Please use a PC Browser to access Register-Tadawul

A Look At Excelerate Energy (EE) Valuation As Shares Trade Near Analyst And Intrinsic Value Estimates

Excelerate Energy, Inc. Class A EE | 42.15 | +0.52% |

Why Excelerate Energy is on investors’ radar

Excelerate Energy (EE) has drawn attention after recent share price moves, with the stock closing at US$36.27 and posting positive returns over the past week, month and past 3 months.

The recent 1-day share price return of 1.82% and 30-day share price return of 29.26% add to a 27.98% year to date share price return and 54.85% three year total shareholder return, suggesting momentum has been building over both shorter and longer periods.

If Excelerate Energy’s move has caught your attention, this can be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Excelerate Energy trading around US$36.27, slightly above an average analyst price target of US$35.75 and an estimated intrinsic value pointing to a small premium, you may ask whether there is still a buying opportunity here or whether the market is already pricing in future growth.

Most Popular Narrative: 5.1% Overvalued

Excelerate Energy’s most followed narrative puts fair value at $34.50, a touch below the recent $36.27 close, so the story leans slightly rich on this view.

Ongoing investments in flexible infrastructure (such as new FSRUs, LNG carrier acquisitions, and asset conversions) enable Excelerate to capture further market share as global LNG import demand grows and as countries accelerate plans to replace coal and oil with natural gas, strengthening long-term revenue potential.

Curious what kind of revenue trajectory, margin improvement and future earnings multiple are baked into that $34.50 fair value? The underlying forecasts are anything but conservative.

Result: Fair Value of $34.50 (OVERVALUED)

However, this story can change quickly if global decarbonization efforts reduce LNG demand faster than expected, or if new LNG capacity squeezes margins and leaves assets underused.

Another angle on Excelerate Energy’s valuation

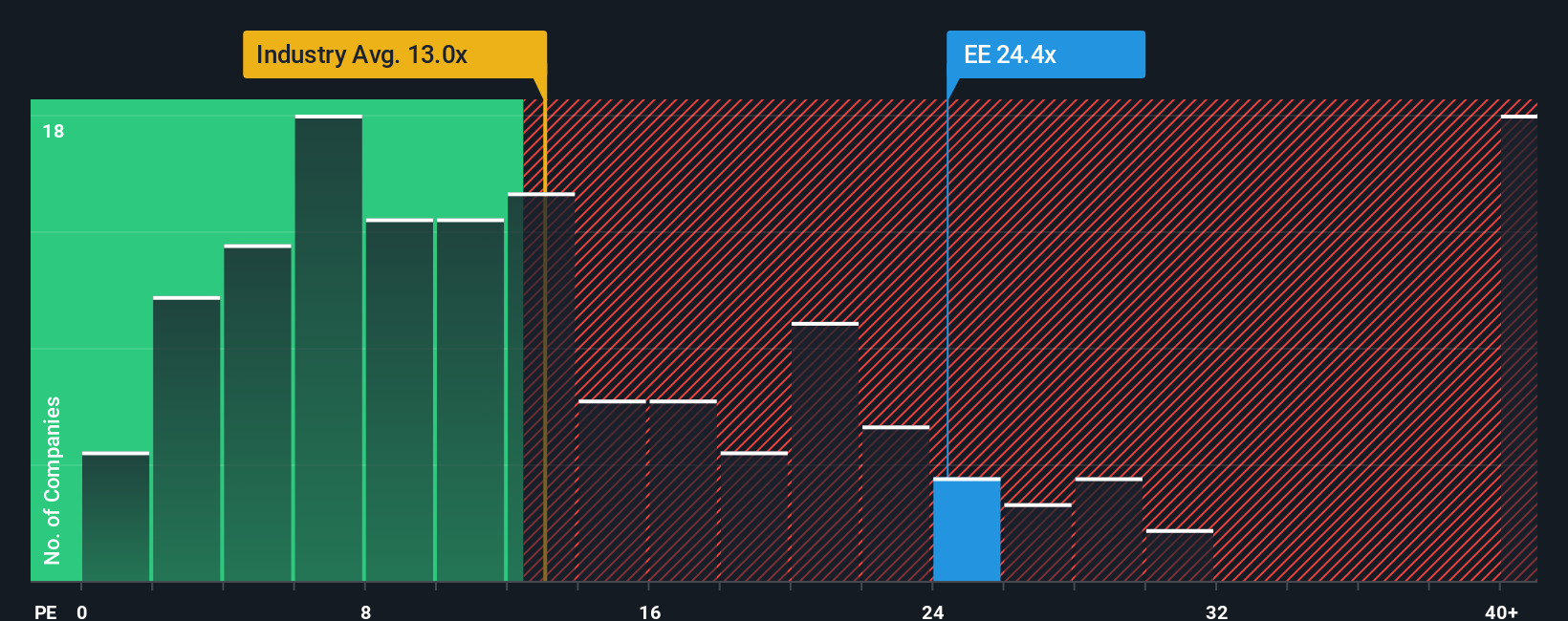

There is a twist when you look at Excelerate Energy through its P/E. At 28.3x, the shares trade well above the US Oil and Gas industry average of 13.6x and also above the stock specific fair ratio of 24.1x, which points to a valuation premium that could matter if sentiment cools.

Build Your Own Excelerate Energy Narrative

If this narrative does not quite match how you see Excelerate Energy, you can review the same data yourself and build a custom story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Excelerate Energy.

Looking for more investment ideas?

If Excelerate Energy is on your radar, do not stop there. Broaden your opportunity set with a few focused stock ideas that other investors might be overlooking.

- Target potential value by scanning these 880 undervalued stocks based on cash flows that may be pricing in more caution than their cash flows suggest.

- Consider technology-related opportunities by checking out these 24 AI penny stocks that are tapping into real-world uses for artificial intelligence.

- Explore emerging digital finance by reviewing these 19 cryptocurrency and blockchain stocks shaping payments, infrastructure, and blockchain services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.