Please use a PC Browser to access Register-Tadawul

A Look At GameStop (GME) Valuation As CEO Option Grant And Store Closures Reshape The Turnaround Story

GameStop Corp. Class A GME | 23.43 | -1.97% |

GameStop (GME) is back in focus after the board approved a performance based stock option package for CEO Ryan Cohen, alongside plans to close about 296 stores as part of a broader overhaul.

At a share price of $21.23, GameStop’s 7 day share price return of 2.46% comes after a 90 day share price decline of 8.53%. The 1 year total shareholder return of a 30.76% decline contrasts with a 5 year total shareholder return of 142.02%. This suggests momentum has cooled compared to the meme stock peak, even as the latest store closures and performance based package keep attention on future execution and risk.

If this kind of turnaround story has your attention, it could be a moment to broaden your watchlist with fast growing stocks with high insider ownership.

With GameStop trading at $21.23 and an intrinsic discount figure of 78.67%, together with a tough recent share price record, the key question now is whether the market is overlooking potential progress or already pricing in everything that lies ahead.

Most Popular Narrative: 90.4% Undervalued

With GameStop at US$21.23 and the narrative fair value set at US$220, the gap is wide enough that the supporting thesis matters a lot.

GameStop’s Q1 2025 financials, combined with an engaged shareholder community, highlighted its takes-money-to-buy-whiskey strategy in action, presenting it as a compelling investment as some retail investors have been saying for years while alleging a battle against corrupt legacy media, bots, social media manipulation and hedge funds. GameStop reported an adjusted EPS of $0.17, exceeding certain estimates by 325%, and recorded a $44.8 million net profit, compared with a $32 million loss in the prior year. With $6.4 billion in cash and zero long-term debt, GameStop reported a high level of financial flexibility.

According to SimpleMan887, this valuation is based on a cash-rich balance sheet, sharply higher profitability and a future earnings multiple that is often associated with market favorites. Curious what kind of revenue growth, margins and profit multiple are implied in that US$220 figure and how Bitcoin fits into the story? The full narrative sets out the numbers behind that assessment.

Result: Fair Value of $220 (UNDERVALUED)

However, this hinges on continued profitability and careful use of that large cash and Bitcoin position, since missteps there could quickly weaken the bullish story.

Another View on GameStop's Valuation

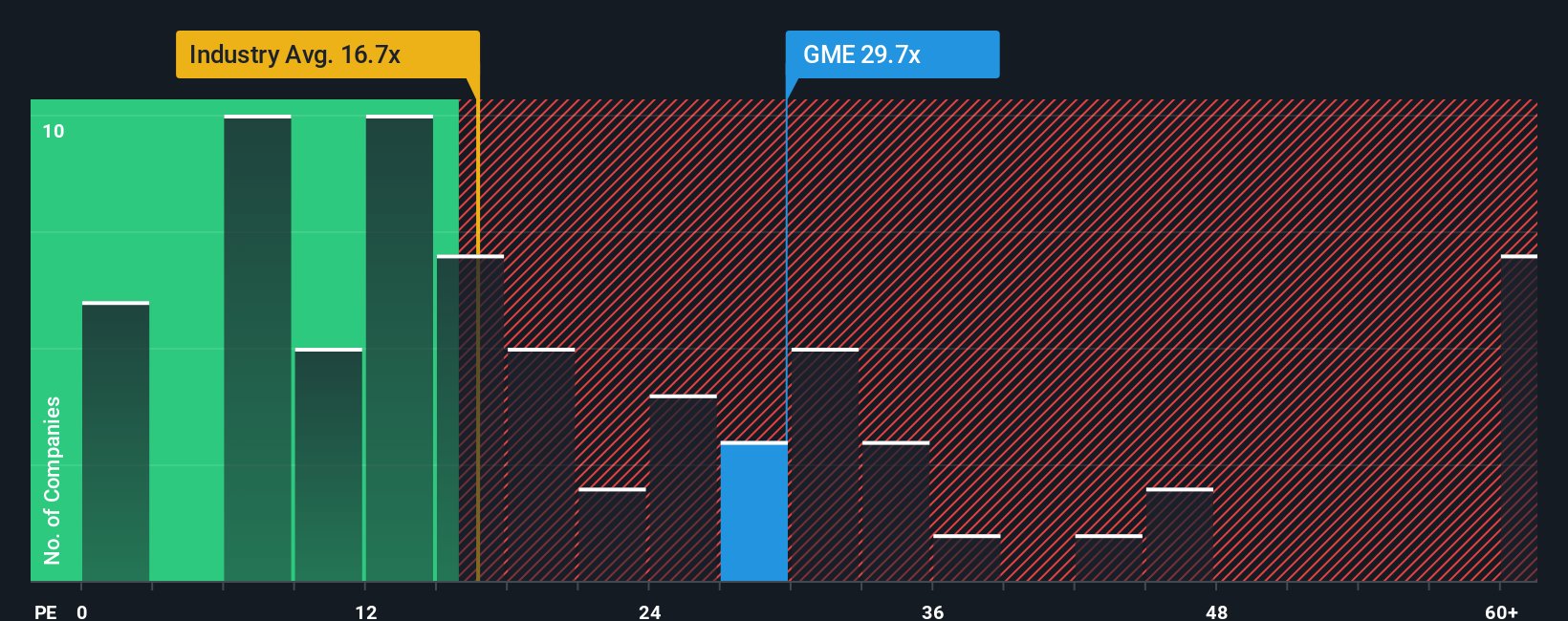

The popular narrative points to a fair value of US$220 per share, but the current P/E ratio of 22.5x tells a different story. That level is slightly higher than both the US Specialty Retail industry at 21x and the peer average at 21.2x, which points to a premium price rather than a clear bargain.

For you as an investor, that premium means less margin for error if expectations do not play out as hoped. It raises a simple question: is the upbeat narrative enough to justify paying more than both the sector and direct peers for GameStop right now?

Build Your Own GameStop Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own thesis, you can build a custom view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for more investment ideas?

If GameStop has sharpened your thinking, do not stop here. Broaden your opportunity set with structured stock ideas you can sort, compare and track in minutes.

- Target potential mispricings by scanning these 883 undervalued stocks based on cash flows that align with your view on cash flows and market expectations.

- Ride powerful tech trends by checking these 28 AI penny stocks that connect artificial intelligence themes with listed businesses.

- Position your portfolio for income by reviewing these 12 dividend stocks with yields > 3% and weighing yields against your risk tolerance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.