Please use a PC Browser to access Register-Tadawul

A Look At Intellia Therapeutics (NTLA) Valuation After FDA Lifts Clinical Hold On Key Phase 3 Trial

Intellia Therapeutics, Inc. NTLA | 11.60 | -2.60% |

Intellia Therapeutics (NTLA) is back in focus after the FDA removed the clinical hold on its MAGNITUDE-2 Phase 3 trial for nexiguran ziclumeran in hereditary transthyretin amyloidosis with polyneuropathy, allowing enrollment to resume.

The FDA decision lands after a volatile stretch, with a 30 day share price return of 18.30% and a 90 day share price return of 26.21%. However, a 3 year total shareholder return of a 69.28% decline shows how long term holders have felt the setbacks. The latest 10.73% 1 day share price gain signals that investors are reacting strongly to the clinical hold update, while the 33.33% year to date share price return suggests momentum is currently building rather than fading.

If this FDA update has you looking across gene editing and related therapies, it could be worth scanning 26 healthcare AI stocks as a way to spot other specialised healthcare names catching fresh attention.

With Intellia still loss making on US$57.528 million of revenue and the share price at US$12.28, the key question is whether today’s valuation reflects recent progress or whether the FDA news has created a fresh entry point that already assumes future growth.

Most Popular Narrative: 92.9% Undervalued

According to the most followed narrative, Intellia Therapeutics' fair value sits at $173.99, far above the last close at $12.28, which puts a spotlight on the assumptions behind that gap.

Phase 3 results have a high probability of Success· Strong Phase 2 Foundation: In the Phase 2 trial, the 50 mg dose (the dose used in Phase 3) achieved an 81% reduction in mean monthly attacks (Weeks 5–16) and a 77% reduction overall.· Complete Response Rate: Perhaps most importantly for your "functional cure" assessment, 73% of Phase 2 patients (8 out of 11) in the 50 mg arm were completely attack-free through the primary observation period.

Want to understand why this narrative stretches so far beyond today’s $12.28 share price? According to lexan99, the fair value leans on aggressive revenue expansion, improving margins and a future earnings multiple that assumes Intellia converts its clinical pipeline into meaningful sales.

Result: Fair Value of $173.99 (UNDERVALUED)

However, this story still depends on successful Phase 3 outcomes and future commercial execution; any setback on either front could quickly challenge such an optimistic fair value.

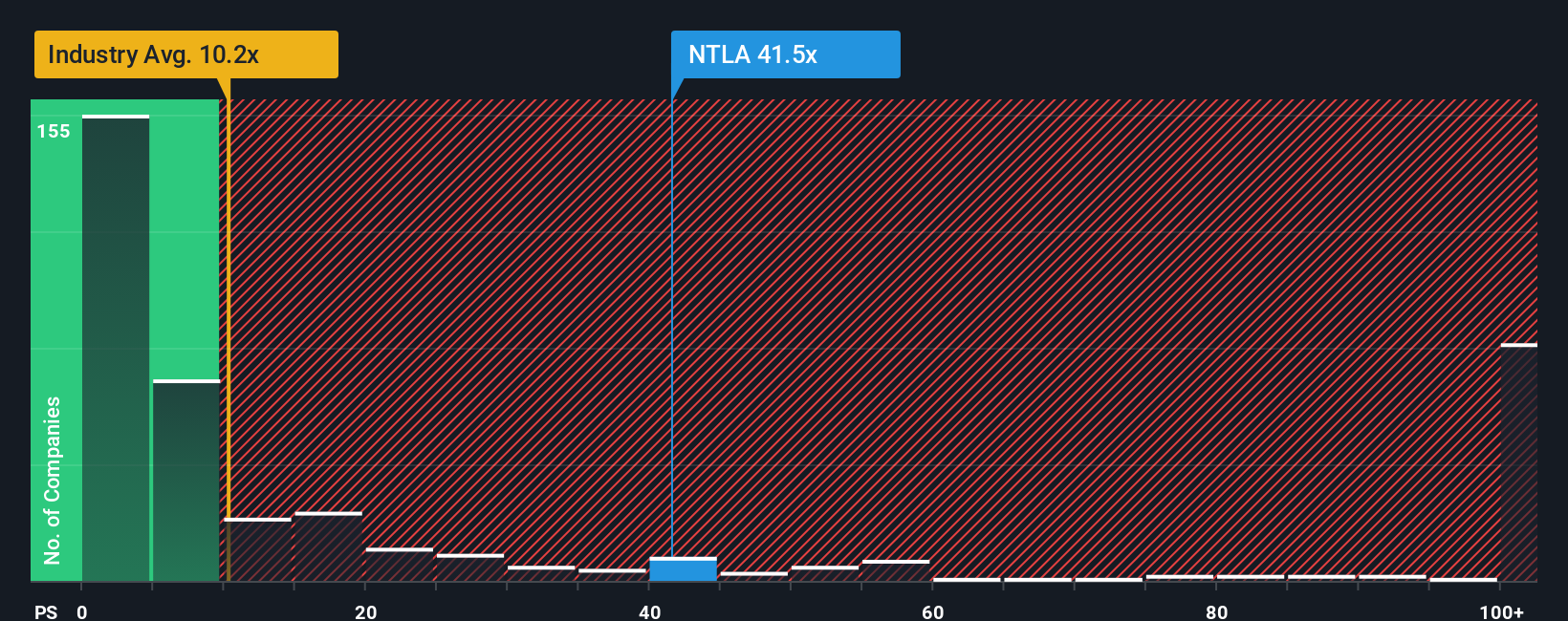

Another View: Price To Sales Sends A Different Signal

That $173.99 fair value hinges on strong future execution, but today the market is already paying a steep P/S of 24.7x for Intellia, compared with 11.2x for the US biotech industry and 12x for peers. Our fair ratio sits at 0x, which points to a very rich set of expectations.

For you, that gap raises a simple question: is this an early opportunity the market has spotted first, or a valuation that leaves little room for error if things do not go to plan?

Build Your Own Intellia Therapeutics Narrative

If you are not fully on board with these conclusions, or if you simply prefer to rely on your own work, you can quickly build a personalised thesis in just a few minutes by starting with Do it your way.

A great starting point for your Intellia Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about broadening your opportunities beyond Intellia, the Simply Wall St screener can help you quickly spot clear ideas that fit your style.

- Target potential value opportunities by reviewing 52 high quality undervalued stocks that pair strong fundamentals with prices that may not fully reflect their underlying business.

- Secure your portfolio with stability focused ideas using our 82 resilient stocks with low risk scores that highlight companies with lower risk profiles.

- Hunt for fresh opportunities off the beaten path with a screener containing 24 high quality undiscovered gems that could add differentiated exposure to your watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.