Please use a PC Browser to access Register-Tadawul

A Look At Marten Transport (MRTN) Valuation After Mixed Fourth Quarter Earnings And Early Signs Of Freight Recovery

Marten Transport, Ltd. MRTN | 13.90 | +1.98% |

Fourth quarter earnings set the tone

Marten Transport (MRTN) reported fourth quarter 2025 earnings that combined softer year over year results with improving quarter over quarter profitability, especially in its Truckload segment, giving investors fresh data on freight market conditions.

Sales for the quarter were US$210.11 million compared with US$230.43 million a year earlier, while net income was US$3.7 million versus US$5.63 million, with diluted EPS from continuing operations at US$0.05 compared with US$0.07.

The earnings release comes after a strong run in the share price over recent months, with a 30 day share price return of 8.08% and a 90 day gain of 20.00%. However, the 1 year total shareholder return of 18.58% and 3 year total shareholder return of 43.97% point to longer term holders still being in negative territory.

If you are reassessing your transport exposure after these results, it could be a good moment to scan other auto manufacturers that are shaping expectations in related parts of the mobility space.

With Marten shares up over the past quarter but still lagging on a 1 and 3 year view, and with the stock trading below the average analyst price target, is this the moment for a reset, or is the market already pricing in better freight conditions?

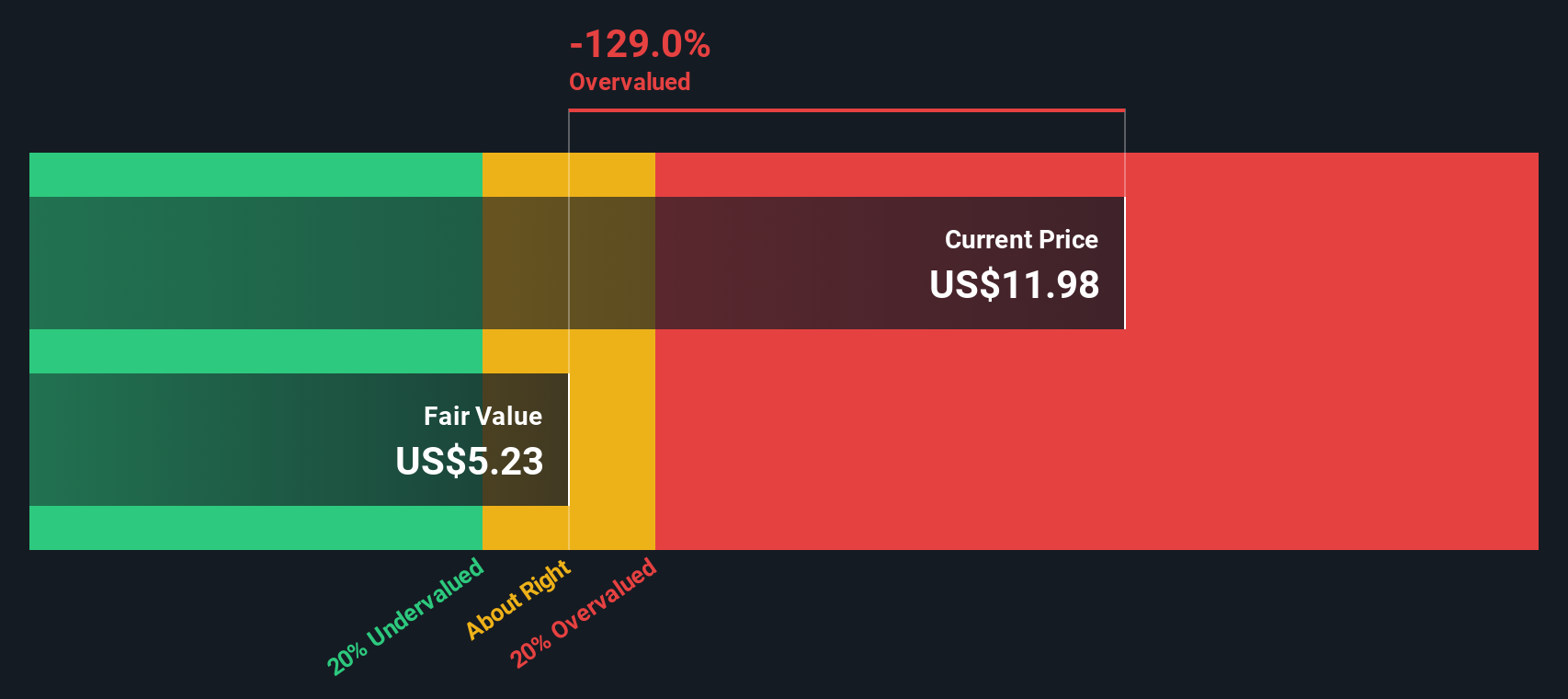

Price-to-Earnings of 57.5x: Is it justified?

On a simple snapshot, Marten Transport trades on a P/E of 57.5x, which the data flags as expensive relative to both its own fair ratio and the broader US Transportation group.

The P/E multiple tells you how many dollars investors are currently paying for each dollar of Marten's earnings, which matters a lot for a business with recent earnings pressure and forecast profit growth. With earnings expected to grow at 35.68% per year while revenue is forecast at 4.2% per year, the current valuation seems to lean heavily on profitability improving rather than on rapid top line expansion.

Against that backdrop, Marten's P/E of 57.5x sits well above the estimated fair P/E of 19.3x and also above the US Transportation industry average of 32.4x. This suggests the market is assigning a premium that could compress if those earnings forecasts or margins do not play out as expected.

Result: Price-to-Earnings of 57.5x (OVERVALUED)

However, you still have to weigh the possibility of freight demand staying weak for longer, as well as Marten's higher P/E compressing quickly if earnings forecasts are revised lower.

Another way to look at value

On the flip side of the rich 57.5x P/E, our DCF model points to a value of $6.60 per share, compared with the current $12.30 price. That flags Marten as expensive on future cash flows. Which signal do you put more weight on: earnings or cash generation?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marten Transport for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marten Transport Narrative

If you see the numbers differently or want to stress test your own assumptions against the market view, you can build a custom Marten thesis in just a few minutes, starting with Do it your way.

A great starting point for your Marten Transport research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at one company, you risk missing better opportunities, so use the Simply Wall St screener to quickly surface fresh ideas that fit your style.

- Target potential value opportunities by checking out these 868 undervalued stocks based on cash flows that might align more closely with the price and quality mix you want.

- Tap into long term income themes by reviewing these 14 dividend stocks with yields > 3% that could complement a total return focused portfolio.

- Ride emerging trends in digital assets by scanning these 18 cryptocurrency and blockchain stocks that are tied to cryptocurrency and blockchain developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.