Please use a PC Browser to access Register-Tadawul

A Look At Ichor Holdings (ICHR) Valuation After Earnings Beat And Growth-Focused Outlook

Ichor Holdings, Ltd. ICHR | 50.35 | +5.25% |

Ichor Holdings (ICHR) has just given investors fresh information to work with, pairing a fourth quarter earnings update with new first quarter 2026 guidance that points to revenue of US$240 million to US$260 million.

The earnings beat and guidance have coincided with a sharp shift in sentiment, with a 1 day share price return of 6.46% and a 90 day share price return of 219.47% lifting the 1 year total shareholder return to 48.38%. Overall, the stock’s short term momentum has strengthened significantly while longer term total shareholder returns remain comparatively modest.

If Ichor’s surge has caught your attention, it could be a good time to see what else is moving in chip related names via our screener of 34 AI infrastructure stocks.

With Ichor now trading very close to its US$46.86 average analyst target, yet still showing a 34% gap to one intrinsic value estimate, the key question is whether there is still upside here or if the market is already pricing in the recovery.

Most Popular Narrative: 57% Overvalued

With Ichor Holdings last closing at $46.77 against a widely followed fair value estimate of about $29.86, the narrative assumes a rich future earnings profile to justify that gap.

The Fair Value Estimate has risen meaningfully, moving from about US$24.17 to roughly US$29.86 per share. The Future P/E assumption has increased sharply, moving from about 56.9x to a very large multiple of roughly 156.2x, which materially raises the valuation placed on potential future earnings.

Curious what kind of earnings ramp and margin lift are baked into that higher fair value? The key is how revenue growth, profitability and that very high future multiple all fit together in this narrative, and which specific assumptions have to hold for the math to work.

Result: Fair Value of $29.86 (OVERVALUED)

However, hiring constraints and soft demand at key customers could delay margin improvement and keep revenue more uneven than this optimistic narrative assumes.

Another Angle: Multiples Point the Other Way

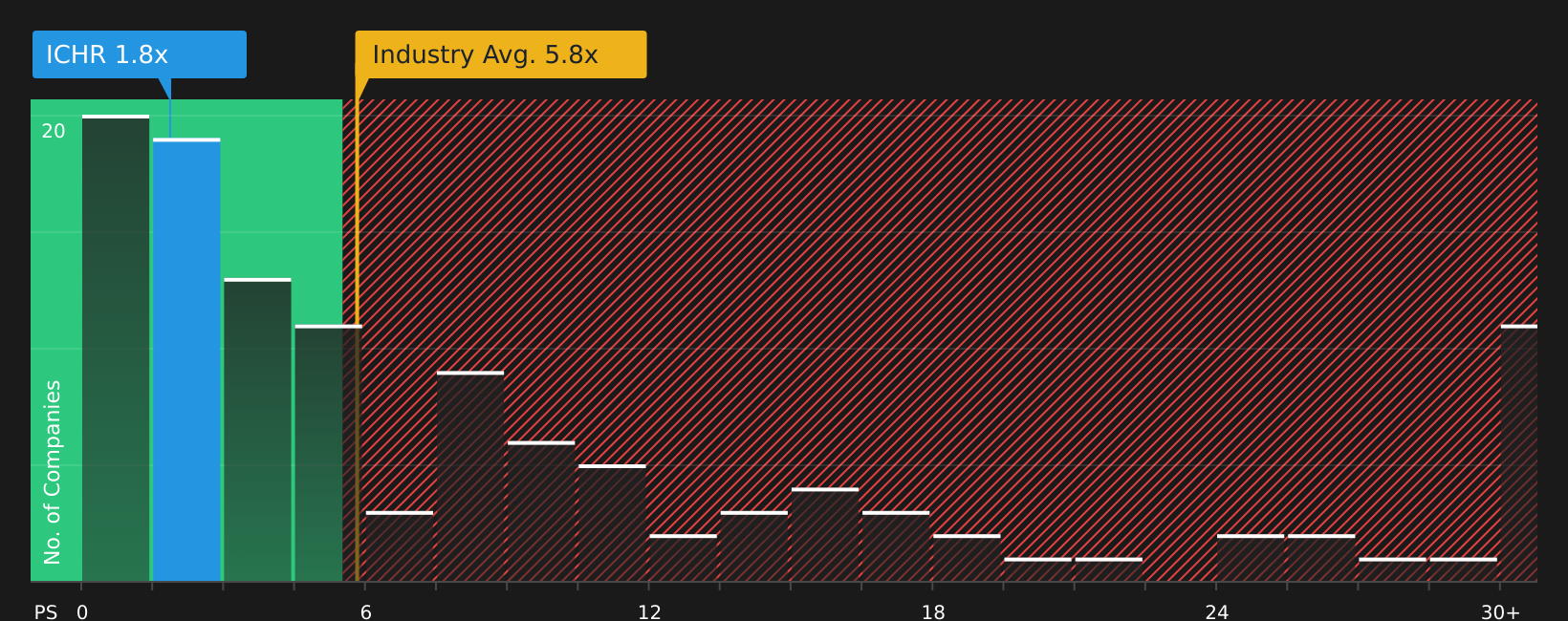

Here is the twist. While that fair value narrative paints Ichor as 57% overvalued at $46.77 versus $29.86, the current P/S of 1.7x sits well below the US Semiconductor industry at 6.1x, peers at 10x, and even a 2.4x fair ratio. So is sentiment too hot, or are the cash flows too cautious?

To see what the numbers say about this price, take a look at our valuation breakdown in See what the numbers say about this price — find out in our valuation breakdown..

Build Your Own Ichor Holdings Narrative

If you see the story differently or want to stress test every assumption yourself, you can spin up a custom Ichor view in under 3 minutes with Do it your way

A great starting point for your Ichor Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Want more investment ideas on your radar?

If Ichor has you thinking more broadly about where to put fresh capital to work, do not stop at a single idea when the data can widen your options.

- Target potential mispricings by scanning our list of 53 high quality undervalued stocks that pair strong fundamentals with prices that may not fully reflect their qualities.

- Lock in income focused ideas by checking out a curated set of 13 dividend fortresses that combine higher yields with an emphasis on staying power.

- Cut through the noise and concentrate on sturdier names using a 85 resilient stocks with low risk scores that filters for companies with more resilient profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.