Please use a PC Browser to access Register-Tadawul

A Look At LegalZoom.com (LZ) Valuation As Sentiment And Support Signals Weaken

LegalZoom.com, Inc. LZ | 6.56 | -6.95% |

Why sentiment around LegalZoom.com (LZ) has turned cautious

Recent analysis points to weaker near and mid-term sentiment for LegalZoom.com (LZ), with the loss of key long-term support signals and a higher perceived risk of further downside influencing recent trading activity.

At a share price of US$8.88, LegalZoom.com has seen a 30 day share price return of 11.90% and a year to date share price return of 7.40%. The 1 year total shareholder return of 4.00% and 3 year total shareholder return of 4.72% suggest performance has been relatively modest, and recent weakness in support signals reinforces concerns that momentum may be fading rather than accelerating.

If LegalZoom.com's recent sentiment shift has you reassessing your watchlist, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With LegalZoom.com trading at US$8.88, modest long term returns and weaker support signals raise a key question for you: is the market overlooking potential value here, or already pricing in all the future growth?

Most Popular Narrative: 28.1% Undervalued

With LegalZoom.com last closing at $8.88 against a narrative fair value of $12.36, the most followed view sees meaningful upside built into the model.

Strong momentum in high margin, recurring subscription offerings, especially within compliance and concierge do it for me products, signals continued growth in predictable revenues and improved customer retention, directly supporting higher net margins and earnings stability.

Want to see what sits behind that confidence in subscriptions and margins? The narrative leans on compound revenue growth, rising profitability, and a richer earnings multiple. Curious how those moving parts come together to support a higher fair value than today’s price? The full narrative lays out the shared assumptions in detail.

Result: Fair Value of $12.36 (UNDERVALUED)

However, that upside view still faces real tests, especially if AI makes basic legal services cheaper and ongoing regulatory scrutiny increases costs or restricts offerings.

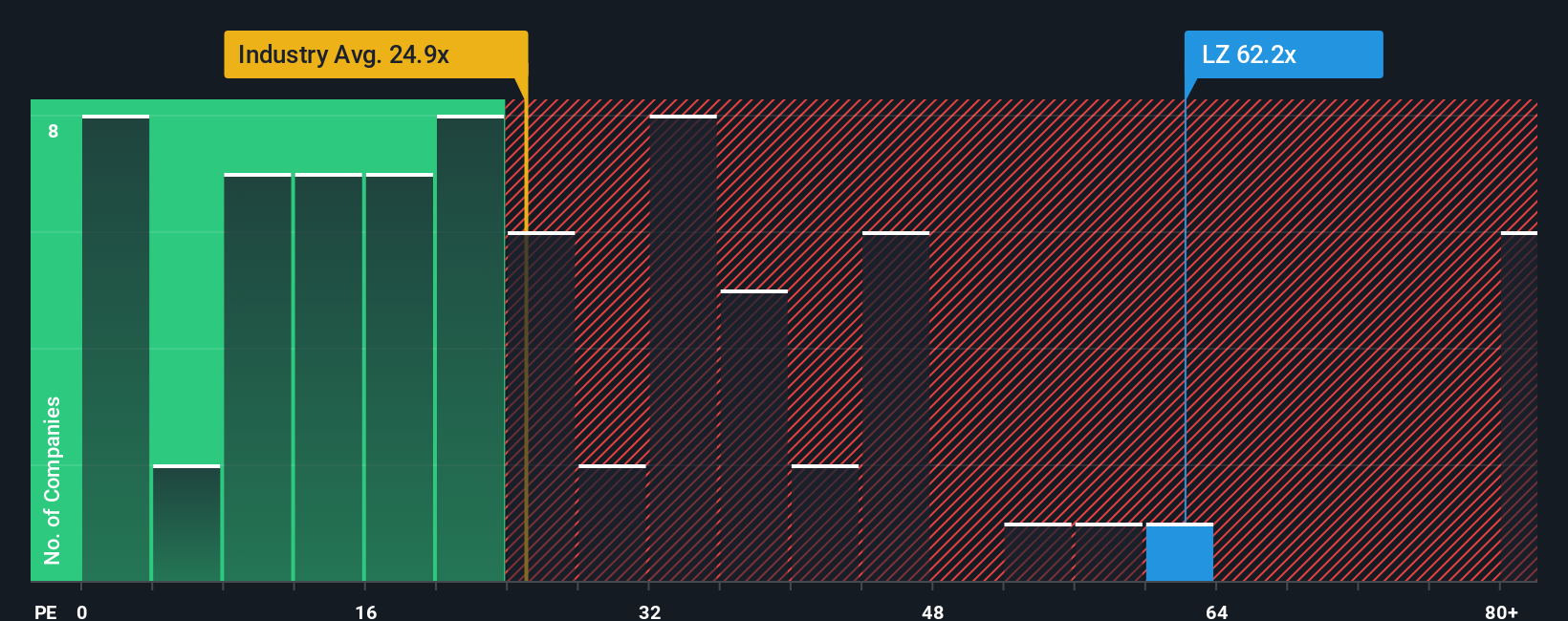

Another View: High P/E Sends A Very Different Signal

While the narrative fair value of $12.36 points to undervaluation, the current P/E of 70.8x is much higher than the US Professional Services industry at 24x and peers at 25.9x, and also above a fair ratio of 41.1x. That kind of gap can mean rich expectations are already baked in, so it is worth considering whether you are comfortable paying that sort of premium.

Build Your Own LegalZoom.com Narrative

If you look at this and feel differently, or simply prefer to weigh the numbers yourself, you can build a personalised view in minutes with Do it your way.

A great starting point for your LegalZoom.com research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If LegalZoom.com has you thinking more critically about price, growth and risk, do not stop here. Broaden your watchlist with a few focused idea generators.

- Zero in on value by checking out these 879 undervalued stocks based on cash flows that align strong cash flow potential with current pricing.

- Explore long term themes by scanning these 19 cryptocurrency and blockchain stocks tied to blockchain, digital assets and payment disruption.

- Put income at the center of your plan by filtering for these 13 dividend stocks with yields > 3% that meet your yield and quality preferences.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.