Please use a PC Browser to access Register-Tadawul

A Look At Gates Industrial (GTES) Valuation After Recent Short Term Share Price Momentum

Gates Industrial Corporation plc GTES | 27.60 | -0.61% |

Event context and recent share performance

With no specific news event driving headlines, Gates Industrial (GTES) has still drawn attention after a recent close at $27.97, alongside month and past 3 months returns of 22.9% and 30.8%.

The recent 22.9% 1 month share price return and 30.8% 3 month share price return, against a 1 year total shareholder return of 23.5% and a 3 year total shareholder return near 2x, points to momentum that has increasingly concentrated in the shorter term.

If Gates Industrial’s move has you looking beyond a single stock, it could be a good time to scan our screener of 25 power grid technology and infrastructure stocks as another way to spot potential ideas.

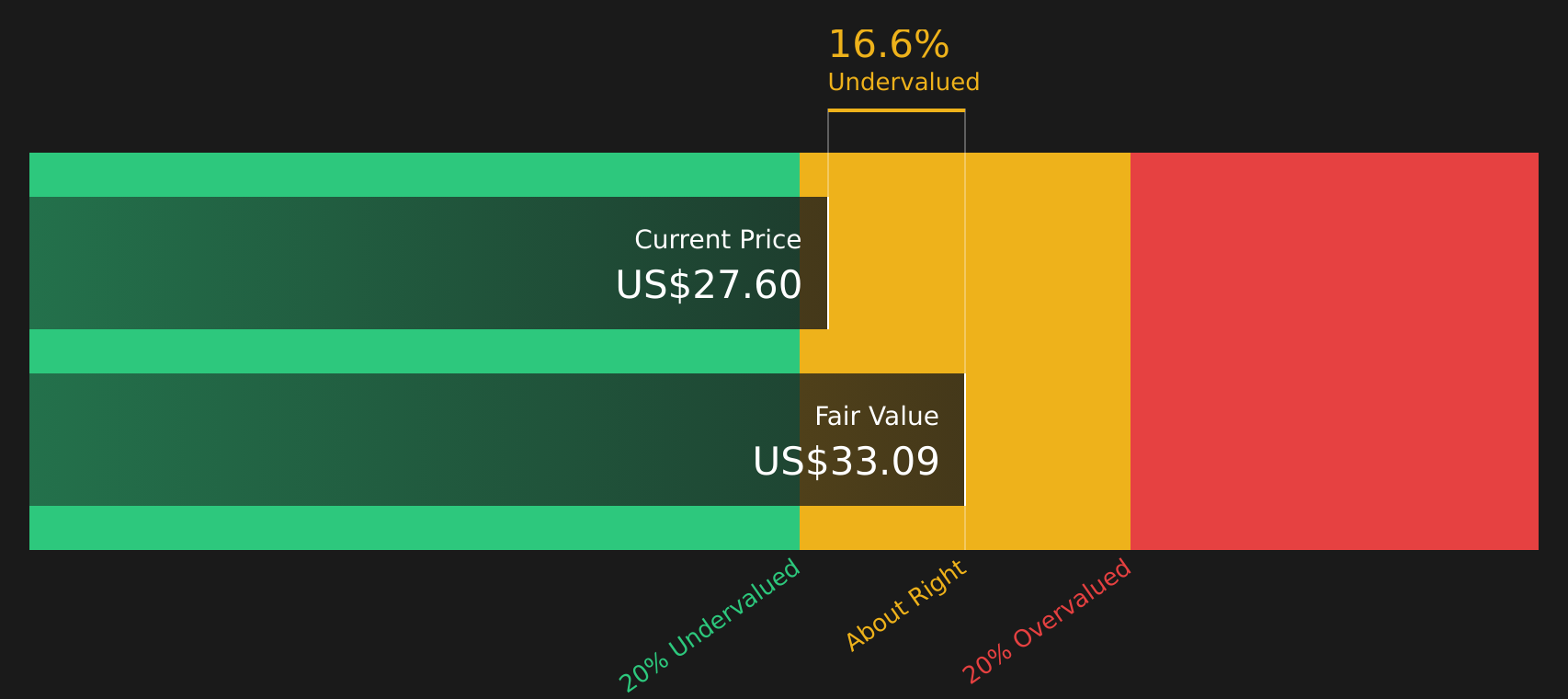

So with Gates Industrial trading at $27.97, some implied upside to a $31.09 target and an estimated intrinsic discount near 15%, is the recent surge still leaving room for an opportunity to buy, or is the market already pricing in future growth?

Most Popular Narrative: 2.9% Overvalued

The most followed narrative puts Gates Industrial’s fair value at about $27.17, just below the recent $27.97 close. This implies only a modest premium and a tight valuation gap.

Rapid expansion in the data center liquid cooling market is driving increasing demand for Gates' fluid transfer and specialized power transmission products, with recent design wins and a growing opportunity pipeline expected to accelerate revenue growth and margin expansion in 2026 and beyond. The company's strong penetration and innovation in personal mobility (e-bikes and similar applications) are fueling high double-digit revenue growth, supported by a $300M+ opportunity pipeline and ongoing new product launches, likely to materially support top-line results and gross margins over the next several years.

Curious how a mature industrial name earns that kind of growth story? Revenue mix shifts, margin uplift, and a punchy future earnings multiple all sit at the core. The exact numbers might surprise you.

Result: Fair Value of $27.17 (OVERVALUED)

However, that story can break if core industrial and automotive demand stays soft, or if tariffs and trade tensions pressure costs and margins more than expected.

Another angle on valuation

The narrative-based fair value of $27.17 points to a small premium at today’s $27.97 price. In contrast, the SWS DCF model produces an estimate of future cash flow value at $33.02 and a 15.3% discount. Which story do you think fits Gates Industrial better?

Build Your Own Gates Industrial Narrative

If this take does not fully match how you see Gates Industrial, you can stress test the same data, shape your own story and Do it your way in just a few minutes.

A great starting point for your Gates Industrial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with one company, you risk missing other opportunities that may suit your goals just as well or even better over time.

- Target reliable cash generators by checking companies in our 53 high quality undervalued stocks that pair quality fundamentals with potentially appealing pricing.

- Prioritise sleep at night holdings by scanning the 84 resilient stocks with low risk scores for businesses with lower risk scores and steadier profiles.

- Spot early standouts before the crowd by reviewing the screener containing 23 high quality undiscovered gems that still fly under most investors’ radars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.