Please use a PC Browser to access Register-Tadawul

A Look At Fluence Energy (FLNC) Valuation After Mixed Q1 2026 Results And Record Backlog

Fluence Energy, Inc. Class A FLNC | 16.55 | -0.06% |

Fluence Energy (FLNC) is back in focus after Q1 2026 results came in mixed, with wider losses and softer margins, even as revenue, new orders, and full year guidance all pointed in a different direction.

The mixed Q1 update and record backlog came after a sharp pullback, with a 31.83% 1 month share price return decline, even though the 1 year total shareholder return of about 187% still signals strong longer term momentum.

If this kind of volatility has you looking across the energy transition space, it could be worth checking our screener of 25 power grid technology and infrastructure stocks as potential next ideas to research.

With the share price sliding about 32% in a month while the 1 year return sits near 187%, investors are now weighing a record US$5.5b backlog and reaffirmed guidance against widening losses. Is this a reset buying opportunity, or is future growth already priced in?

Most Popular Narrative: 7.8% Overvalued

With Fluence Energy last closing at $18.46 versus a narrative fair value of about $17.13, the most followed storyline sees the shares a bit ahead of that estimate, anchored to detailed views on growth, margins, and future valuation multiples.

The analysts have a consensus price target of $7.737 for Fluence Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $2.0.

Curious how earnings, revenue and margin assumptions all line up to justify that fair value and future P/E? The narrative leans on a specific growth glide path, a shift from losses to profits, and a pricing multiple more commonly associated with mature compounders. Want to see exactly which forecasts are doing the heavy lifting in that story? Read on and compare those expectations with your own view.

Result: Fair Value of $17.13 (OVERVALUED)

However, that fair value story relies heavily on assumptions about tariffs and trade, as well as on smooth backlog conversion, both of which could easily change and challenge the current narrative.

Another Take: Multiples Point The Other Way

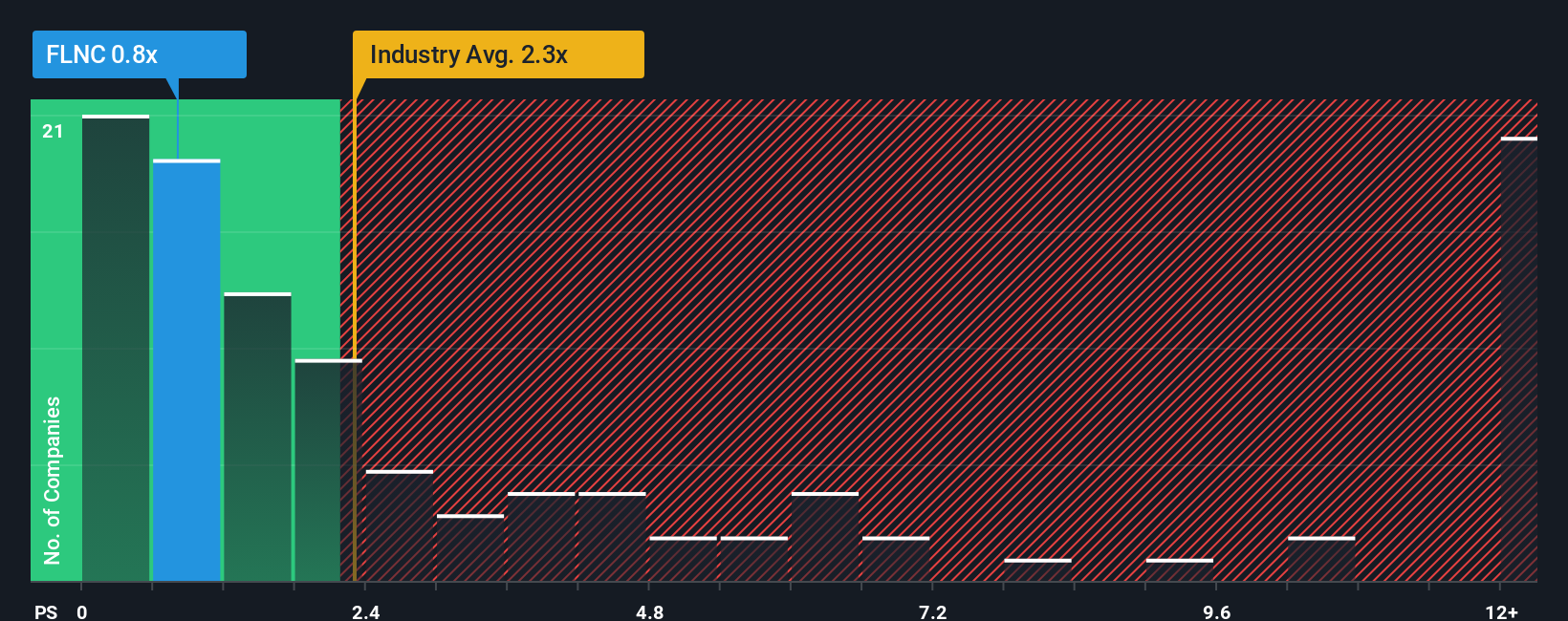

Here is the twist. While the narrative fair value pegs Fluence Energy at about $17.13 and labels the shares as slightly overvalued versus the $18.46 price, our work with P/S tells a different story. At roughly 1x P/S, the stock sits well below the US Electrical industry at 2.5x and peers at 16.4x, and also below a fair ratio of 2.4x that the market could move toward. That wide gap suggests more valuation risk if sentiment turns, but also potential upside if Fluence earns a richer multiple. Which side of that trade do you think wins out?

Build Your Own Fluence Energy Narrative

If you see the numbers differently, or would rather stress test each assumption yourself, you can build a custom Fluence Energy view in minutes, then Do it your way.

A great starting point for your Fluence Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at one company, you could miss other opportunities that fit your style. Widen your search and let the screener surface fresh candidates.

- Spot potential value candidates early by scanning our list of 54 high quality undervalued stocks that combine quality with attractive pricing signals.

- Prioritise resilience in your portfolio by searching through a solid balance sheet and fundamentals stocks screener (45 results) that can help you focus on financial strength.

- Hunt for off the radar ideas by reviewing a screener containing 24 high quality undiscovered gems that most investors may not be paying attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.