Please use a PC Browser to access Register-Tadawul

A Look At Eastman Chemical (EMN) Valuation After Earnings Softness And Fresh Analyst Optimism

Eastman Chemical Company EMN | 79.16 | +1.46% |

Why Eastman Chemical’s latest earnings and analyst reactions matter

Eastman Chemical (EMN) has been in focus after its full year 2025 earnings and a cluster of analyst rating reaffirmations and price target changes, even as some international revenues and recent performance raised questions.

Despite weaker full year 2025 earnings, Eastman Chemical’s share price has shown strong recent momentum, with a 24.21% 3 month share price return and an 18.25% year to date share price return, even though the 1 year total shareholder return is a decline of 21.39%.

If this mix of short term momentum and longer term pressure has you thinking about diversification, it could be a good moment to scan 7 top copper producer stocks for other materials names catching investor interest.

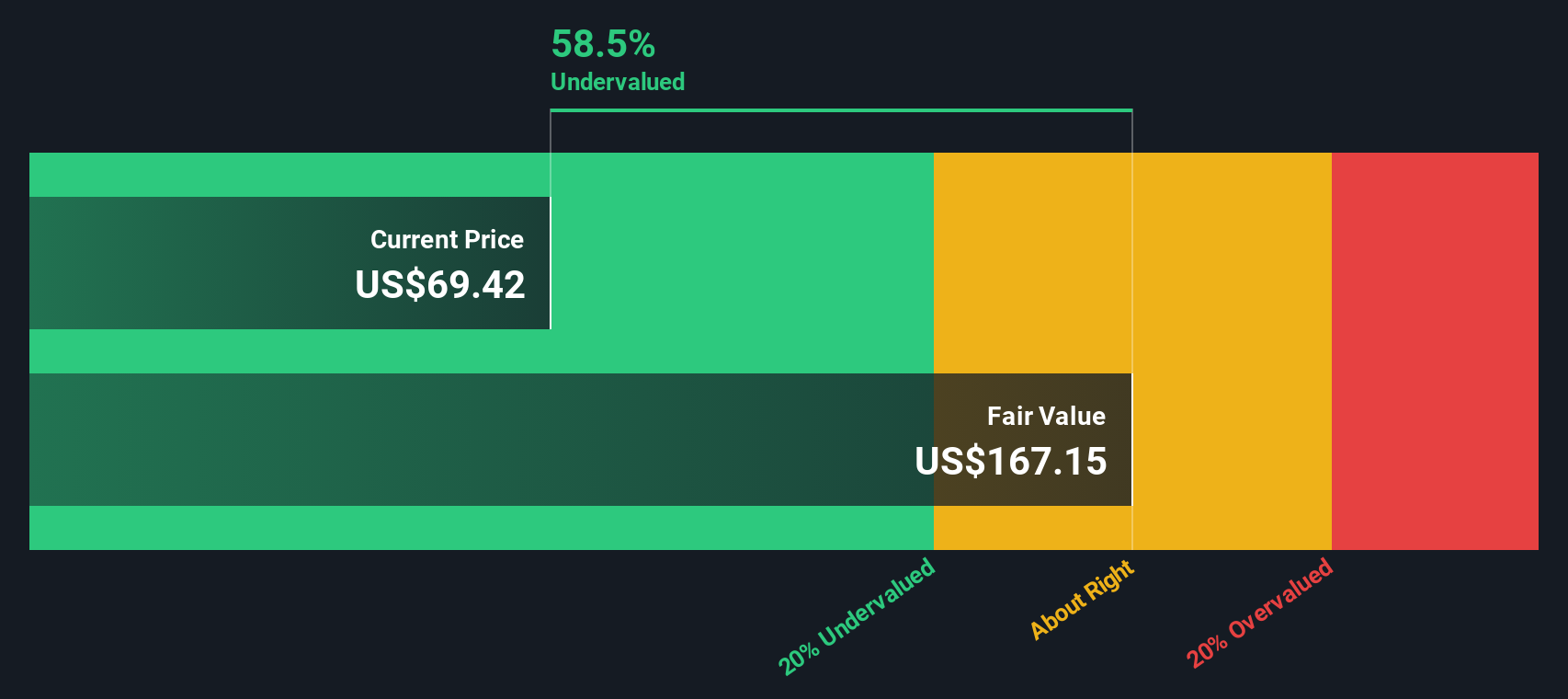

With Eastman trading close to its average analyst target and carrying an intrinsic value estimate at a sizeable discount, the key question is whether recent earnings weakness is already reflected in the price or if the market is quietly beginning to price in expectations for improved performance.

Most Popular Narrative: 4% Overvalued

At a last close of $76.08 versus a narrative fair value of about $73.35, the most followed view sees Eastman Chemical as slightly ahead of its fundamentals, with the gap tied closely to how its specialty and recycling businesses evolve.

Eastman's ongoing success and expansion in molecular recycling/methanolysis (including debottlenecking at Kingsport and operational improvements) positions the company to capture premium pricing and win volume as regulations and customer demand for recycled content accelerate, particularly as mechanical recycling underperforms in key end markets, driving sustained revenue growth and EBITDA margin expansion.

Curious what kind of revenue path and margin profile that recycling push is built on, or how rich a future earnings multiple this narrative leans on? The full story unpacks the expected earnings climb, the revenue glide path, and the profit margins needed to back up that fair value number.

Result: Fair Value of $73.35 (OVERVALUED)

However, that story can break if trade tensions and tariffs pressure pricing, or if adoption of recycled products like methanolysis based Renew remains sluggish.

Another View: Cash Flows Tell a Different Story

While the consensus narrative sees Eastman Chemical as about 4% overvalued at $76.08 versus a fair value of roughly $73.35, our DCF model points the other way, with an estimate of future cash flow value around $117.80. That is a sizeable gap. Which set of assumptions do you trust more?

Build Your Own Eastman Chemical Narrative

If parts of this story do not sit right with you, or you would rather test the assumptions yourself, you can create your own view in just a few minutes and Do it your way.

A great starting point for your Eastman Chemical research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Eastman Chemical has you thinking more broadly about your portfolio, do not stop here. Fresh ideas often come from comparing quality, income and resilience across other opportunities.

- Consider raising the overall quality bar in your portfolio by scanning companies in our 55 high quality undervalued stocks, where solid fundamentals meet more appealing price tags.

- Strengthen your income stream by reviewing the 15 dividend fortresses, a focused list of higher yielding names designed for investors who care about consistency and cash returns.

- Dial down portfolio stress with the 80 resilient stocks with low risk scores, highlighting companies that our model views as more resilient so you are not relying on one story alone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.