Please use a PC Browser to access Register-Tadawul

A Look at Generac Holdings’s Valuation Following Its New PWRmicro Clean Energy Launch

Generac Holdings Inc. GNRC | 159.13 | -1.01% |

Most Popular Narrative: 9.8% Undervalued

According to the most widely followed narrative, Generac Holdings is currently trading below its estimated fair value, indicating potential upside in the share price based on analysts’ forward-looking assumptions.

Accelerating demand for backup power solutions in data centers driven by AI adoption and global digitalization has resulted in a structural supply deficit for large commercial generators. Generac's rapid entry and more than $150 million backlog position it to capture significant revenue growth and operating leverage over the next several years. There is further potential upside as the company expands capacity to address demand beyond 2027.

There is more to the story than meets the eye. Want to uncover the pivotal financial assumptions and the bullish profit forecasts that make this valuation stand out from the crowd? The optimism behind this fair value hinges on a bold bet for future growth. Dive deeper to discover what could propel Generac to the next level.

Result: Fair Value of $204.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a sharp downturn in residential solar or a decrease in major power outages could challenge Generac’s optimistic outlook and test market confidence in future growth.

Find out about the key risks to this Generac Holdings narrative.Another View: SWS DCF Model Weighs In

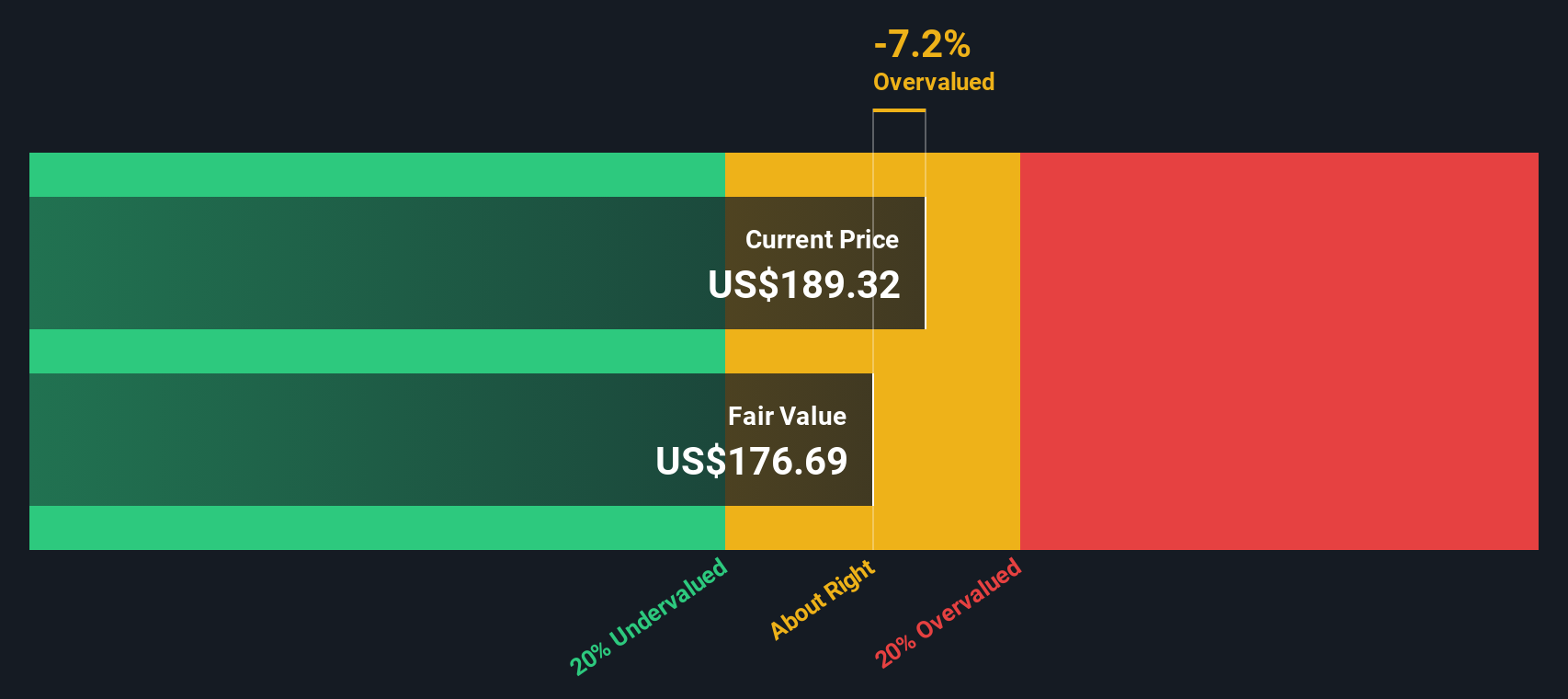

Looking through the lens of our DCF model, Generac's valuation appears less optimistic than the popular narrative suggests. This approach points to a fair value below the current trading level and raises doubts about just how much upside is left. Could this more cautious estimate signal that expectations have gotten ahead of reality?

Build Your Own Generac Holdings Narrative

If you have a different perspective or want to analyze the numbers on your own terms, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Generac Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock fresh opportunities by leveraging new trends and powerful data-driven insights with Simply Wall Street’s screeners. Act now and give your portfolio a head start.

- Spot up-and-coming tech disruptors by checking out AI penny stocks. These companies are transforming artificial intelligence across industries and delivering cutting-edge innovation.

- Boost your income potential with dividend stocks with yields > 3%, which features companies offering impressive yields that can help cushion volatile markets and support long-term growth goals.

- Pinpoint overlooked gems by using undervalued stocks based on cash flows to find quality companies trading at attractive prices based on future cash flows and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.