Please use a PC Browser to access Register-Tadawul

A Look At Home Bancshares (HOMB) Valuation As Recent Share Price Momentum Draws Attention

Home BancShares, Inc. HOMB | 29.40 | +0.72% |

Why Home Bancshares (HOMB) Is On Investors’ Radar Today

Home Bancshares (HOMB) has drawn fresh attention after recent trading performance, with the stock last closing at $30.59 and showing positive returns over the past week, month, and past 3 months.

For investors watching regional banks, the company’s reported revenue of $1.07b and net income of $475.44 million, along with a value score of 3 and an indicated intrinsic discount of 41.16%, may invite closer comparison with peers.

Recent trading has been fairly supportive for Home Bancshares, with a 1-day share price return of 1.70% adding to a 30-day share price return of 7.98% and a 5-year total shareholder return of 50.23%. This suggests momentum has been building rather than fading.

If this regional bank story has you thinking more broadly about financial stocks, it might be a good moment to widen your search and check out 22 top founder-led companies.

With Home Bancshares trading at $30.59, an indicated intrinsic discount of 41.16% and only an 8.35% gap to the analyst price target, you have to ask whether there is real value left here or whether the market is already pricing in future growth.

Most Popular Narrative: 7.7% Undervalued

With Home Bancshares (Conway AR) last closing at $30.59 against a narrative fair value of $33.14, the current setup leans toward a modest undervaluation, with the story built around how growth, margins, and capital deployment might play out over time.

Effective credit risk management and a robust loan loss reserve (1.86%) have resulted in superior asset quality and minimized credit losses, positioning the company for resilient net interest margin and earnings performance even during periods of economic uncertainty.

Want to see what sits behind that resilience story? The most followed narrative leans on steady top line progress, firm margins, and a richer future earnings multiple. Curious which specific revenue and profit assumptions justify that fair value gap and how long they are projected to hold up?

Result: Fair Value of $33.14 (UNDERVALUED)

However, that story can change quickly if acquisition-heavy growth leads to integration issues, or if concentrated loan pockets face a tougher credit cycle.

Another Angle On Valuation

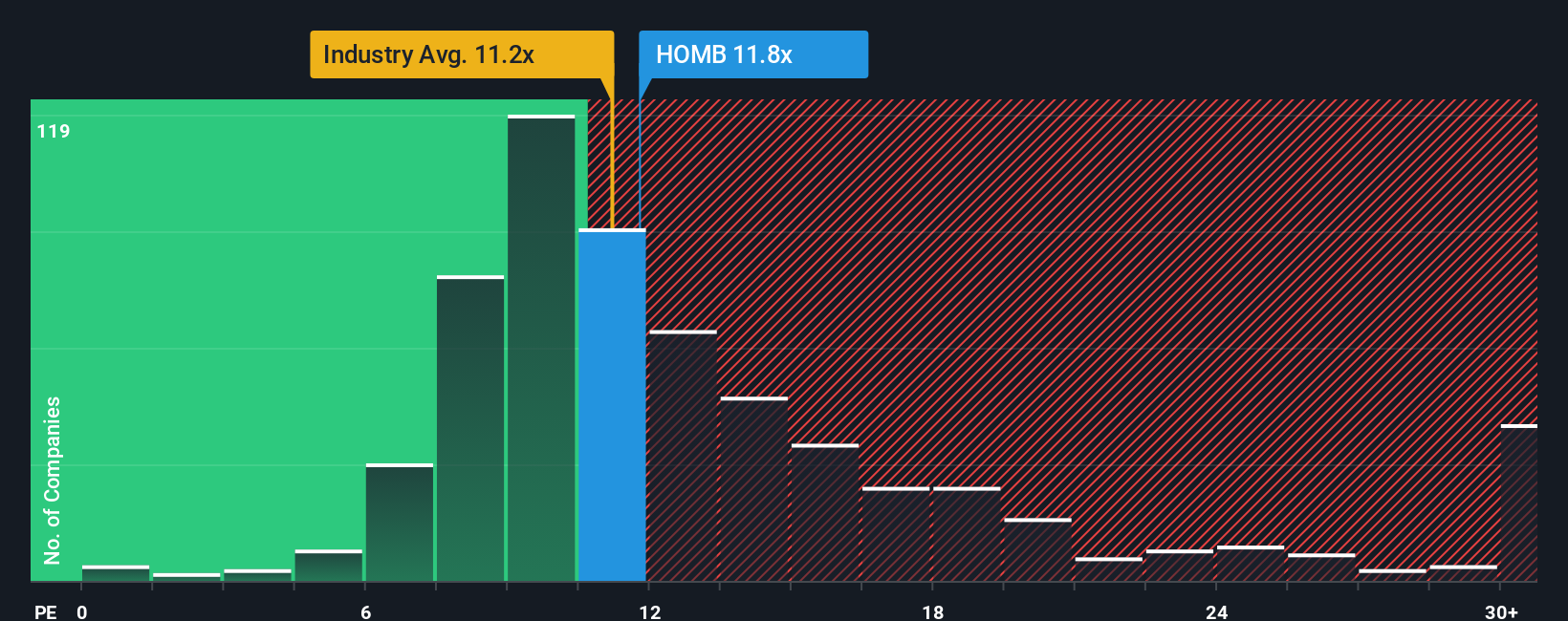

The earlier fair value story leans on growth and earnings assumptions, but the simple P/E picture is more cautious. Home Bancshares trades at 12.6x earnings, above its 12.2x fair ratio and the US Banks industry on 12x, even though peers on average sit higher at 13.9x. This raises the question of whether this acts as a cushion or a warning sign if expectations shift.

Build Your Own Home Bancshares (Conway AR) Narrative

If parts of this story do not quite line up with your own view, or you would rather test the numbers yourself, you can pull together a custom narrative in just a few minutes and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Home Bancshares (Conway AR).

Looking For More Investment Ideas?

If you stop with one bank, you miss the bigger picture. Let the data do the heavy lifting and give yourself more options on the table.

- Target potential value opportunities by scanning companies that score well on quality and pricing through our 53 high quality undervalued stocks.

- Focus on stability first and shortlist companies that show strong finances and dependable balance sheets using the solid balance sheet and fundamentals stocks screener (45 results).

- Hunt for overlooked opportunities by running your eye over a screener containing 25 high quality undiscovered gems that most investors may not be watching yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.