Please use a PC Browser to access Register-Tadawul

A Look At Evercore (EVR) Valuation After Recent Multi Year Gains And New Annual Results

Evercore Inc. Class A EVR | 322.28 | +0.97% |

Evercore stock at a glance

Evercore (EVR) has drawn investor attention after a period of strong multi year total returns and fresh annual figures, with revenue of US$3,542.875m and net income of US$528.403m now in focus.

At a share price of US$363.51, Evercore has recently seen a 24.28% 90 day share price return and a 28.36% 1 year total shareholder return, suggesting momentum has been building over both shorter and longer horizons.

If this kind of compounding performance has your attention, it could be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

With revenue of US$3,542.875m, net income of US$528.403m and strong multi year total returns already on the board, the key question now is whether Evercore is undervalued or if the market is already pricing in its future growth.

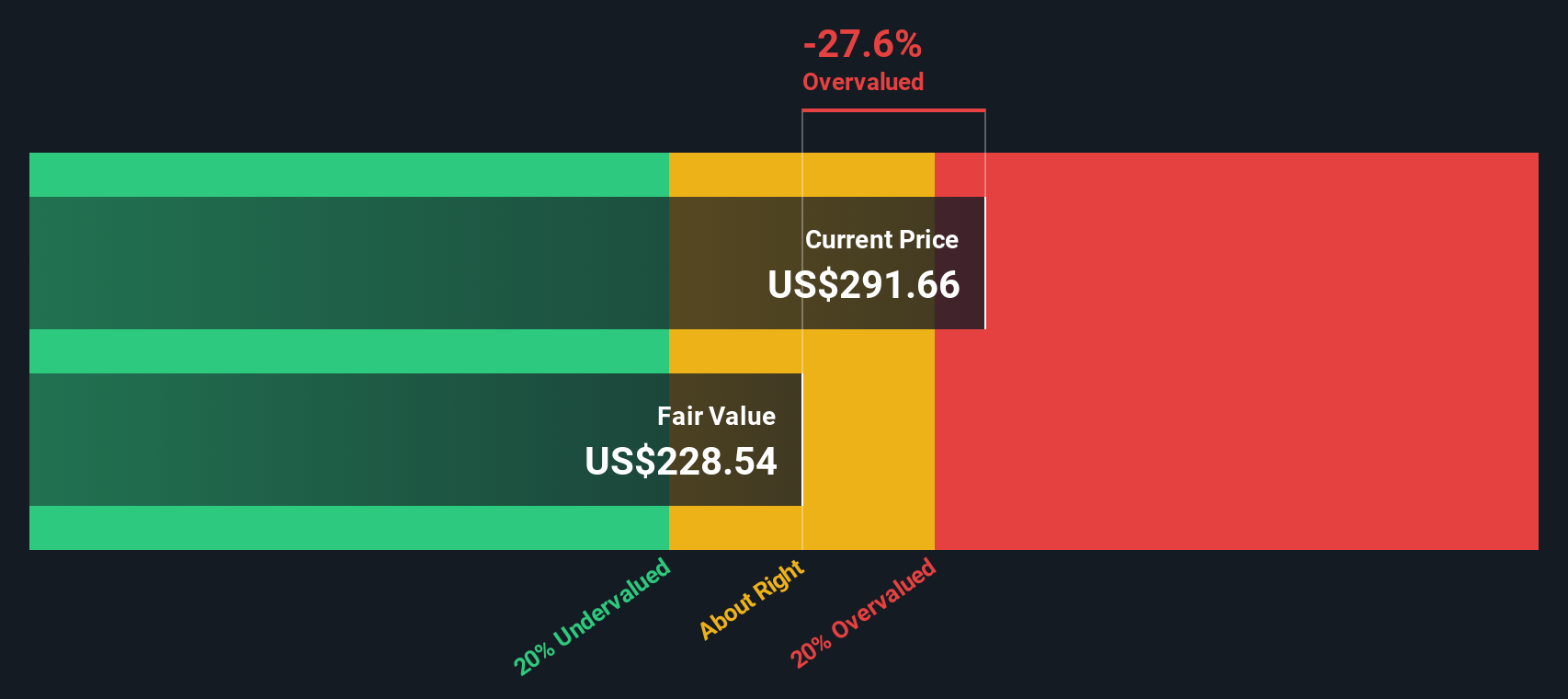

Most Popular Narrative: 2.8% Overvalued

Evercore's most followed narrative puts fair value at about $353.56, slightly below the last close of $363.51, which suggests a mild premium and raises questions about what is priced in.

Evercore's increasing diversification, with roughly 50% of revenues from non-M&A businesses such as private capital advisory (PCA), restructuring, and activism defense, provides greater earnings resilience and positions the firm to capitalize on the growing complexity and volume in private capital and alternative asset markets. This supports more stable net margins and less cyclical volatility in earnings.

Curious how a richer mix of fee streams, higher margin expectations, and a re rated earnings multiple all feed into that fair value line? The full narrative walks through the revenue build, margin path, and valuation math step by step, so you can judge whether those assumptions feel realistic.

Result: Fair Value of $353.56 (OVERVALUED)

However, you should also keep an eye on rising fixed and compensation costs, as well as any disappointment in M&A volumes, which could challenge those upbeat assumptions.

Another View: What Our DCF Model Says

Analysts see Evercore as mildly overvalued versus a fair value of about $353.56, but our DCF model points the other way, with a future cash flow value of $408.03, around 11% above the current $363.51 share price. Which perspective do you think reflects reality?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Evercore for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Evercore Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Evercore.

Looking for more investment ideas?

If Evercore has sharpened your thinking, do not stop here. Put that focus to work by stress testing other opportunities with targeted screeners built for serious research.

- Zero in on potential mispricings by filtering for these 878 undervalued stocks based on cash flows that might not be on everyone else's radar yet.

- Explore the evolving automation landscape by scanning these 24 AI penny stocks that are tied to business adoption of AI.

- Position your portfolio for regular cash returns by reviewing these 13 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.