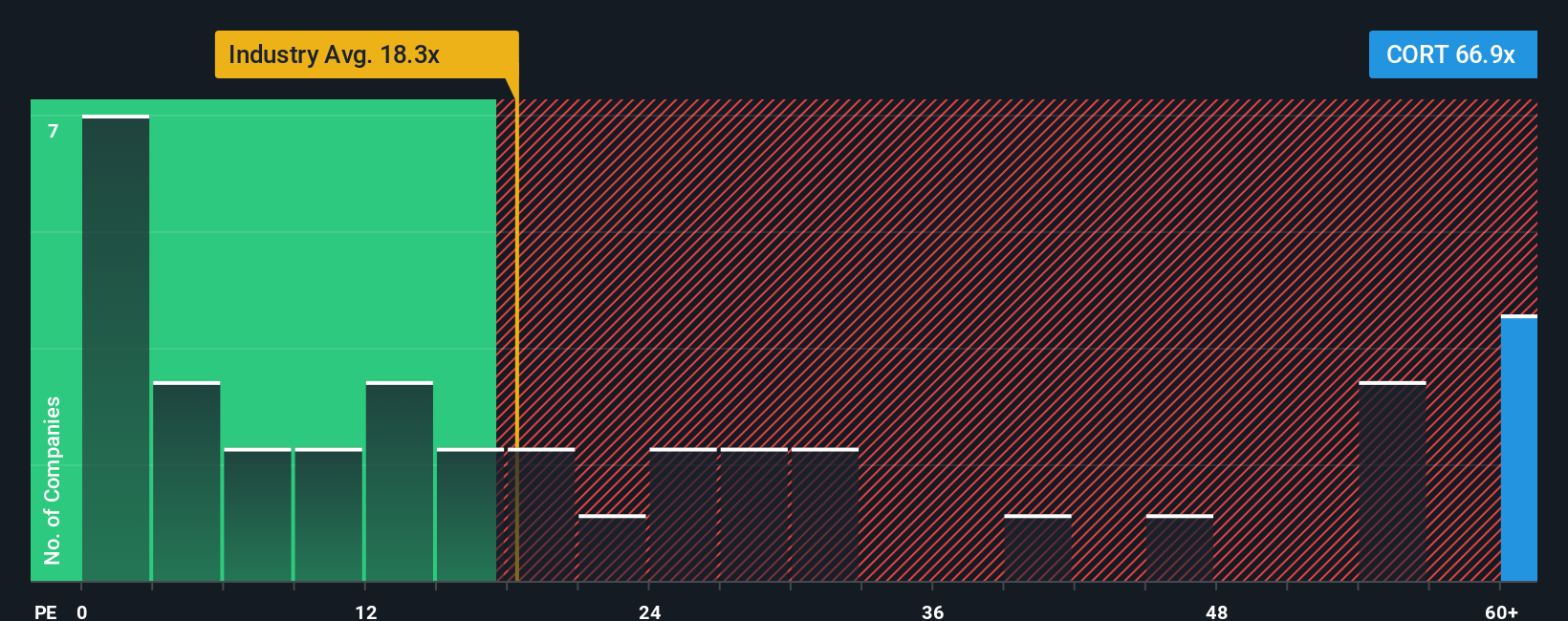

Looking at Corcept through the lens of its earnings multiple versus the industry, the shares appear expensive compared to sector averages. Could the market already be factoring in a best-case growth scenario?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corcept Therapeutics Narrative

Of course, if you see things differently or want to dig into the numbers yourself, you can craft your own Corcept thesis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Corcept Therapeutics.

Looking for more investment ideas?

Smart investors know opportunities do not last long. If you want a competitive edge, use these powerful tools to uncover strategies you might be missing and target your next big win.

- Seize value with opportunities that trade below intrinsic worth. This opens the door to undervalued stocks based on cash flows before the crowd catches on.

- Spot high-yield potential from shares that could boost your portfolio income. dividend stocks with yields > 3% delivers over 3% in annual payouts.

- Ride the wave of innovation and capture growth from companies driving progress in artificial intelligence within healthcare, with healthcare AI stocks leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.