Please use a PC Browser to access Register-Tadawul

A Look At DT Midstream (DTM) Valuation After Recent Executive Leadership Changes

DT Midstream, Inc. DTM | 136.06 | +2.82% |

DT Midstream (DTM) is reshaping its leadership, with long-time Chief Executive Officer David Slater elected Executive Chairman and Christopher Zona stepping into the President role while continuing as Chief Operating Officer.

Those leadership changes come at a time when DT Midstream’s share price, at US$125.47, has been gaining ground, with a 90 day share price return of 14.59% and a 3 year total shareholder return of about 7x. This suggests momentum has been building rather than fading.

If management transitions have you thinking more broadly about where capital could work hardest next, this can be a good moment to scan aerospace and defense stocks as another pocket of potential opportunity.

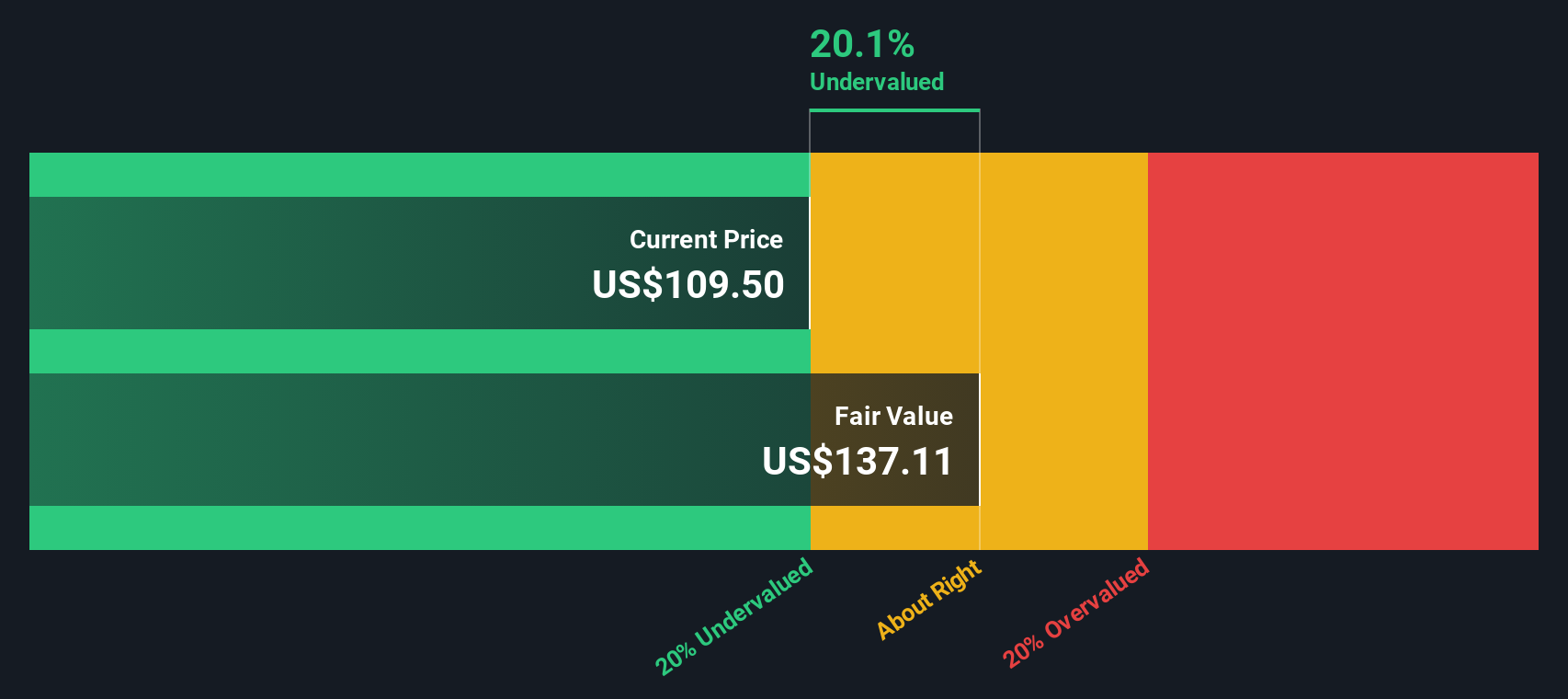

With revenue of US$1.18b, net income of US$403m, a recent price of US$125.47 and a reported intrinsic discount of about 40%, the key question is whether DTM is still mispriced or if the market is already factoring in potential future growth.

Most Popular Narrative: 2% Overvalued

Compared to the last close of $125.47, the most followed narrative fair value of about $123.23 points to a small valuation gap rather than a major mismatch.

Analysts have nudged their price target on DT Midstream higher by US$5, reflecting updated assumptions around fair value, discount rates, revenue growth, profit margins, and future P/E multiples highlighted in recent research.

Recent research around the US$5 price target increase focuses on how current assumptions about DT Midstream’s earnings power, risk profile, and P/E support the updated valuation.

Want to see what sits behind that small gap between price and fair value? The narrative focuses on assumptions about steady revenue growth, firmer margins and a richer future earnings multiple. Curious how those pieces fit together, and which assumption really does the most work in the model?

Result: Fair Value of $123.23 (OVERVALUED)

However, that narrative could be tested if large utility customers shift away from long term gas contracts, or if heavy modernization spending weighs on future cash flows.

Another Angle on Value: Cash Flows Say “Undervalued”

The narrative work suggests DT Midstream looks slightly overvalued at a fair value of about $123.23, but our DCF model points in a very different direction. On that view, the shares trade around 40% below an estimated future cash flow value of $207.71. When earnings based multiples and cash flow models disagree this sharply, which one do you trust more and why?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DT Midstream for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 869 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DT Midstream Narrative

If you see the numbers differently or prefer to test your own assumptions directly in the model, you can build a custom view in minutes by starting with Do it your way.

A great starting point for your DT Midstream research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for your next idea?

If you are weighing your next move, this is the moment to widen the net and see what other opportunities the Simply Wall St screener surfaces for you.

- Spot underappreciated opportunities by scanning these 869 undervalued stocks based on cash flows, where current prices and cash flow estimates look out of sync.

- Position yourself early in emerging tech themes by checking out these 25 AI penny stocks, which are tied to artificial intelligence growth stories.

- Lock in potential income ideas by reviewing these 14 dividend stocks with yields > 3%, which focuses on yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.