Please use a PC Browser to access Register-Tadawul

A Look at LCI Industries (LCII) Valuation After Latest Dividend Increase

LCI Industries LCII | 121.76 121.76 | -0.29% 0.00% Pre |

LCI Industries (LCII) has just increased its quarterly dividend from $1.05 to $1.15 per share, marking another year of steady increases that income-focused investors tend to appreciate.

LCI Industries’ latest dividend hike comes as the stock has seen limited momentum, reflecting a 1-year total shareholder return of -0.17%. Despite the reliable dividend growth, investors have yet to reward shares in a meaningful way, suggesting that confidence in near-term growth is still building.

If you’re looking to broaden your search after LCI’s steady dividend news, discover new opportunities among automotive companies with our curated list in the following section: See the full list for free.

With LCI Industries’ price trading below analyst targets but fundamentals showing only moderate growth, investors must ask: Is there hidden value yet to be realized, or is the market already looking ahead to future gains?

Most Popular Narrative: 10.7% Undervalued

With LCI Industries closing at $93.52 and the most popular narrative assigning fair value at $104.75, there is a visible gap between price and perceived value. Recent analyst consensus continues to favor room for upside, creating interest in the factors driving these expectations.

The demographic shift towards retirees and millennials seeking travel and flexible lifestyles, as well as the continued normalization of RV travel post-pandemic, is expanding the addressable RV market. This supports LCI Industries' long-term revenue growth potential as evidenced by steady increases in RV ownership. With 72 million Americans expected to take an RV trip in 2025, the company appears positioned for higher sales and a broadened customer base.

Want to know why analysts expect the company to outpace expectations? There is a bold forecast under the surface. This narrative leans on ambitious profit margins, recurring revenue from aftermarket sales, and new market diversification. What numbers justify the optimism? Uncover the projections and strategies that are shaping this target.

Result: Fair Value of $104.75 (UNDERVALUED)

However, persistent weakness in RV demand or continued pressure from rising input costs could quickly challenge the current optimism that supports LCI Industries’ outlook.

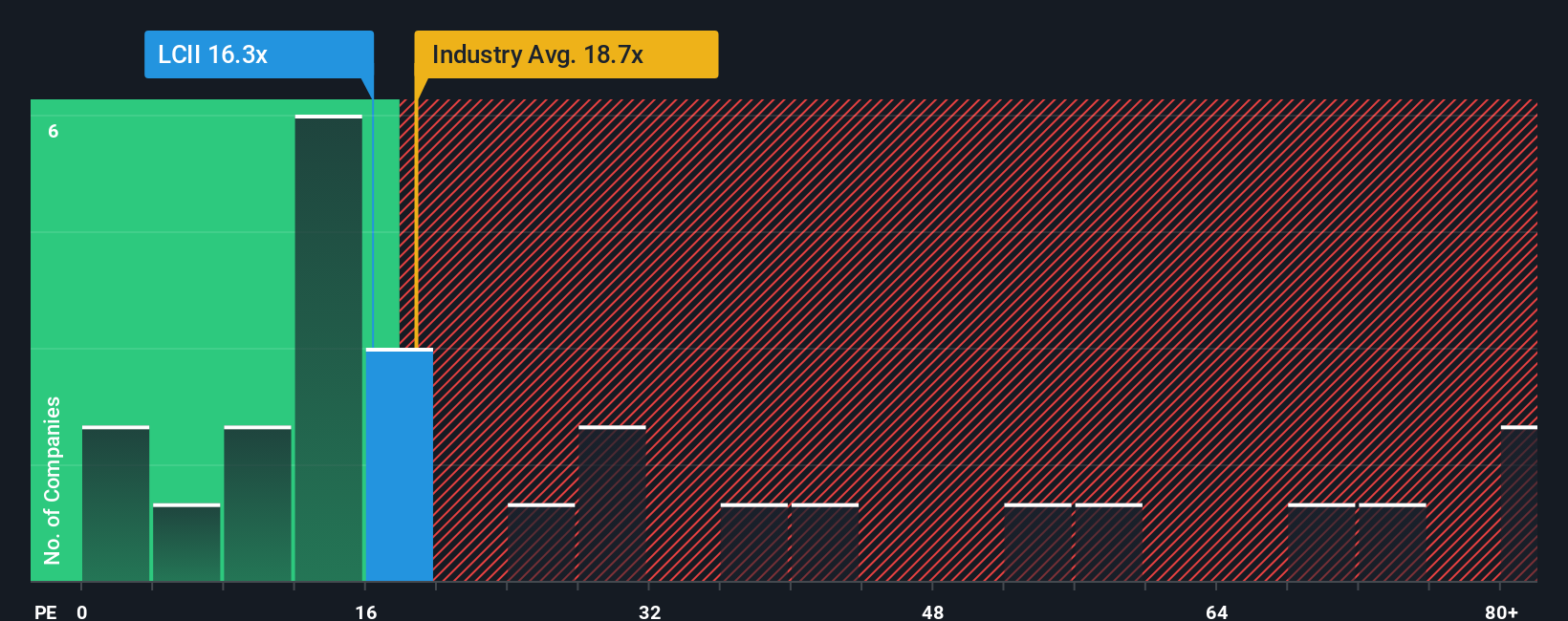

Another View: Comparing Price-to-Earnings

Looking at the price-to-earnings ratio, LCI Industries trades at 14.9x, which is noticeably lower than the industry average of 18.7x and the peer average of 37.7x. However, it remains above the fair ratio of 11.8x. This suggests there is room for valuation risk if market sentiment shifts. Does this discount to the industry mean the market is overlooking a key risk factor or underestimating potential?

Build Your Own LCI Industries Narrative

If you see things differently or prefer to dive into the numbers yourself, you can shape your own perspective on LCI Industries in just a few minutes. Do it your way.

A great starting point for your LCI Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay ahead by seeking out new opportunities. You could be missing serious growth or value plays if you don’t check these out now:

- Spot powerful income potential by reviewing yield-strong companies featured in these 19 dividend stocks with yields > 3%. This can help you enhance your portfolio’s cash flow prospects.

- Capitalize on innovation in emerging tech by targeting the most promising startups using these 24 AI penny stocks, which are making waves in artificial intelligence.

- Secure hidden value by hunting for underappreciated stocks with strong fundamentals through these 909 undervalued stocks based on cash flows before the crowd jumps in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.