Please use a PC Browser to access Register-Tadawul

A Look At Enerpac Tool Group (EPAC) Valuation After William Blair Initiates Coverage With Market Perform Rating

Enerpac Tool Group Corp Class A EPAC | 42.39 | +0.17% |

William Blair has started covering Enerpac Tool Group (EPAC) with a Market Perform rating, adding a fresh research voice just ahead of the company’s presentation at CJS Securities’ New Ideas for the New Year investor conference.

The William Blair initiation comes after a solid run in the past month, with a 30 day share price return of 9.32%. Over the past year there has been a 7.99% decline in total shareholder return, while the 3 year total shareholder return of 69.24% points to momentum that has built over a longer horizon.

If this kind of research attention has you thinking beyond a single stock, it could be worth widening your search with aerospace and defense stocks as another area of the market to review.

With Enerpac Tool Group trading at $40.70 against an average analyst price target of $51 and an indicated intrinsic value gap, the key question is whether this signals a potential undervalued opportunity or if the market already reflects anticipated future growth.

Most Popular Narrative: 17.8% Undervalued

The most followed narrative sees Enerpac Tool Group’s fair value above the last close of $40.70, anchoring that view on earnings growth, margin expansion, and a higher future earnings multiple.

Accelerated innovation cycles (due to the new in-house R&D/innovation lab and process improvements) reduce time to market for new products, allowing faster capture of emerging opportunities and enhancing the rate of product launches, which can drive incremental revenue growth while reducing R&D and prototyping costs, supporting margin expansion.

Curious how steady revenue growth, rising margins, and a richer future P/E are stitched together into one fair value story? The narrative leans on specific earnings targets, a premium multiple, and share count assumptions. Want to see exactly how those moving parts line up against today’s price?

Result: Fair Value of $49.50 (UNDERVALUED)

However, this story can unravel if industrial softness lingers or if tariff costs and margin pressure persist, limiting the revenue and earnings path analysts are counting on.

Another Way To Look At Valuation

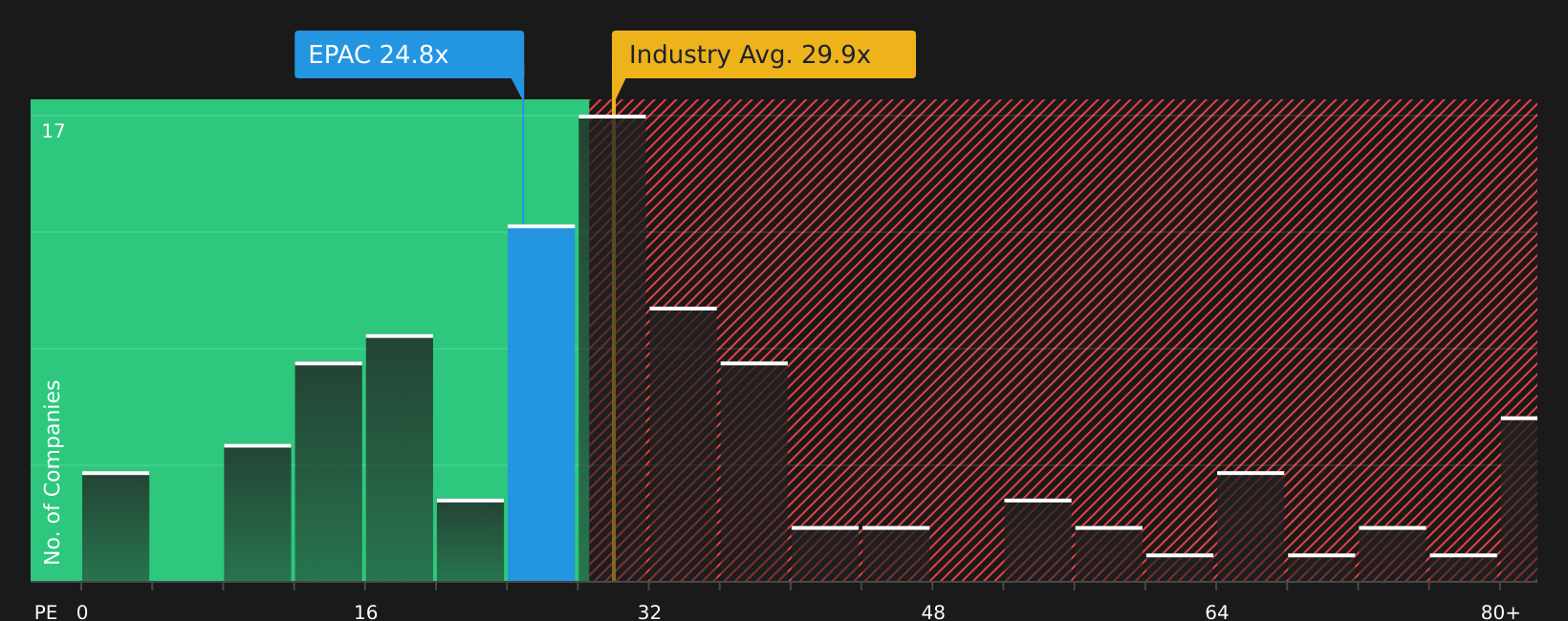

The narrative you just read leans on earnings forecasts and a richer future P/E. Our checks using today’s P/E of 23.8x tell a more mixed story. Enerpac screens as good value against the US Machinery industry at 27.5x and peers at 48.7x, yet it sits above its fair ratio of 20.9x, which suggests some valuation risk if sentiment cools.

That gap is not huge, but it is enough to raise a practical question for you as an investor: is the market paying slightly ahead of fundamentals in the near term, or is this simply the price of owning a business with solid recent earnings quality and high 20.9% return on equity?

Build Your Own Enerpac Tool Group Narrative

If you see the numbers differently, or simply want to test your own assumptions, you can create a tailored Enerpac view in minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Enerpac Tool Group.

Looking for more investment ideas?

If Enerpac has sharpened your interest, do not stop here. Use the Simply Wall St Screener to uncover fresh ideas that could suit your watchlist.

- Spot potential value by reviewing these 873 undervalued stocks based on cash flows that currently trade below what their cash flows may justify.

- Back long term income goals by scanning these 12 dividend stocks with yields > 3% that offer yields above 3% and consistent payout profiles.

- Lean into powerful themes in digital assets by checking these 80 cryptocurrency and blockchain stocks tied to cryptocurrency and blockchain developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.