Please use a PC Browser to access Register-Tadawul

A Look At LendingClub (LC) Valuation After Earnings Beat Guidance Credit Gains And Buyback Completion

LendingClub Corp LC | 16.26 | -1.93% |

Why LendingClub’s latest earnings are drawing attention

LendingClub (LC) just reported fourth quarter and full year 2025 results, pairing higher net income and earnings per share with new 2026 profit guidance, lower net charge offs, boardroom changes, and a completed share buyback.

The earnings release has come with a sharp 1 day share price return of 7.97% to US$16.94. However, the 30 day share price return of 15.22% and year to date share price return of 11.40% suggest recent momentum has cooled. At the same time, the 1 year total shareholder return of 25.67% and 3 year total shareholder return of 71.81% point to a stronger longer term picture that investors are weighing against the new 2026 guidance, lower net charge offs, leadership changes and the completed buyback.

If this kind of earnings driven move has your attention, it could be a moment to widen your watchlist with our screener of 22 top founder-led companies.

With LendingClub trading at US$16.94 and sitting at a discount to both analyst targets and some intrinsic value estimates, you have to ask: is this a genuine mispricing, or is the market already factoring in expectations for future growth?

Most Popular Narrative: 30% Undervalued

LendingClub’s most followed narrative pins fair value at about $24.20, compared with the current $16.94 share price, and builds that gap around future earnings power and margins.

The hybrid digital marketplace/bank model continues to scale. Marketplace originations and balance sheet loans are growing in tandem, with the former providing high-margin, capital-light revenue, and the latter building durable recurring net interest income. This dual engine offers operating leverage for sustained growth in earnings and tangible book value.

Curious what has to happen for that higher value to make sense? Earnings, margins and revenue are all wired into this story. The exact mix may surprise you.

Result: Fair Value of $24.20 (UNDERVALUED)

However, this depends on competition not eroding margins and on personal loans avoiding a sharp credit downturn, both of which could pressure earnings and fair value.

Another angle on valuation

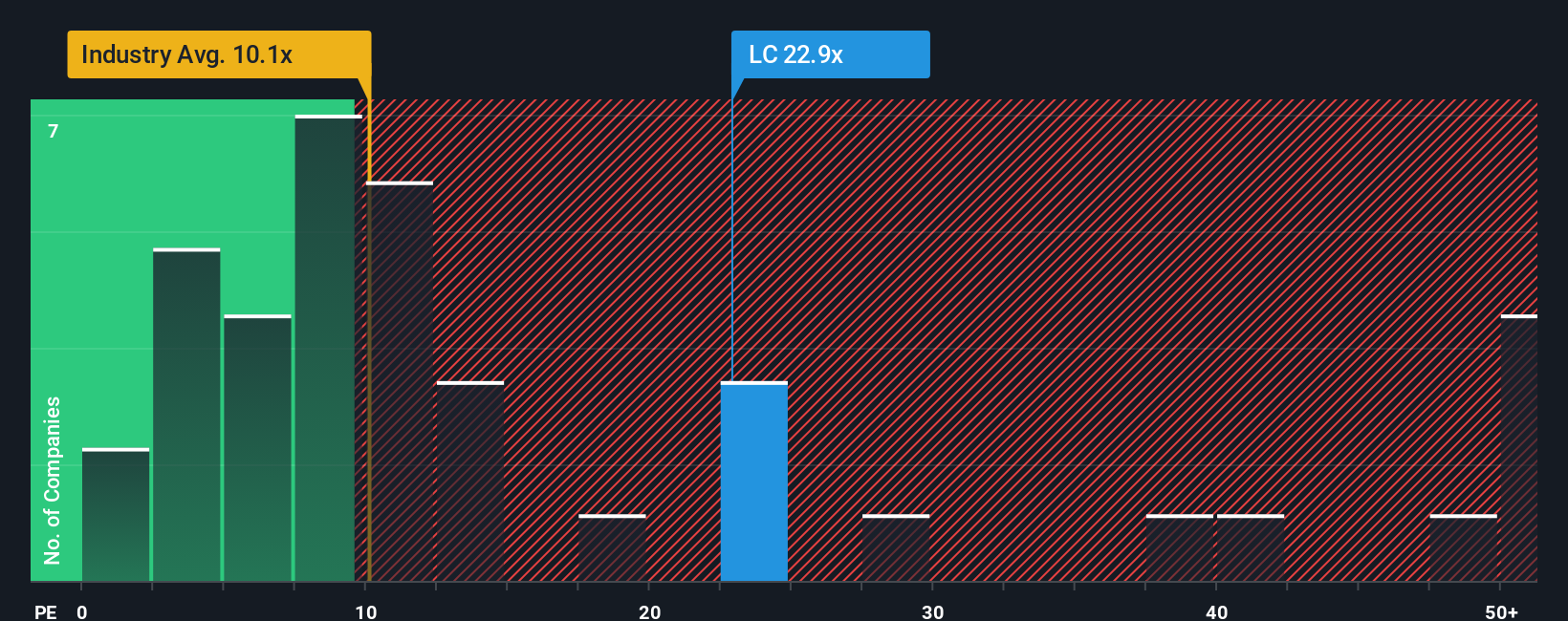

The narrative pegs fair value at $24.20 and calls LendingClub undervalued, but the P/E ratio tells a more mixed story. At 14.4x earnings, the shares look expensive versus the US Consumer Finance industry at 8.3x, yet cheap against peers at 33.2x and a fair ratio of 21.4x.

That spread cuts both ways. It hints at potential upside if sentiment shifts toward the fair ratio, but also leaves room for disappointment if the stock drifts closer to the industry average. Which reference point do you think the market is more likely to lean on over time?

Build Your Own LendingClub Narrative

If your perspective differs or you prefer to test the assumptions yourself, you can create a custom thesis in minutes by starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding LendingClub.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop with one stock story. Broaden your research now while these opportunities are still under the radar.

- Target potential mispricings by scanning our list of 52 high quality undervalued stocks that pair quality fundamentals with appealing valuations.

- Step up your focus on resilience with 82 resilient stocks with low risk scores designed to highlight companies that score well on our risk checks.

- Hunt for future standouts using our screener containing 24 high quality undiscovered gems to spot quality names that many investors may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.