Please use a PC Browser to access Register-Tadawul

A Look at Diebold Nixdorf (DBD) Valuation Following First Major European AI Self-Checkout Launch

Diebold Nixdorf Inc DBD | 67.68 | +0.04% |

Diebold Nixdorf (NYSE:DBD) Shares Stir as AI Checkout Tech Launches in Europe

If you have been following Diebold Nixdorf, you probably noticed the shares making moves lately. The latest spark came from Germany, where EDEKA Paschmann became the first supermarket to roll out Diebold Nixdorf’s AI-driven Shrink Reduction and age verification solutions. This debut puts real-time machine learning directly into the self-checkout aisle, tackling losses from both intentional and accidental errors while also streamlining purchases of age-restricted items. For investors, this signals more than just a product launch; it offers a potential foothold in a large European retail market eager for automation and efficiency.

Stepping back, Diebold Nixdorf has gained momentum this year. The stock is up 57% over the past year and nearly 49% year-to-date. After years of restructuring and product investment, these recent gains suggest that the market is taking a fresh look at the company as it delivers on technology partnerships, such as the ECB’s digital euro initiative, alongside real-world client deployments. The question hanging over the stock is whether this marks the start of a sustained growth cycle or represents a temporary repricing as these new solutions reach the market.

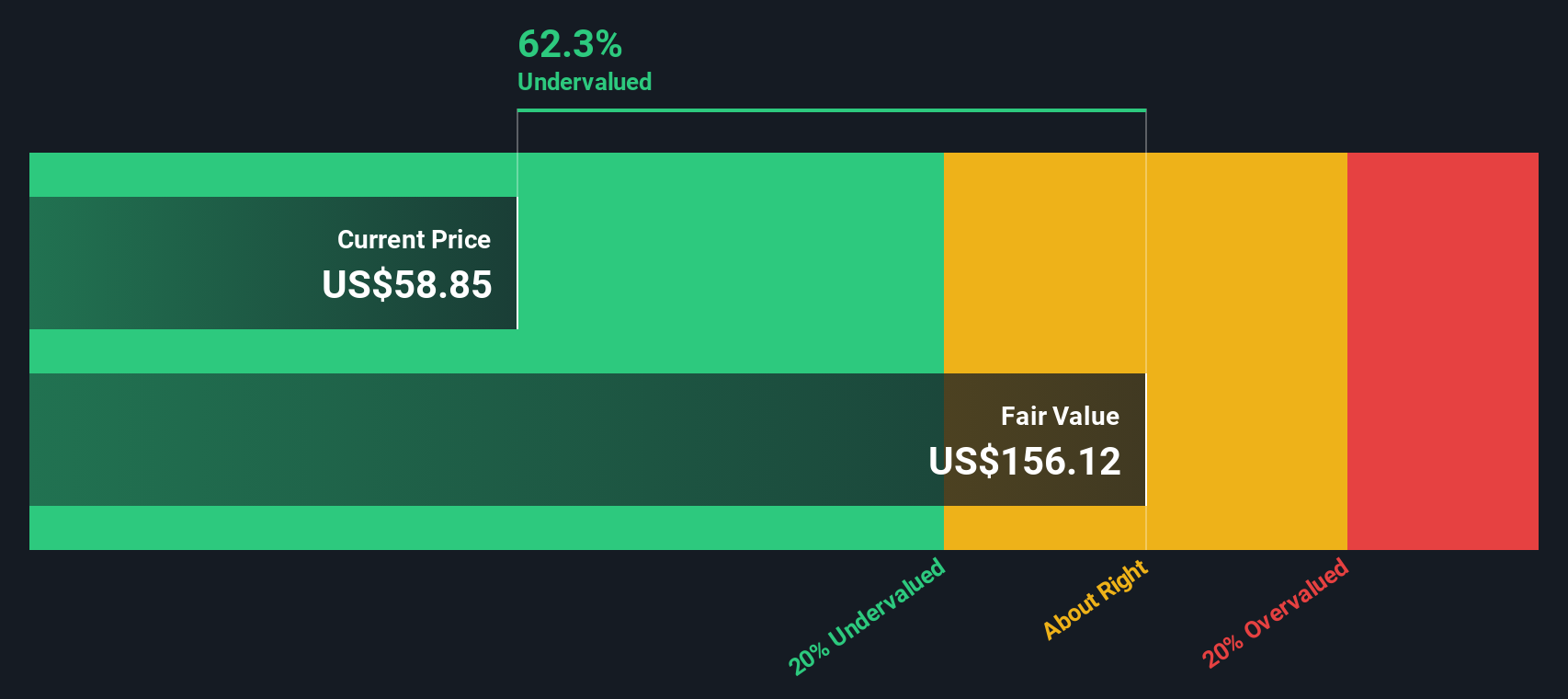

This brings us to the heart of the debate: is Diebold Nixdorf now attractively valued given its momentum and product successes, or has the market already factored in the company’s future growth?

Most Popular Narrative: 16.6% Undervalued

According to community narrative, Diebold Nixdorf's shares are seen as significantly undervalued, with a fair value that sits well above the current price. The narrative is built around analyst forecasts that project strong revenue and earnings potential for the company in the years ahead.

“Diebold Nixdorf's accelerating deployment of advanced ATMs with cash recycling, branch-in-a-box solutions, and teller cash recyclers is being driven by banks' global push for branch automation and more efficient cash management. This increases long-term demand for high-value hardware and generates recurring, higher-margin service contracts, supporting both future revenue and net margin improvement.”

Think the market is missing something big about Diebold Nixdorf? There is a key set of long-term growth predictions at play. Curious which financial leaps and product rollouts push this stock’s fair value over the top? Unpack the analyst assumptions in the narrative for the story behind the upside.

Result: Fair Value of $75.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rapid growth of digital-only banking or slow adoption of new software could limit Diebold Nixdorf's margin gains and challenge the bullish outlook.

Find out about the key risks to this Diebold Nixdorf narrative.Another View: What Does the SWS DCF Model Say?

While the previous valuation focused on analyst price targets, our DCF model takes a different approach and suggests Diebold Nixdorf remains deeply undervalued. This adds a new layer to the debate: how much weight should be given to future cash flow forecasts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Diebold Nixdorf Narrative

If you have a different perspective or want to see the numbers for yourself, you can easily construct your own narrative in just a few minutes using our platform. do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Diebold Nixdorf.

Looking for More Winning Investment Ideas?

Smart moves start with the right tools. Give yourself an edge and uncover compelling stocks tailored to your goals, whether you want reliable dividends, emerging tech trends, or undervalued gems. You will not want to miss the investment opportunities waiting in these handpicked selections:

- Tap into steady income streams by choosing dividend stocks with yields > 3%, which deliver attractive yields above 3% for your portfolio.

- Stay at the forefront of innovation by targeting healthcare AI stocks to capture growth from advances in medical technology powered by artificial intelligence.

- Uncover hidden potential with undervalued stocks based on cash flows and spot undervalued stocks with strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.