Please use a PC Browser to access Register-Tadawul

A Look At MannKind (MNKD) Valuation As Afrezza Secures FDA Label Update On Dosing And Conversion

MannKind Corporation MNKD | 5.54 | +0.18% |

FDA label update puts Afrezza dosing in focus for MannKind (MNKD) investors

MannKind (MNKD) shares are reacting to the U.S. Food and Drug Administration’s approval of updated prescribing information for Afrezza, clarifying how adults with diabetes can switch from injectable mealtime insulin or pump boluses to the inhaled product.

The FDA label update lands at a time when MannKind’s latest share price sits at US$5.64, with a 90 day share price return of 1.62% but a 1 year total shareholder return of a 7.69% decline, suggesting short term momentum is firmer than the longer term picture.

If this Afrezza update has you looking across the sector, it could be a good moment to scan other healthcare stocks that might fit a similar healthcare thesis.

With MannKind trading at US$5.64 and screening on some metrics as intrinsically discounted, the real question is whether the Afrezza label update leaves upside on the table or if the market already prices in future growth.

Most Popular Narrative: 41.3% Undervalued

MannKind’s most followed narrative sets a fair value of $9.61 per share versus the last close at $5.64, putting a clear spotlight on Afrezza and the pipeline.

Afrezza's continued double-digit prescription growth, international expansion efforts, upcoming pediatric indication launch, and a broadened salesforce footprint are set to accelerate market penetration amid a rising global diabetes burden and an aging population, which directly supports revenue and earnings growth.

Curious what kind of revenue ramp, margin lift and future earnings multiple are baked into that fair value, and how much relies on Afrezza versus newer inhaled programs and Tyvaso DPI royalties.

Result: Fair Value of $9.61 (UNDERVALUED)

However, this hinges on Afrezza broadening beyond its current niche and on Tyvaso DPI avoiding clinical, competitive, or pricing setbacks that could reshape the story.

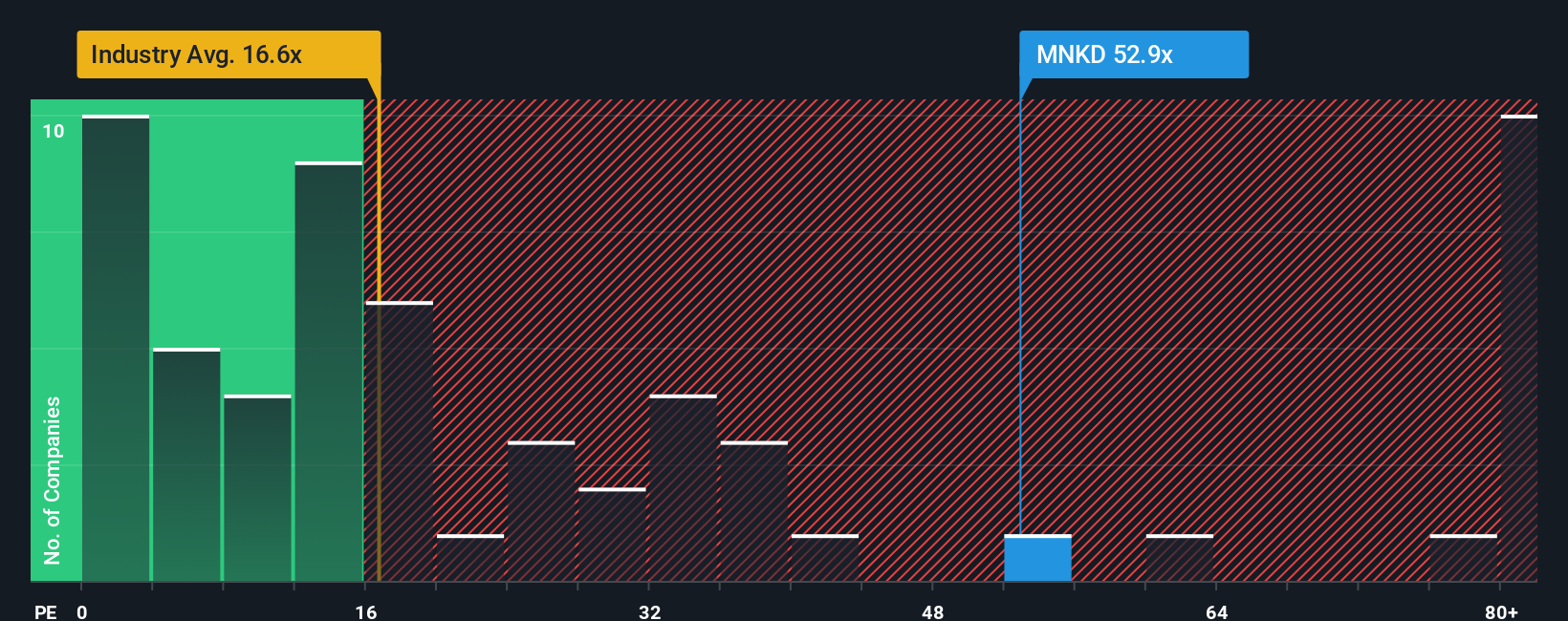

Another View: Earnings Multiple Sends A Different Signal

If you zoom out from fair value models and just look at the price tag, MannKind trades on a P/E of 59.2x, compared with 20.1x for the wider US Biotechs group and a fair ratio of 25x. That gap points to higher valuation risk, so how comfortable are you paying up for this story?

Build Your Own MannKind Narrative

If you see the story differently or want to stress test these assumptions against your own numbers, you can build and publish your version in minutes, starting with Do it your way.

A great starting point for your MannKind research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at a single stock story. Instead, widen your search and pressure test your next moves.

- Target growth potential at lower price points by scanning these 3522 penny stocks with strong financials, which combine smaller market caps with stronger balance sheets and fundamentals.

- Ride the next wave of automation and data intelligence by filtering for these 24 AI penny stocks, which are already building real-world AI products and services.

- Hunt for mispriced opportunities using these 880 undervalued stocks based on cash flows to find companies that screen as cheaper based on their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.