Please use a PC Browser to access Register-Tadawul

A Look At Kite Realty Group (KRG) Valuation After Announcing A Special Cash Dividend

Kite Realty Group Trust KRG | 25.95 | +1.45% |

Kite Realty Group Trust (KRG) has put extra income on the table for shareholders, declaring a special cash dividend of $0.145 per share tied to a January 9, 2026 special ex dividend date.

That special dividend comes after a solid run in the stock, with a 90 day share price return of 9.61% and a 1 year total shareholder return of 9.24%. This comes even though the 1 day move was a 4.06% decline and the year to date share price return is slightly negative at 1.81%, suggesting some momentum has cooled after recent gains.

If this kind of income story has your attention, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With KRG trading at $23.38 alongside an indicated intrinsic discount of about 23%, the special dividend adds another twist. Is this a rare value opportunity, or is the market already pricing in everything ahead?

Most Popular Narrative: 10.1% Undervalued

The most followed valuation workup puts Kite Realty Group Trust’s fair value above the recent US$23.38 close, framing today’s price as a discount worth examining more closely.

Strong leasing momentum, evidenced by record high leasing spreads (17% blended, 36.6% anchor new leases), embedded escalators, and sustained increases in small shop lease rates, signals significant mark-to-market potential and points to accelerating future revenue and cash flow growth as new tenant commencements ramp up in 2026 and 2027.

Curious how modest top line growth, thinner margins, and a much higher future earnings multiple can still point to upside? The full narrative walks through the math, tension by tension, and shows exactly how these moving parts add up to that fair value call.

Result: Fair Value of $26 (UNDERVALUED)

However, you still need to weigh ongoing exposure to bankrupt or at risk tenants, as well as the potential earnings drag from higher interest costs and portfolio recycling.

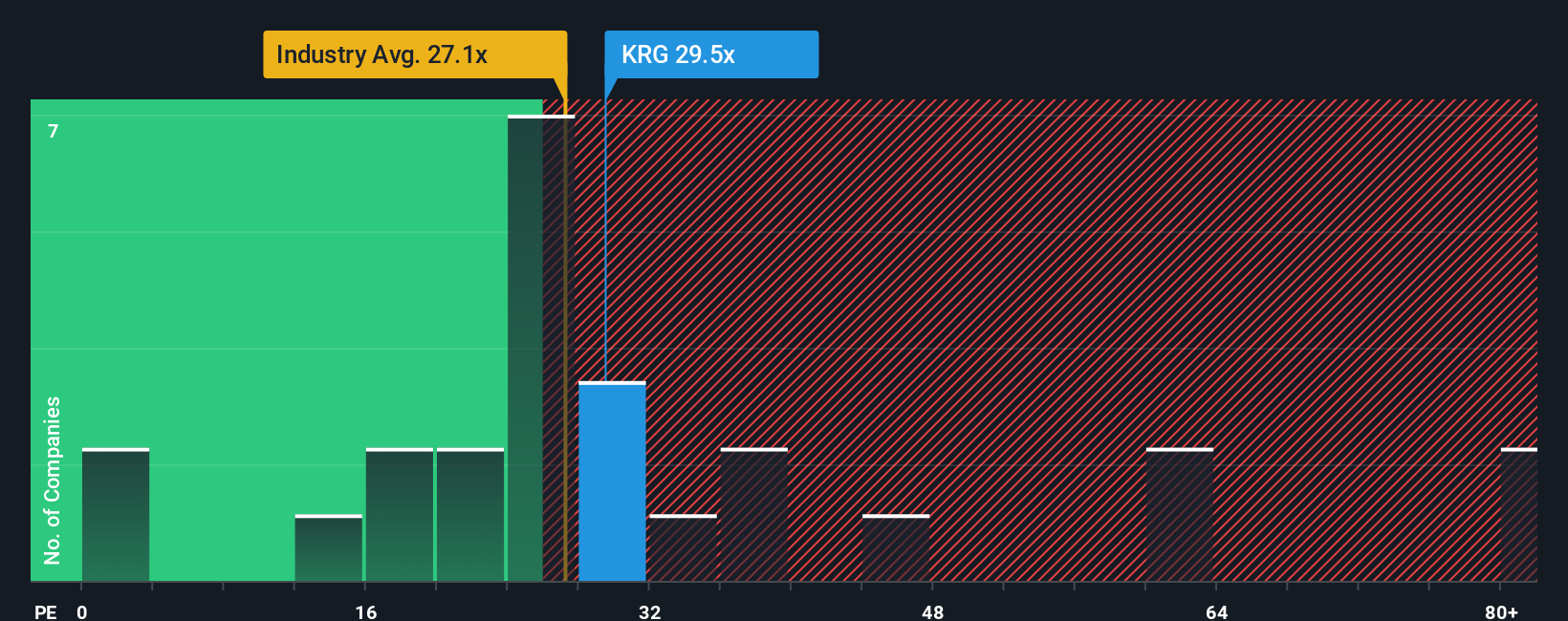

Another View: What The P/E Ratio Is Saying

The SWS DCF model flags Kite Realty Group Trust as trading about 23% below an estimated fair value of US$30.34, which points to upside. Yet the current P/E of 36.2x sits well above the fair ratio of 22.3x, the US Retail REITs average of 27.6x, and a 33.4x peer average. That gap can signal valuation risk if sentiment cools. Which signal do you trust more right now?

Build Your Own Kite Realty Group Trust Narrative

If you are not on board with this view or simply prefer to test the numbers yourself, you can build a fresh narrative in just a few minutes, starting with Do it your way.

A great starting point for your Kite Realty Group Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Kite Realty Group Trust is on your radar, do not stop there. Broaden your watchlist with a few focused stock ideas sourced directly from the Simply Wall St screener.

- Spot potential high-return opportunities early by scanning these 3538 penny stocks with strong financials that combine smaller size with solid financial underpinnings and clear business models.

- Position yourself at the front of the AI wave by reviewing these 28 AI penny stocks powering real world applications in automation, data analytics, and intelligent software.

- Strengthen your income stream by shortlisting these 12 dividend stocks with yields > 3% that pair meaningful yields above 3% with disciplined payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.