Please use a PC Browser to access Register-Tadawul

A Look At DXP Enterprises (DXPE) Valuation After Strong Recent Share Price Momentum

DXP Enterprises, Inc. DXPE | 149.13 | +1.46% |

Recent share performance and business snapshot

DXP Enterprises (DXPE) has drawn fresh attention after a recent move in its share price, with the stock showing mixed short term returns but stronger gains over the month and past 3 months.

At a last close of US$148.55, the industrial distributor now reflects a 1 day return of about 4.3%, a 7 day return of about 2%, and a month gain near 20%. Over the past 3 months, the stock shows a gain of roughly 74% and about 45% over the past year.

For investors zooming out, the recent 1 month share price return of about 20% and year to date gain of roughly 38% sit alongside a very large 3 year total shareholder return. This suggests momentum has been building rather than fading.

If this industrial supplier's strong run has you thinking about where else momentum could show up, you might want to scan our list of 25 power grid technology and infrastructure stocks as another way to find infrastructure themed ideas.

With DXP Enterprises trading near US$148.55 after a sharp multi year total return and an intrinsic value estimate that suggests some discount, you have to ask: is there still an opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 9% Overvalued

DXP Enterprises last closed at about US$148.55, while the most followed narrative anchors fair value at US$136.50 using a detailed cash flow based view.

The company's robust acquisition pipeline and recent moves to expand geographically and diversify into new markets (such as water, air compressors, and data centers) position it to accelerate top-line growth and increase earnings power, leveraging long-term industry consolidation trends.

Curious how a moderate growth outlook, rising margins and a slightly lower future P/E can still support that fair value math, even with refinancing in the mix?

Result: Fair Value of $136.50 (OVERVALUED)

However, this story could change quickly if energy exposed revenue proves more cyclical than expected, or if acquisition integration drags on margins and earnings.

Another angle on valuation

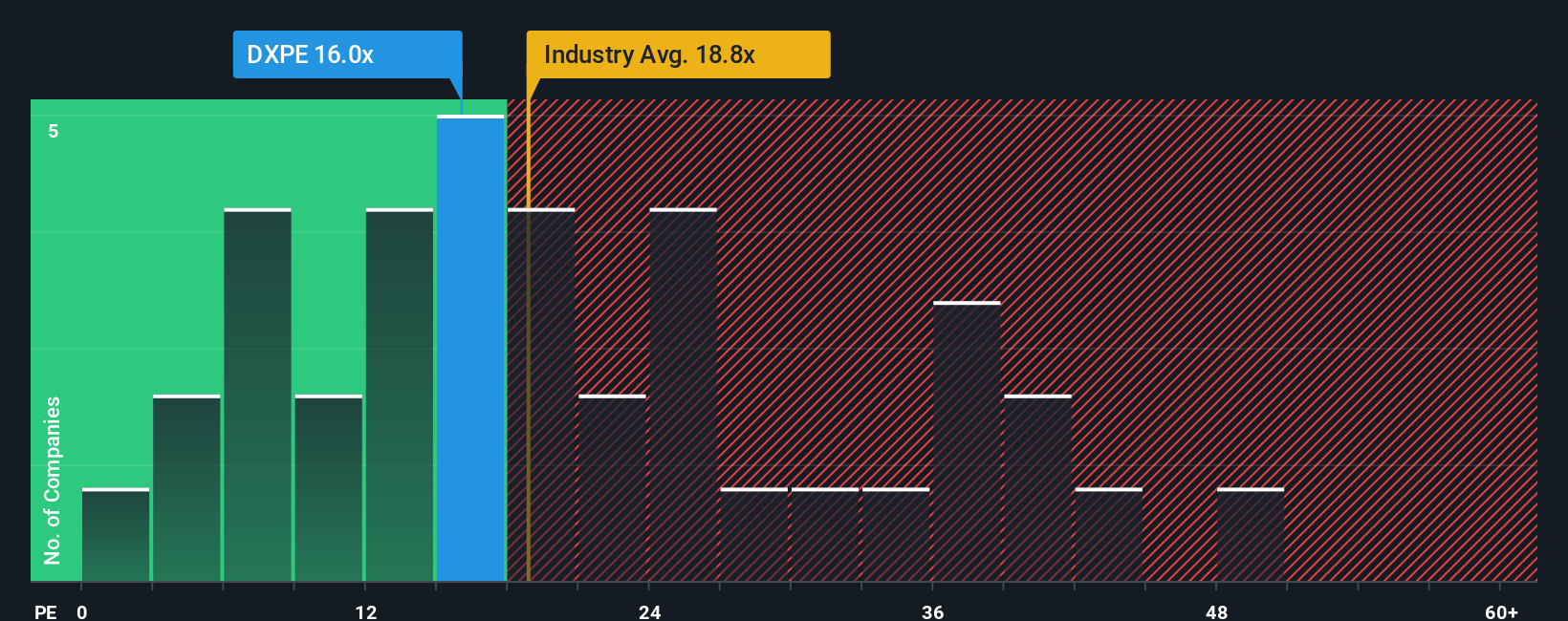

That cash flow based fair value of US$136.50 paints one picture, but the earnings multiple tells a different story. DXP Enterprises trades on a P/E of 26.7x versus an estimated fair ratio of 28.7x, even though it sits above peers at 21.9x and the wider US Trade Distributors industry at 24.2x. Does that premium look like justified quality or extra valuation risk to you?

Build Your Own DXP Enterprises Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a complete DXP story in just a few minutes: Do it your way.

A great starting point for your DXP Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If DXP has sparked your interest, do not stop here. Use this momentum to broaden your watchlist and uncover other opportunities that fit your style.

- Target resilient names by scanning companies in our 84 resilient stocks with low risk scores and see which businesses score well on our risk checks.

- Spot potential value by reviewing our 54 high quality undervalued stocks that combine quality fundamentals with attractive pricing.

- Build a watchlist of financially grounded companies starting with the solid balance sheet and fundamentals stocks screener (45 results) that aim to pair balance sheet strength with consistent operations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.