Please use a PC Browser to access Register-Tadawul

A Look at Fifth Third Bancorp’s (FITB) Valuation Following $200 Million Fraud-Linked Loan Charge

Fifth Third Bancorp FITB | 47.53 | -0.62% |

If you’re tracking Fifth Third Bancorp (FITB), this week’s news likely got your attention. The bank revealed it could take a charge of up to $200 million in the current quarter, tied to external fraud involving subprime auto lender Tricolor Holdings. Management described this as a one-off loss, citing corrupted data and irregular borrower financial statements that slipped through monitoring. While Fifth Third is cooperating with law enforcement and increasing its risk controls, investors understandably wonder what this means for the company’s bottom line and how it could shift perceptions of risk around the stock.

Stepping back, FITB’s stock has delivered an 11% return over the past year, outpacing many peers despite challenges facing banks nationwide. The news comes just as Fifth Third secured high-profile business as the financial agent for the Direct Express benefit card and posted healthy revenue and net income growth of around 8% year-over-year. However, with this fraud-driven write-down following a period of steady performance, momentum is coming under new scrutiny and the market will be watching the bank’s response closely.

With these events in focus, investors may be considering whether Fifth Third Bancorp is priced for future growth or if this setback has created a new opportunity for those willing to wait.

Most Popular Narrative: 5.4% Undervalued

According to the most widely followed narrative, Fifth Third Bancorp is currently trading at a discount to its estimated fair value. Analysts see several structural and operational catalysts as key drivers for future growth, and the market may be overlooking these factors in its current pricing.

Expansion and densification in fast-growing Southeast markets, supported by accelerated branch openings and direct marketing initiatives, are expected to drive sustained loan and deposit growth in regions benefiting from robust economic and population increases. This will likely feed into higher revenue and market share over time.

Curious how analysts get to that optimistic price target? The blueprint involves bold bets on growth, performance, and future profitability, not just for today but for years ahead. Think the numbers behind this story are just typical bank projections? You might be surprised which trends tip this valuation into “undervalued” territory. Want to see what specific financial leaps analysts see as game changers? This narrative has the answers.

Result: Fair Value of $48.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower loan growth or abrupt declines in noninterest income from reduced solar lending could create challenges for the outlook of sustained earnings expansion.

Find out about the key risks to this Fifth Third Bancorp narrative.Another View: How Do Market Comparisons Stack Up?

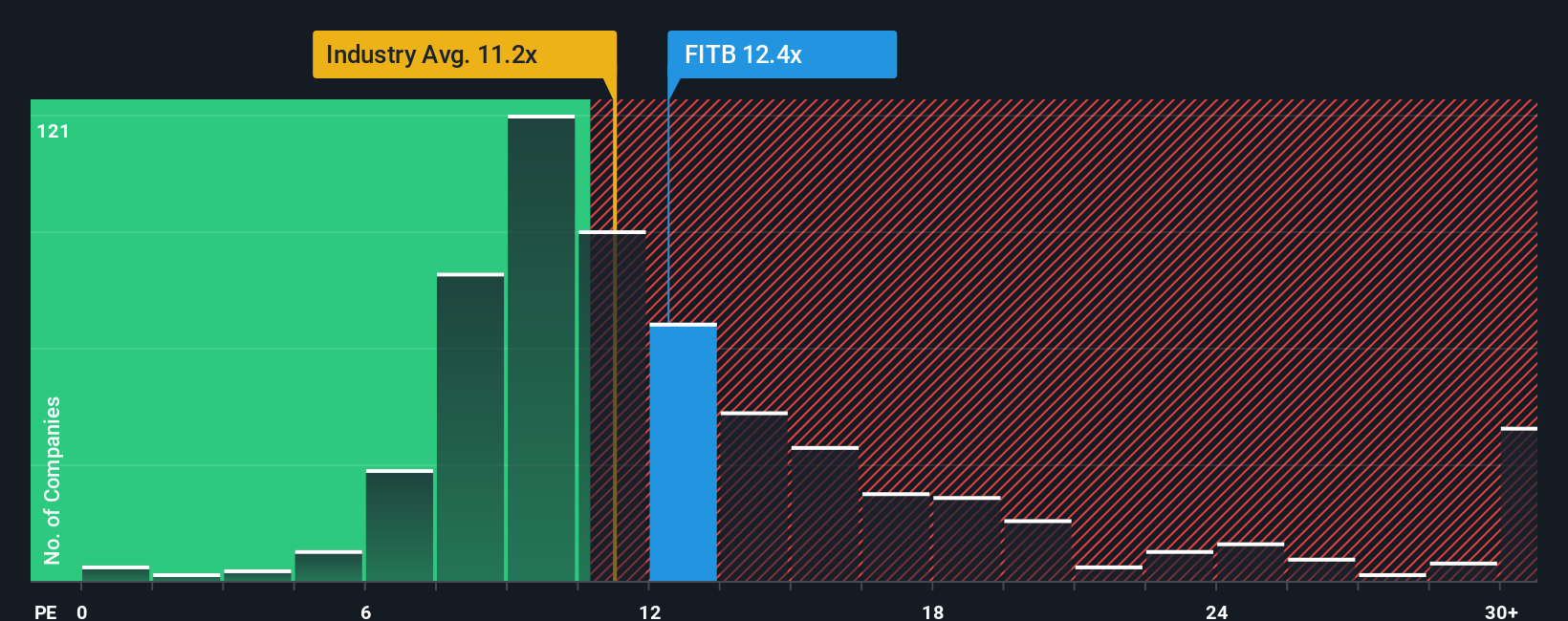

While our earlier look showed Fifth Third Bancorp as undervalued based on its outlook, a quick check against others in the industry suggests the stock is actually priced on the expensive side right now. Which take is closer to reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fifth Third Bancorp Narrative

If you see things differently or want to dig into the details on your own terms, creating your own narrative is quick and easy. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fifth Third Bancorp.

Ready for More Investing Opportunities?

The search for standout investments doesn’t end here. With the right tools, you can pinpoint promising stocks that fit your goals and uncover new strategies that others might overlook. Put yourself ahead of the crowd by checking out these compelling ideas:

- Uncover high-potential growth stories in technology and innovation by jumping into the world of AI-driven companies through AI penny stocks.

- Secure streams of income with established businesses offering yields above 3% by checking out the companies highlighted in dividend stocks with yields > 3%.

- Tap into undervalued market gems and find stocks trading at attractive prices based on future cash flows in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.