Please use a PC Browser to access Register-Tadawul

A Look At Fluence Energy (FLNC) Valuation As Policy Momentum And Rate Cut Hopes Draw Interest

Fluence Energy, Inc. Class A FLNC | 16.55 | -0.06% |

Recent gains in Fluence Energy (FLNC) have been closely tied to expectations for interest rate cuts and renewed attention on Virginia legislation aimed at raising energy storage targets, where company executives are actively engaged in policy discussions.

Those rate cut hopes and the Virginia storage debate have arrived on top of a mixed price pattern, with a 7 day share price return of 10.17% and a 90 day share price return of 15.68%. The 1 year total shareholder return of 44.18% contrasts with a more muted 3 year total shareholder return of 5.20%, suggesting momentum has picked up more recently around policy and macro headlines.

If this kind of interest around grid storage has your attention, it might be a good moment to see what else is moving across high growth tech and AI stocks. You could find a few new names worth a closer look.

With FLNC trading above its average analyst price target and carrying a low value score, it is fair to ask whether enthusiasm around policy and rates has already been priced in, or if markets are still underestimating future growth.

Most Popular Narrative: 51.3% Overvaluled

Compared with Fluence Energy’s last close at US$22.65, the most followed narrative points to a fair value closer to the mid teens, creating a wide gap for investors to weigh.

The growing backlog exceeding $4.9 billion, expanding international pipeline, and initial traction for next-generation products (e.g., Smartstack) set the stage for an eventual rebound in order volumes, margin expansion from operational efficiencies, and a path back to positive free cash flow as uncertainty recedes and the storage market resumes robust growth.

Curious what kind of revenue curve and profit margins support that fair value, and how they connect to a specific future earnings multiple and discount rate? The narrative lays out a detailed earnings path, revenue ramp, and targeted profitability that all have to line up for today’s price to make sense. If you want to see exactly which assumptions drive that gap between current price and fair value, the full story is one click away.

Result: Fair Value of $14.97 (OVERVALUED)

However, there is still a real chance that prolonged tariff uncertainty and delayed U.S. bookings will disrupt backlog conversion and keep earnings and cash flow outcomes below the optimistic case.

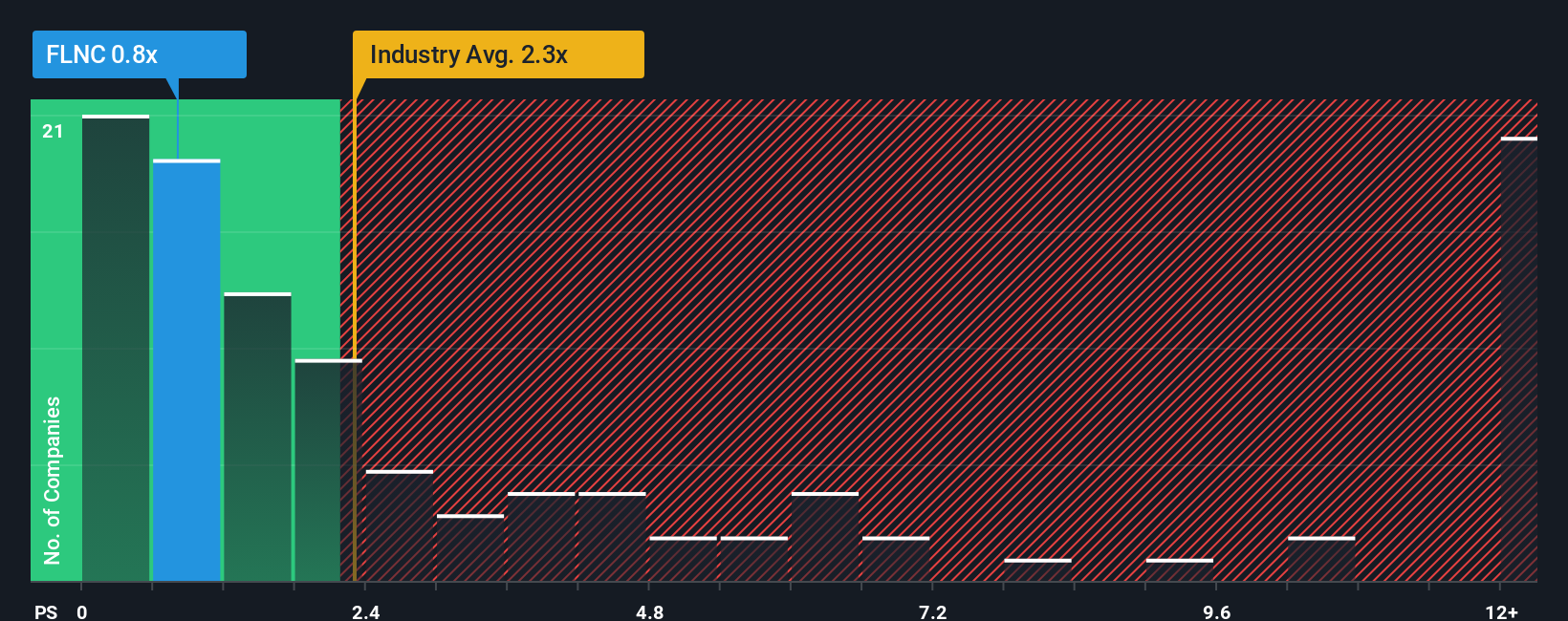

Another View: What The P/S Ratio Is Saying

While the Simply Wall St fair value estimate of US$16.88 points to Fluence Energy trading in overvalued territory at US$22.65, the P/S ratio tells a different story. At 1.3x sales, the shares sit well below the US Electrical industry average of 2.2x and the peer average of 3.1x.

The fair ratio for Fluence Energy is 2.5x sales, which is much closer to where the broader market and peers trade. If the market moved toward that fair ratio, today’s price could look less stretched. However, if sentiment cools, the current discount on sales might stay in place for longer. Which signal do you trust more right now, the earnings based fair value or the revenue based multiple?

Build Your Own Fluence Energy Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to build on your own research, you can put together a custom Fluence view in just a few minutes with Do it your way.

A great starting point for your Fluence Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You have already done the hard work on Fluence, so keep that momentum going and widen your watchlist with a few focused stock idea screens.

- Spot potential value by reviewing these 884 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

- Capture emerging themes by scanning these 25 AI penny stocks that are tied to artificial intelligence trends.

- Tap into income ideas by checking these 12 dividend stocks with yields > 3% that could add steadier yield to your portfolio.

If you stop here you only see one corner of the market. Take a few minutes with these screeners to broaden your view and potentially uncover additional ideas.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.