Please use a PC Browser to access Register-Tadawul

A Look At Houlihan Lokey (HLI) Valuation After New Aerospace And Defence Hiring Move

Houlihan Lokey, Inc. Class A HLI | 168.32 | -0.29% |

Executive hire puts Houlihan Lokey in focus for European aerospace and defence

Houlihan Lokey (HLI) is drawing investor attention after appointing Géraud Estrangin as a Managing Director in its Industrials Group, with a focus on aerospace and defence transactions across Europe.

While Houlihan Lokey’s appointment of Géraud Estrangin puts a spotlight on its European aerospace and defence ambitions, the shares tell a more mixed story. The recent 1-day share price return shows a 1.9% decline and the 90-day share price return shows a 9.6% decline. These shorter-term moves sit alongside a much stronger 3-year total shareholder return of 96.8%, indicating that longer term holders have still seen substantial value creation even as short term momentum has cooled.

If this move into European aerospace and defence has caught your interest, it could be a useful moment to scan other aerospace and defense stocks that might be reacting to similar industry trends.

With Houlihan Lokey’s shares slipping in the short term but posting strong multi year total returns, and trading at a discount to the US$208.25 analyst price target, is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 13.4% Undervalued

At a last close of $182.70 against a narrative fair value of about $210.86, Houlihan Lokey is framed as undervalued, with that gap hinging on specific growth and profitability assumptions.

Ongoing global expansion, sector diversification, and talent recruitment position Houlihan Lokey for sustained revenue growth and increased market share.

Strong pipelines from succession planning, resilient restructuring activity, and enhanced client engagement are stabilizing fee income and supporting earnings despite macroeconomic shifts.

Curious what kind of revenue trajectory and margin profile justify that higher fair value, and how rich the future earnings multiple needs to be to support it? The most followed narrative lays out a detailed path for both top line growth and profit expansion, and then compresses those assumptions into a single valuation number that sits above today’s price.

Result: Fair Value of $210.86 (UNDERVALUED)

However, there are still clear pressure points, including high compensation costs and a heavy reliance on U.S.-driven M&A trends that could limit the upside in this story.

Another View: Earnings Multiple Paints a Richer Picture

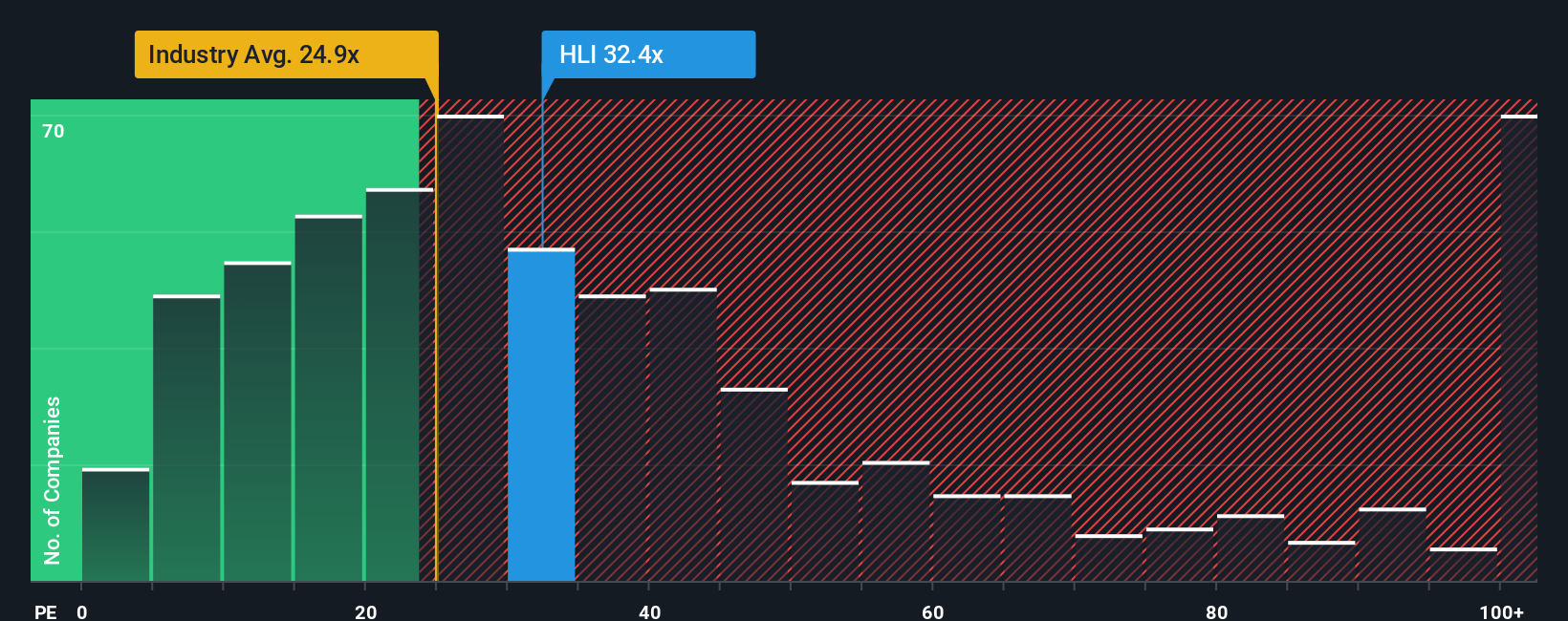

Those 13.4% undervalued fair value estimates meet a very different signal when you look at the current P/E. Houlihan Lokey trades on about 30x earnings, compared with 24.8x for the US Capital Markets industry, 19.7x for peers, and a fair ratio of 16.2x that the market could move towards.

That gap suggests investors are already paying a premium for the story, which could limit upside if growth or margins fall short, or create room for a rerating if the company keeps justifying that higher bar. Which side of that trade do you think is more likely to play out?

Build Your Own Houlihan Lokey Narrative

If you are not fully on board with this view or prefer to work from your own numbers and assumptions, you can test different scenarios, shape your own Houlihan Lokey story, and see how it stacks up with our tools in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Houlihan Lokey.

Looking for more investment ideas?

If Houlihan Lokey is on your radar, do not stop there. A few minutes with the Simply Wall St Screener could surface other opportunities that fit your style.

- Spot potential value candidates by checking out these 886 undervalued stocks based on cash flows that line up with discounted cash flow estimates and market expectations.

- Capture growth themes in technology by scanning these 23 AI penny stocks that are building real businesses around artificial intelligence tools and services.

- Strengthen your income focus by reviewing these 13 dividend stocks with yields > 3% that pair higher yields with underlying business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.