Please use a PC Browser to access Register-Tadawul

A Look At Healthcare Services Group (HCSG) Valuation After Strong One Year Shareholder Returns

Healthcare Services Group, Inc. HCSG | 21.59 | +1.17% |

Event context and recent share performance

Healthcare Services Group (HCSG) has come onto investors’ radar without a single clear headline event, prompting closer attention to its recent share performance and fundamentals rather than a one off catalyst.

At a share price of $18.91, Healthcare Services Group has recently seen softer momentum, with a 30-day share price return of 3.67% and a 90-day share price return of 1.66%. The year to date share price return sits at 8.99% and the 1-year total shareholder return is 68.09%, suggesting earlier optimism has cooled but longer term holders have still seen strong gains.

If you are reassessing healthcare exposure after HCSG’s strong 1-year total shareholder return, it could be a useful moment to compare it with other healthcare stocks.

With annual revenue of about $1.8b, net income of roughly $39.7m and mixed recent returns, the key question is whether HCSG’s current $18.91 share price still leaves upside or if the market is already pricing in future growth.

Most Popular Narrative: 12% Undervalued

Healthcare Services Group's most followed narrative points to a fair value of $21.50 per share, compared with the recent $18.91 close, framing a valuation gap that rests on detailed earnings and margin assumptions.

Strong operational execution, including 90%+ client retention, increased cross-selling of dining services into environmental accounts, and a focus on bundled solutions, should drive recurring revenues and improve earnings consistency over time.

Curious what underpins that $21.50 fair value? The narrative leans heavily on steadily rising revenue, fatter margins and a future earnings multiple that has to compress meaningfully. The tension between those earnings assumptions and today’s higher P/E sits at the heart of the story. If you want to see exactly how those moving parts are stitched together, the full narrative lays out the numbers behind that valuation gap.

Result: Fair Value of $21.50 (UNDERVALUED)

However, you still need to weigh client concentration and labor cost pressures, as setbacks in these areas could quickly challenge the earnings and margin assumptions behind that $21.50 fair value.

Another Take On Value

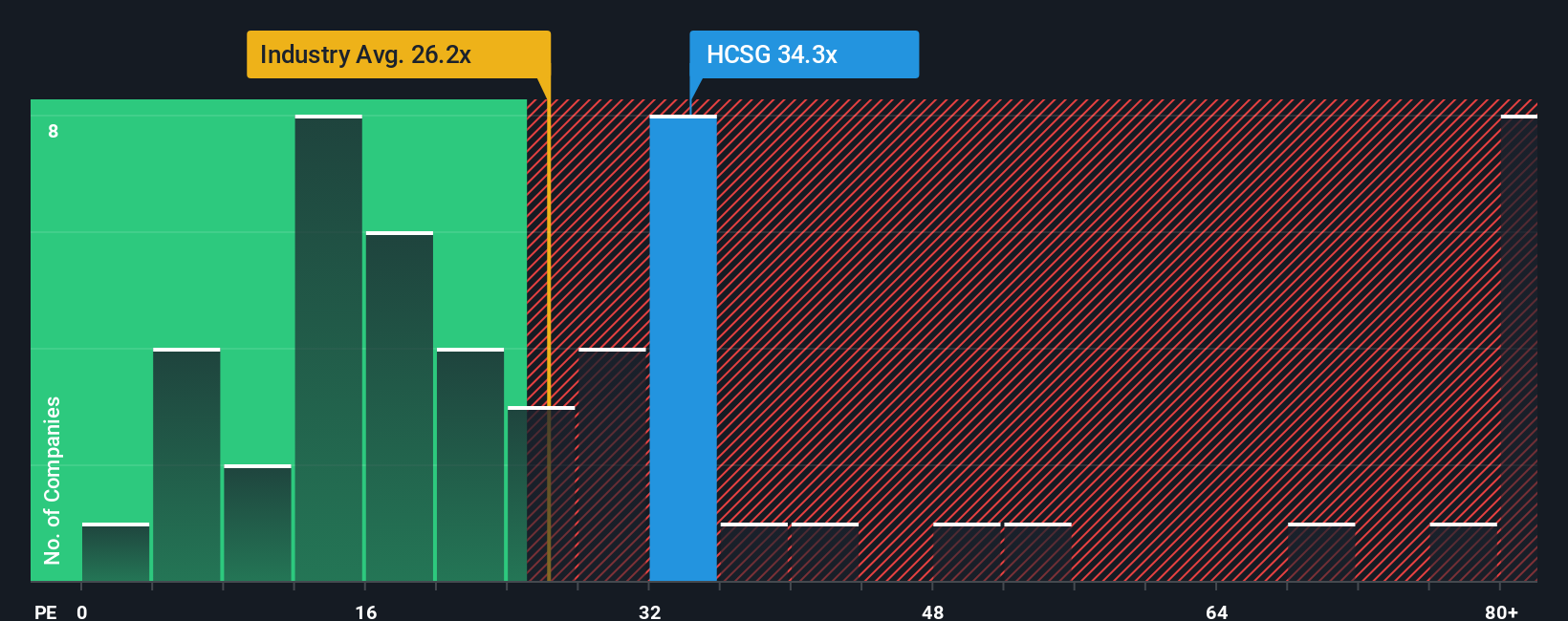

Those fair value narratives paint Healthcare Services Group as undervalued, but its current P/E of 33.5x is higher than the US Commercial Services average of 26.2x and above its own fair ratio of 27.7x. That richer multiple points to valuation risk if earnings do not meet the optimistic forecasts. Which signal do you trust more?

Build Your Own Healthcare Services Group Narrative

If the story here does not quite line up with your own view, or you prefer to test the numbers yourself, you can build a personalized Healthcare Services Group thesis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Healthcare Services Group.

Looking for more investment ideas?

If HCSG has sharpened your focus on opportunities, do not stop here. The screener can quickly surface other ideas that fit your style and risk comfort.

- Spot early stage opportunities with stronger balance sheets by reviewing these 3521 penny stocks with strong financials that already show a measure of financial resilience.

- Position your portfolio for AI driven themes by scanning these 23 AI penny stocks that connect real businesses to artificial intelligence trends.

- Put value front and center by checking these 867 undervalued stocks based on cash flows that trade at prices the model flags as below their cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.