Please use a PC Browser to access Register-Tadawul

A Look At DT Midstream (DTM) Valuation After Leadership Moves At The Top

DT Midstream, Inc. DTM | 136.06 | +2.82% |

DT Midstream (DTM) has announced a leadership reshuffle, with longtime CEO David Slater moving to Executive Chairman and current Chief Operating Officer Christopher Zona taking on the additional role of President.

The leadership changes come as DT Midstream’s share price has gained momentum, with a 30 day share price return of 7.99% and a 90 day share price return of 12.79%, contributing to a 1 year total shareholder return of 30.26% and a 3 year total shareholder return that is well over 7x.

If this energy infrastructure story has your attention, it could be a good moment to broaden your watchlist. Consider using 24 power grid technology and infrastructure stocks as another way to uncover potential ideas.

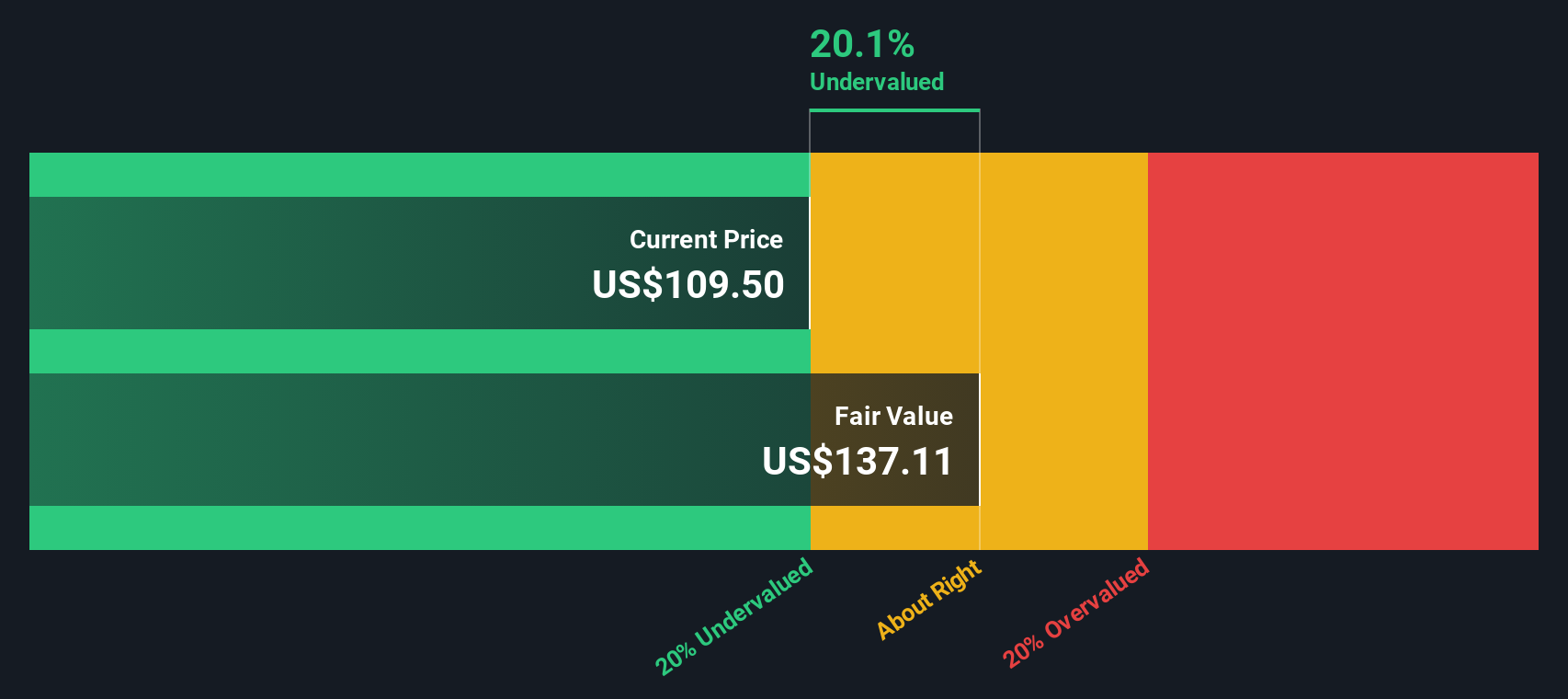

With revenue of US$1.18b, net income of US$403m and a modelled intrinsic value implying about a 41% discount, yet a market price slightly above the average analyst target, you have to ask: is this a mispriced opportunity, or is the market already baking in future growth?

Most Popular Narrative: 2% Overvalued

Compared to DT Midstream’s last close of $128.58, the most widely followed narrative fair value of about $126.08 sits slightly lower, framing the stock as just above that modelled estimate.

Revisions to the risk profile in recent research imply that some analysts view the balance between cash generation and operational risk as more attractive than before, which feeds into their target-setting framework.

Curious what sits behind that small gap between price and fair value? The narrative leans on steady revenue build, firmer margins, and a richer earnings multiple that is anything but conservative.

Result: Fair Value of $126.08 (OVERVALUED)

However, the story can change quickly if modernization spending only keeps assets treading water, or if key utility customers shift away from long term gas contracts.

Another Take On Value

While the narrative work suggests DT Midstream is about 2% overvalued at $126.08, our DCF model points in the opposite direction, with a fair value estimate of $216.43, or roughly a 41% discount to the current $128.58 price. Which story appears more convincing?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DT Midstream for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DT Midstream Narrative

If you look at the numbers and reach a different conclusion, that is the point. You can reshape the data into your own view in just a few minutes, Do it your way.

A great starting point for your DT Midstream research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If DT Midstream has you thinking harder about where to put your money next, do not stop here, your next strong idea could be one screen away.

- Spot potential value plays by scanning through 53 high quality undervalued stocks that pair quality fundamentals with prices that may not fully reflect them yet.

- Strengthen your downside protection by focusing on companies in the solid balance sheet and fundamentals stocks screener (45 results) that prioritize resilient financial positions.

- Hunt for tomorrow’s standouts with the screener containing 24 high quality undiscovered gems, where quieter names with solid fundamentals might be waiting for attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.