Please use a PC Browser to access Register-Tadawul

A Look At ExlService Holdings (EXLS) Valuation After Recent Share Price Weakness

ExlService Holdings, Inc. EXLS | 30.07 | -1.12% |

Event context and recent share performance

ExlService Holdings (EXLS) is drawing investor attention after a period of weaker share performance, with the stock showing a 22.7% decline over the past month and a 16.2% decline over the past 3 months.

Over longer horizons, the total return stands at a 21.2% decline year to date and a 37.2% decline over the past year. The 5 year total return is 88.5%, setting a mixed backdrop for fresh analysis.

The recent 7 day share price return of a 18.4% decline and 1 month share price return of a 22.7% decline at a last close of US$32.46 point to fading momentum, especially when set against a 1 year total shareholder return of a 37.2% decline and a 5 year total shareholder return of 88.5%.

If this kind of volatility has you reassessing your watchlist, it could be a good time to broaden your search with fast growing stocks with high insider ownership.

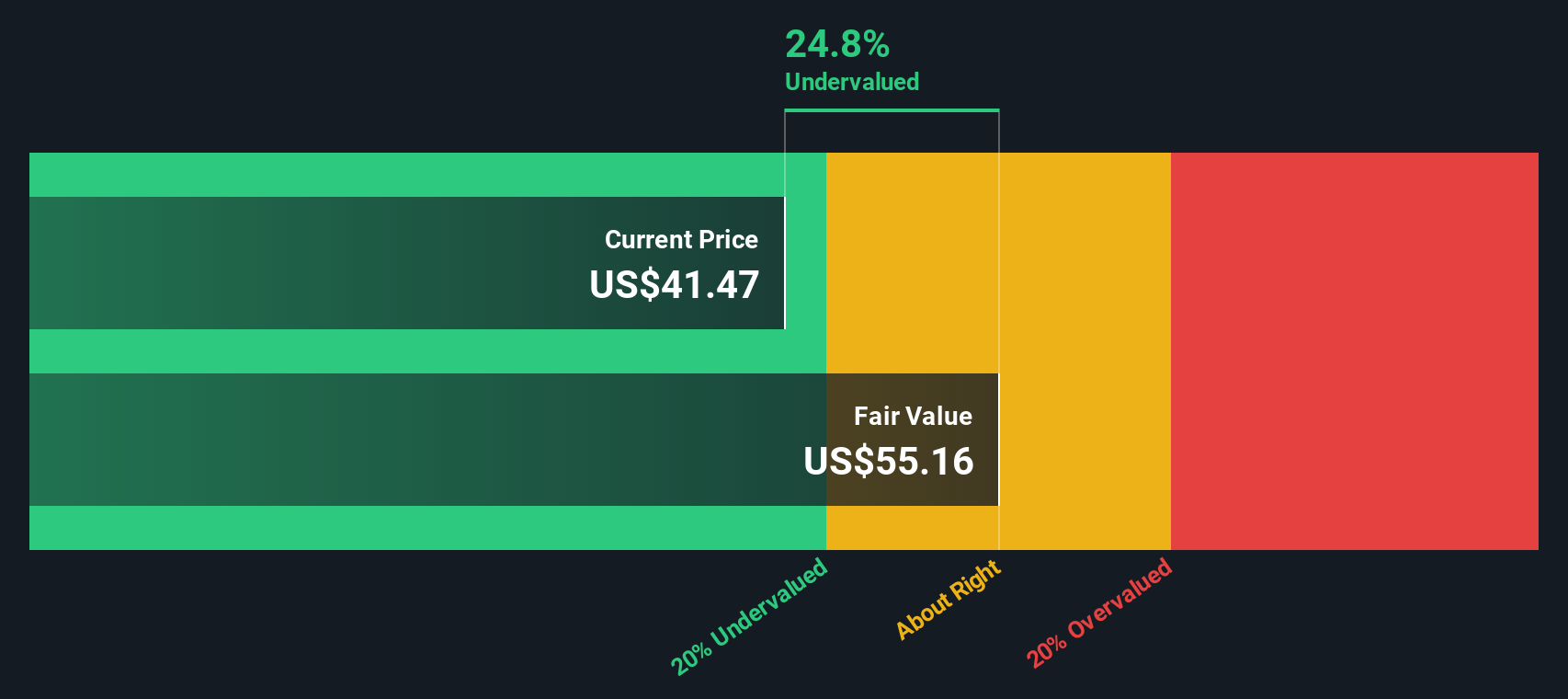

With EXLS trading at US$32.46 and sitting at a 44% intrinsic discount and a 39% discount to analyst targets, investors may ask whether this represents a reset that creates a potential buying opportunity or whether the market is correctly pricing in future growth.

Most Popular Narrative: 155.6% Overvalued

According to the narrative, ExlService Holdings has a fair value of $12.70, which sits well below the last close of $32.46, setting up a sharp valuation gap.

• 2 áreas de negocio: Data Analytics y Digital Op. & Solutions • Data Analytics: usa datos y ayuda a transformarlos en oportunidades para las empresas • Digital Op. & Solutions: mejora procesos en empresa a traves de la digitalización (incluye AI). Finanzas y contabilidad digital, mejora experiencia cliente, soluciones digitales para áreas de operaciones.

Want to see what kind of revenue path and profit margins this narrative assumes for those two business lines, and how that connects to its future earnings multiple?

Result: Fair Value of $12.70 (OVERVALUED)

However, there are clear watchpoints, including heavy reliance on a concentrated group of large US clients and a cost base tied to wage and currency trends in India.

Another view on value

The user narrative pins fair value at $12.70 and calls ExlService Holdings overvalued, but our DCF model points the other way, with an estimate of $57.83 versus the current $32.46. One method sees a big premium and the other a wide discount. Which story do you think fits better with the risks you care about?

Build Your Own ExlService Holdings Narrative

If this view does not quite match your own thinking or you would rather test the numbers yourself, you can build a fresh narrative in just a few minutes with Do it your way.

A great starting point for your ExlService Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are reassessing your portfolio after looking at ExlService Holdings, do not stop here. Your next strong idea might be sitting in another corner of the market.

- Spot potential value opportunities early by scanning these 868 undervalued stocks based on cash flows that line up with your view on cash flows and price.

- Ride the growth of artificial intelligence by hunting through these 27 AI penny stocks that put data and automation at the center of their business models.

- Lean into income focused ideas with these 11 dividend stocks with yields > 3%, where yields above 3% could play a useful role in your returns and cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.